I was taking a rare vacation trip (most trips are work related for me), when my wife and I decided to check into the inn at Tivoli for a kick (last visit, it was closed for renovations to the wax museum) . Well, it wasn’t scary at all – but that got me thinking: What could be scary? Here is my answer:

“Economic Policy in Trump’s Second Term”

Consider some policy suggestions:

“It is not really possible for prices to fully replace income tax. Tariff rates would have to be unbelievably high on such a small import base to replace the income tax, and as tax rates rise, the base itself will shrink as imports fall, making Trump’s $2 trillion goal unattainable.”

And I never thought…

Great discussion here about how Trump’s policies could make inflation/output a real nightmare.

Just a reminder, here is the US trade balance explained using NIPA data.

Figure 1: US Net Exports to GDP (in blue), as NBER defined recession days are higher than in gray. Source: BEA 2024Q1 second release, and author’s calculations.

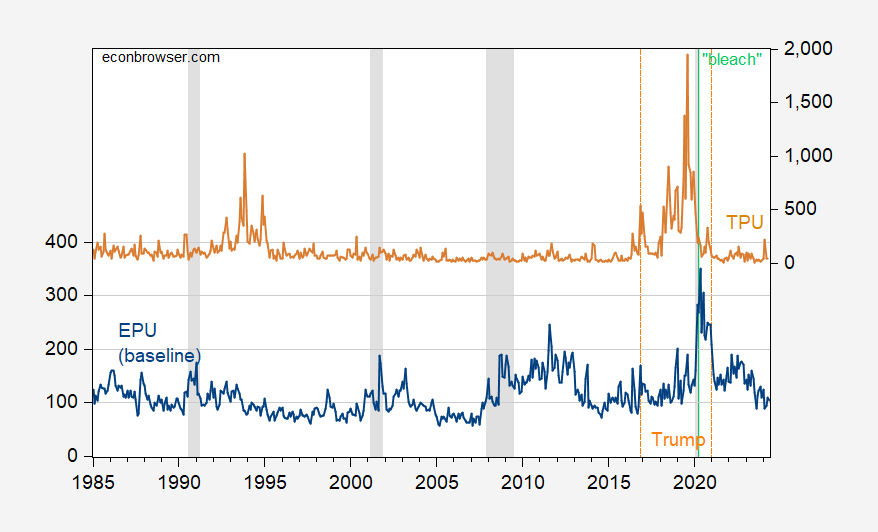

And about policy uncertainty (which used to be lamented as slow investment and growth):

Figure 2: Economic Policy Uncertainty (blue, left scale), and Trade Policy Uncertainty (tan, right scale). The NBER has defined recession days as shaded in gray. Source: policyuncertainty.com via FRED, NBER.

Source link