Patience readers, I can’t stand what I planned and researched because I suddenly got sick with what I hope is only food poisoning. So I’m going to put this post up instead. I’m sorry! – of course

By Violaine Faubert, Economist at Banque De France, Nathan Guessé, graduate student in economics at ENSAE and Institut Polytechnique de Paris, and Julien Le Roux, Senior Economist at the European Relations Unit in the Directorate General Statistics, Economics and International of the Banque de France. Originally published at VoxEU.

The energy transition will require large amounts of important raw materials to be mined and processed in countries geographically distant from the EU. This column records the ownership interests in the issuing companies, information that is important for accurately assessing the EU’s strategic dependence. Investors from outside the EU control a large part of the capital of globally listed companies involved in the mining of cobalt, copper, lithium, nickel, and rare earths, underscoring the need to improve the EU’s strategic independence and design a metal-specific strategy going forward.

The EU has enacted recent legislation that aims to increase the security of its raw materials (CRMs) and make them more strategically independent (Key Raw Materials 2024). Although the energy transition will require large amounts of CRMs, the mining and processing of CRMs is concentrated in countries geographically distant from the EU (see Figure 1). For example, 73% of all cobalt is mined in the Democratic Republic of the Congo (DRC), 69% of rare earth minerals are mined in China, and half of the world’s nickel supply is mined in Indonesia (USGS 2023 ). This accumulation of resources raises concerns that dominant countries may use their market position as leverage to pursue other important priorities (Buysse and Essers 2023), highlighting the urgent need to strengthen the EU’s raw material strategy.

The concentration of production facilities is combined with the concentration of firms that control the supply of CRMs, producing oligopolistic market structures (IRENA 2023). A handful of multinational corporations and state-owned or state-owned enterprises (SOEs) control the majority of global production. For example, the top four mining companies control about 55% of cobalt production, while the top five mining companies control 80% of global lithium production.

Figure 1 Share 0f World Production of EU Imports (x-Axis) Compared to the Geopolitical Distance of CRM Producers From the EU (y-Axis)

Be careful: The geopolitical distance shows country positions towards the US-led liberal order, based on an ordinal spatial variable model, using UN General Assembly votes as input. The index has no unit and ranges from zero to six. Only two producing countries are shown in each mineral and manufacturing category. C stands for natural graphite, Co cobalt, Copper copper, Li lithium, and Nickel. AUS stands for Australia, BRA for Brazil, CHL for Chile, CHN for China, COD for the Democratic Republic of the Congo (DRC), FIN for Finland, IDN for Indonesia, PER for Peru, PHL for the Philippines, and RUS for Russia.

Sources: Bailey et al. (2017), European Commission (2023), and authors’ figures.

Non-European Investors Control Significant Share of Capital of Companies Listed in CRM Mining

Although the local concentration of resources is well documented (IRENA 2023, Javorcik et al. 2023), ownership interests in extractive companies are very small. However, documenting the sources of control of mining companies is important in assessing strategic dependence. Building on Leruth et al. (2022), we design a comprehensive database documenting the origins of shareholders of global listed companies involved in the mining of cobalt, copper, lithium, nickel, and rare earths (Faubert et al. 2024).

We create several indicators to map the geographic origin of investors, including productivity and market-weighted average holdings, along with indices that focus on multiple holdings. All indications suggest that non-European investors control a large part of the capital of the mining companies listed in the CRM.

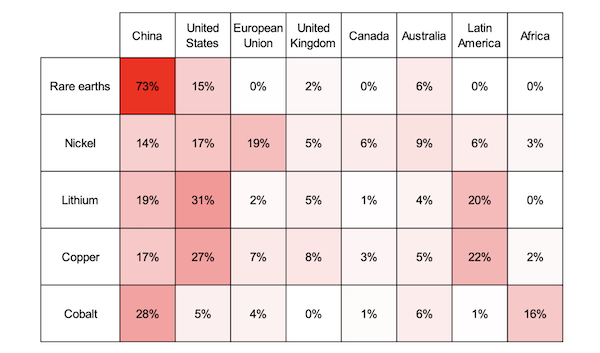

Figure 2 summarizes ownership values by investor origin for cobalt, copper, lithium, nickel, and rare earths. China’s leading position is particularly notable in the extraction of rare earths, cobalt, and, to a lesser extent, lithium. In contrast, European investors hold a limited stake in CRM mining companies. The EU’s relatively high shares in the nickel sector partly reflect the investment in Cyprus that represents Russian interests. Besides China, investors from the US also have significant assets, especially in the lithium and copper sectors. Although Latin American investors hold a large share of the capital of lithium and copper producing firms, they are underrepresented in terms of the region’s share of global production. Australian investors’ weight is limited to lithium given the importance of the country’s lithium resources. Indeed, while Australia accounts for half of the world’s lithium production (USGS 2023), its two largest lithium mines are owned by Chinese companies.

