From Zerohedge

Given the long time between recession and recession indicators, it’s no wonder economists have stopped expecting a recession. However, even though a recession hasn’t happened yet, it doesn’t mean it won’t happen again. We should pay special attention to data related historically to economic growth.

To reiterate, here are the indicators the NBER uses to determine peaks and troughs, although not in “real time”.

Figure 1: Nonfarm Payroll (NFP) from CES (blue), employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bright green), trade and sales in Ch.2017$ (black), consumption in Ch.2017$ (blue), and monthly GDP in Ch.2017$ (pink), GDP, 3rd release (green bars) , all logs are normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q1 advance release, S&P Global Market Insights (probably Macroeconomic Advisors, IHS Markit) (5/1/2024), and author’s calculations.

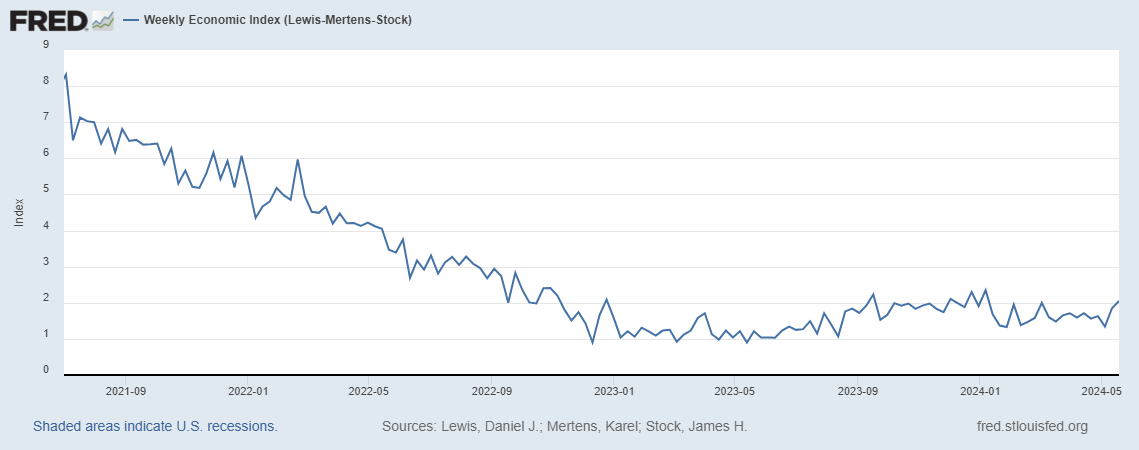

Everyone has their favorite indicator – Vehicle Miles Traveled, fuel consumption, full-time employee growth, and more. I’ll just note that the Lewis-Mertens-Stock Weekly Economic Index shows 2.05% – just in case the trend is 2% – using data released up to May 18th.

Baumeister, Leiva-Leon, Sims Weekly Economic Register of Economic Conditions -0.52% (ie about half a point below trend growth).

So a recession could still happen, maybe six months from now, maybe next month. A simple vanilla distribution model says that May is likely to be a recession so it’s still possible. Or not.

Source link