The CBO released an updated Economic Outlook yesterday. Expected PCE inflation is high, and so is the budget deficit. First Fed funds rate cut in 2025Q1. For me, the most interesting is the GDP projections, including in relation to potential GDP.

Here are the GDP projections from June, and from February.

Figure 1: GDP as reported (bold black), February CBO (red), June CBO (blue), FT-Booth median (red triangle), GDPNow as of 18 Jun (blue square), all in bn. Ch.2017$ SAAR. Source: BEA (2024Q1 2nd release, CBO February Budget and Economic Outlook, CBO June Economic Outlook update, June Booth macroeconomist survey, Atlanta Fed.

CBO projections are based on data available as of May 2nd. The latest CBO projections are significantly higher than the February projections (see discussion here), mainly due to the dramatic intervention of GDP. It is currently in line with the FT-Booth June median forecast, and slightly below (for Q2) the Atlanta Fed nowcast. (Slightly above the May median Survey of Professional Forecasters average).

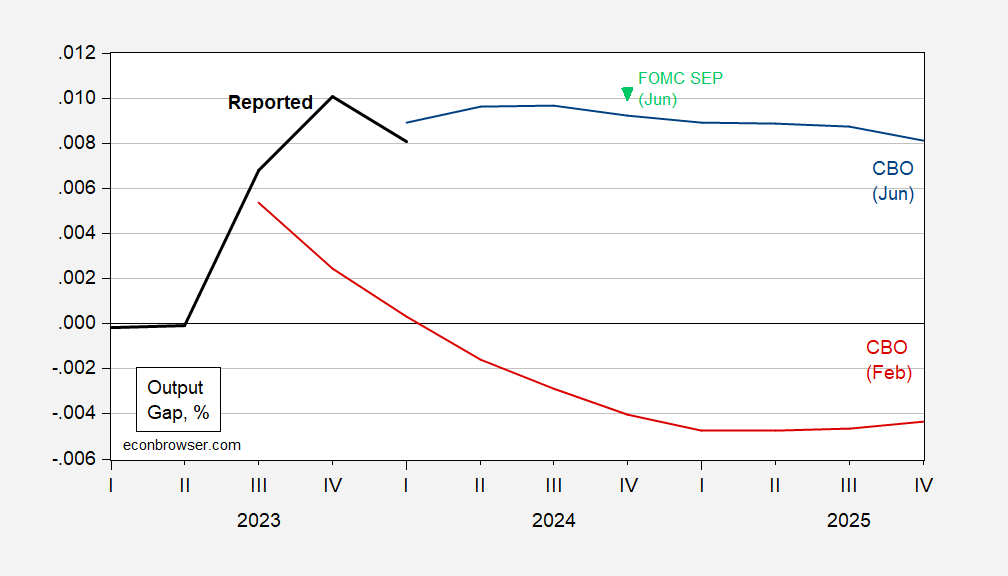

Although the revised estimate of the q/q growth rate is higher in the short term, compared to the February forecast (based on data available as of January 6), it is then reduced to slower rates by the end of 2025, implying a reversal of momentum. That being said, CBO’s current implicit projection for the output gap is significantly different than that reported in the February Economic Outlook. [Update: As suggested by Paweł Skrzypczyński, the implied output gap is even larger using SEP and CBO potential. However, we don’t know what the FOMC’s view on potential GDP is, although the Green Book must have an estimate.]

Figure 2 [updated 1pm CT]: Log output gap, in % (bold black), February CBO projections (red), June CBO projections (blue), FOMC June Summary of Economic Projections (green inverted triangle). Reported based on reported GDP and June CBO estimated potential GDP. Source: BEA (2024Q1 2nd release, CBO February Budget and Economic Outlook, CBO June Economic Outlook update, Federal Reserve, and author’s calculations.

This means that the CBO is projecting a gap in positive outcomes for the next year and a half, under current law. For perspective, the pre-pandemic output gap was 0.9 ppts, while the highest in recent history was 2.4% in 2000Q2.

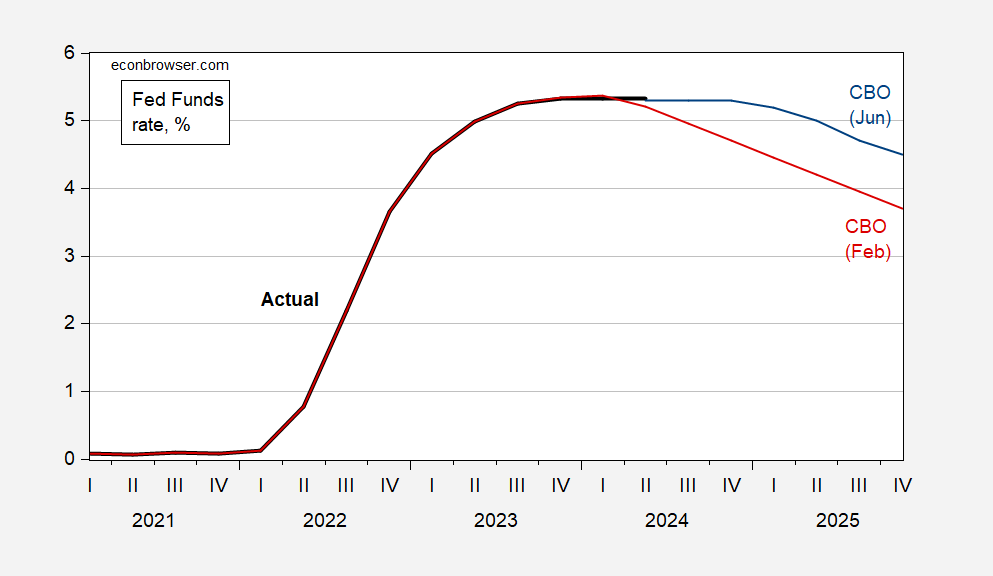

It is interesting to note that the CBO projection is based on the assumption that the Fed begins reducing the Fed Funds rate in 2025Q1; this contrasts with an assumed rate cut of around 60 bps (on average) by the end of 2024 in the February forecast.

Figure 3: Fed funds rate (bold black), February CBO projection (red), June CBO projection (blue), all in %, period average. Source: Federal Reserve, CBO February Budget and Economic Outlook, CBO June Economic Outlook update.

Source link