Figure 2 Production-Weighted Holding Ratio for Companies Mining Key Raw Materials

Be careful: EU shares in the nickel mining sector, which includes an estimated 15% share of Russian investors, are close to 4% if European investors representing Russian interests are not counted. EU shares in the cobalt mining sector, which includes an estimated 3% share of Russian investors, are close to 1% if Cypriot investors representing Russian interests are not counted.

Sources: Refinitiv and scribe figures.

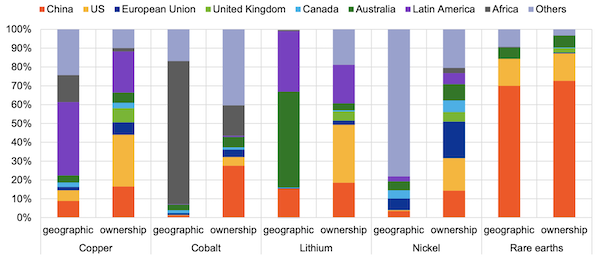

Figure 3 highlights the potential difference between the focus of the manufacturing sector and that of investors analyzed by corporate ownership. US investors and, to a lesser extent, EU and UK investors play a larger role in the supply of copper and lithium compared to domestic production. Conversely, Chinese investors have a significant stake in nickel and cobalt companies, while these minerals are mined mainly in Indonesia (nickel) and the DRC (cobalt). In contrast, in the informal world, production and capital ownership go hand in hand, and both the US and China are major producers and investors.

Figure 3 Geographic Concentration of Production and Ownership

Be careful: Nickel production is geographically concentrated in Indonesia, resulting in a large contribution from the ‘other’ category in the bar chart that breaks down nickel production by region.

Sources: US Geological Survey, Refinitiv, and authors’ calculations.

Smart Investors Play a Key Role in Leveraging CRMs

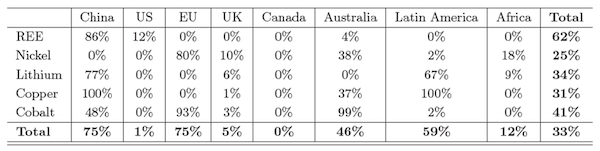

Table 1 documents the importance of strategic investors such as public companies and other strategic investors (including families of founders, board members, or management teams) in the ownership of firms involved in rare earth mining, and, to a lesser extent, in cobalt, lithium and copper mining. Chinese investors are highly strategic, book-friendly investors (IRENA 2023). Indeed, strategic investors account for 86% of Chinese investors’ funds in the rare earth sector. Strategic investors also play an important role in the exploitation of lithium and copper resources in Latin America. Strategic investors make up 67% of Latin American investors’ money in lithium mining companies. Overall, the last column of Table 1 confirms the rise of strategic investors in exotic global companies, which are mostly owned by Chinese investors. Strategic investors also own more than a third of the capital of firms involved in cobalt, lithium, and copper mining. For example, two strategic organizations (Chile Pampa Group and China’s Tianqi Lithium) control part of the capital of Sociedad Quiımica y Minera (SQM), the world’s second largest lithium company.

Table 1 Share of Key Investors in CRM Mining Companies in 2022

Be careful: Smart investors account for 86% of Chinese investors’ funds in the rare earth sector.

Sources: Refinitiv and scribe figures.

Conclusions and Policy Implications

Our database provides insights into ownership interests in CRM-listed companies, against a backdrop of growing political tensions. Although the EU’s CRM Law aims to reduce strategic dependence by diversifying EU assets, it does not address the risks associated with the accumulation of mining money. Indeed, the CRM Law sets diversification goals at the country level of producers. Such targets do not take into account the concentration risk associated with capital ownership. However, examining the concentration in the mining sector through stock data shows a very different picture compared to the mining sector. Therefore, our database can be useful in identifying the risks associated with the ownership of funds and refining the diversification target.

The CRM law also aims to improve the EU’s capacity to extract, process, and recycle key raw materials. Developing the European mining industry will require significant funding from private sources (Hache and Normand 2024). Due to the EU’s commitment to strengthen its economic security, examining the sources of control of European mining companies is very important in assessing the supply and political risks within the EU. Against this background, our results suggest the need for increased transparency regarding the sources of control for new mining projects announced in the EU.

Overall, our analysis underlines the need to improve the EU’s strategic autonomy and suggests the need for a steel-specific strategy. In particular, our database can be useful in guiding investment decisions, if European businesses want to increase their stake in large CRM firms.

Authors’ note: The views expressed are those of the authors and do not reflect those of the Banque de France.

References are available at the beginning.

Source link