More articles on dollar dominance, eg on Foreign Policy, Wells Fargo, vs. BitcoinNews. But most of the discussions focus on the use of the dollar in terms of exchange etc. (use of SWIFT, invoices). Here, some of the latest trends in size are laid out.

Here are some important financial pictures kept by the BRICS.

Figure 1: Share of foreign currency in USD, by central bank. Source: Ito-McCauley database,.

Next, the shares of EUR Holdings; notice the change in scale.

Figure 2: Share of foreign currencies in EUR, by central bank. Source: Ito-McCauley database,.

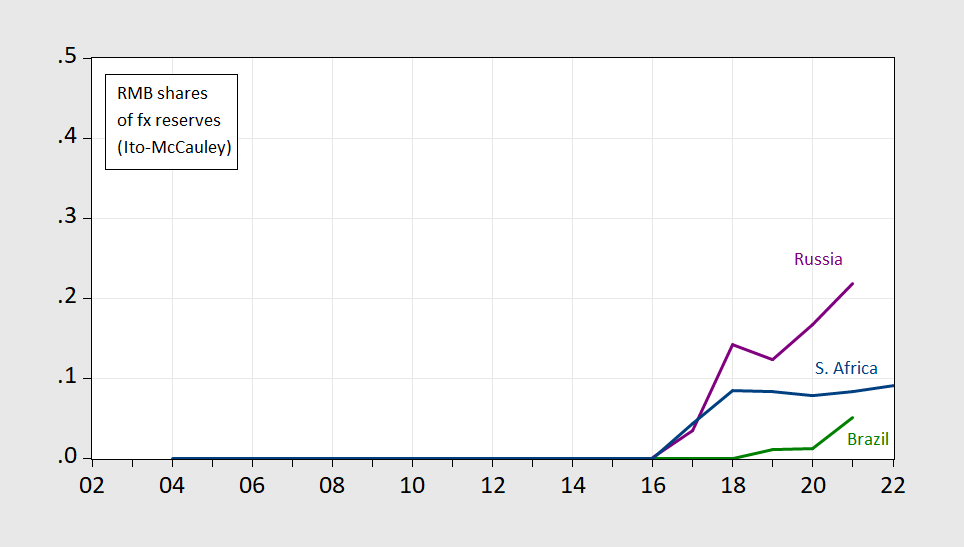

The holding of the USD shows a significant decline only in Russia. What about RMB? We have limited information here.

Figure 3: Share of foreign currencies held in RMB, by the central bank. Source: Ito-McCauley database,.

