China q/q and y/y GDP is below consensus, +0.7% vs +1.1% cons, +4.7% vs. +5.1% cons (Bloomberg).

Here are the q/q rates (not released annually):

Source: NBS by TradingEconomics.com.

Answer from Bloomberg:

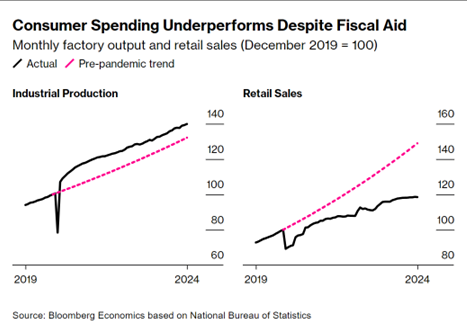

Gross domestic product grew 4.7% in the second quarter from the same period last year, the weakest of all but one of the 28 economists surveyed by Bloomberg. Retail sales rose at the slowest monthly pace since December 2022, reflecting a flurry of government efforts to juice confidence that have done little to revive the Chinese consumer.

Here are more series photos:

Source: Bloomberg.

Recently at the WEF event (also known as “Summer Davos”), Premier Li Qiang has signed that there is no future shock treatment (FT):

After the epidemic, China’s economy was like a patient recovering from a serious illness, Li said. “From the point of view of Chinese medicine, right now, we cannot use strong medicine. We have to fine tune and grow a bit [the economy]which allows the body to recover gradually”.

Natixis urges us not to focus on short-term movements, but the trend is down to growth and inflation, with default GDP growth at +4%, (compared to real at +4.7%). Note that the CPI for June decreased by 0.2% m/m.

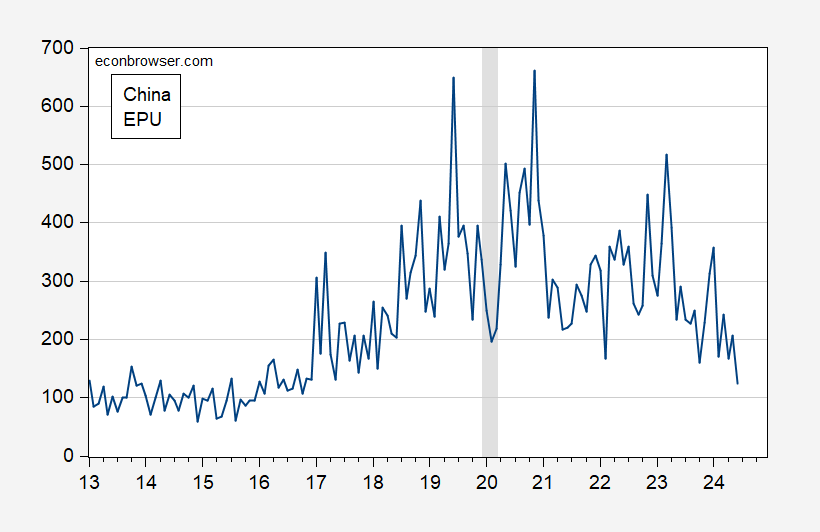

Personally, I doubt the effectiveness of “Chinese medicine” if by this one name it refers to folk remedies and roots (and other things you don’t want to hear much about) that were used in the past. I would say that some strong medicine is necessary, although my definition of strong medicine may differ from that conveyed by the CCP leadership. My definition includes moving away from an increasingly dirigiste approach and a business-oriented approach to government, so that policy uncertainty is stable for a long time.

Figure 1: China’s Economic Policy Uncertainty (Mainland Newspapers) (blue line). ECRI high recession days in gray. Source: policyuncertainty.com via FRED, ECRI.

Source link