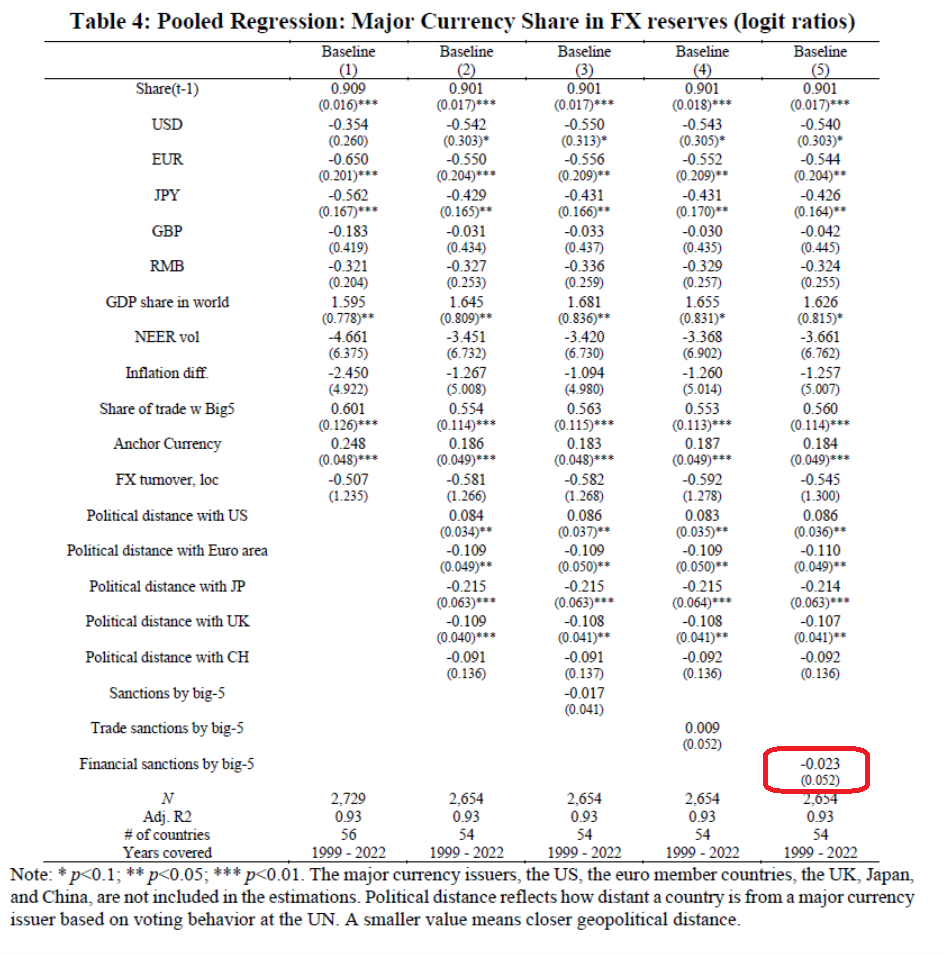

Will the use of sanctions result in reduced dollar savings? Unfortunately, we do not have data for the period after the extended invasion of Ukraine, but we have estimates that cover up to 2021.

The source: Chinn, Frankel and Ito (JIMF2024).

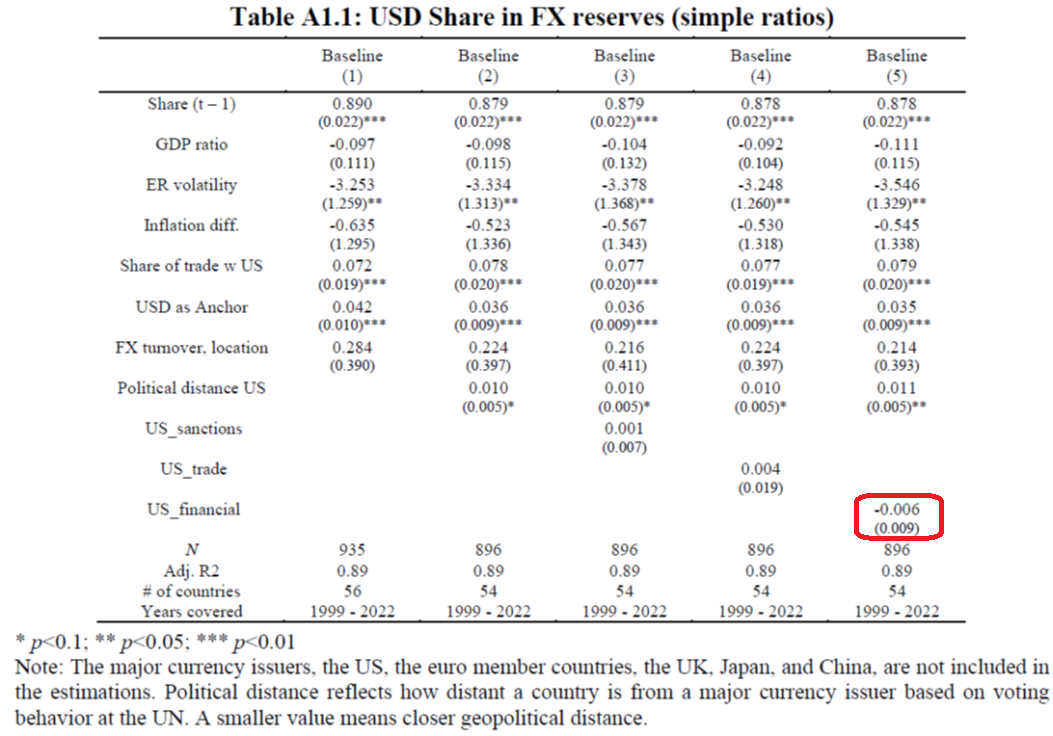

Note that the estimated coefficient is not statistically significant. And it’s not specific, so it’s hard to interpret. Table A1.1 in the paper presents estimates from linear regressions of USD holdings (only), so that the coefficient estimate is easier to interpret.

The source: Chinn, Frankel and Ito (JIMF2024).

The point average is very small (again not mathematically). Taken as it is, with an autoregressive coefficient of 0.88, the for a long time the effect is 0.05, so that if the US imposes financial sanctions on a country, on average the central bank of that country will have 5 points less US dollars. But, the 95% confidence interval includes 6 percent increase in dollar shares.

Therefore, the arguments that the use of financial sanctions will destroy the dominance of the dollar have not been confirmed by law, so far (perhaps with the data going to 2023, we will find something different).

Source link