Consumers, CEOs, or economists?

Figure 1: Year-over-year CPI inflation (bold black line), corresponding to 1-year inflation expectations from the NY Fed consumer survey (green line), from the Coibion-Gorodnichenko survey (red triangle), from -Survey of Professional Forecasters (teal squares). The NBER has defined recession days as shaded in gray. Source: BLS via FRED, NY Fed, Cleveland Fed, Philadelphia Fed, NBER.

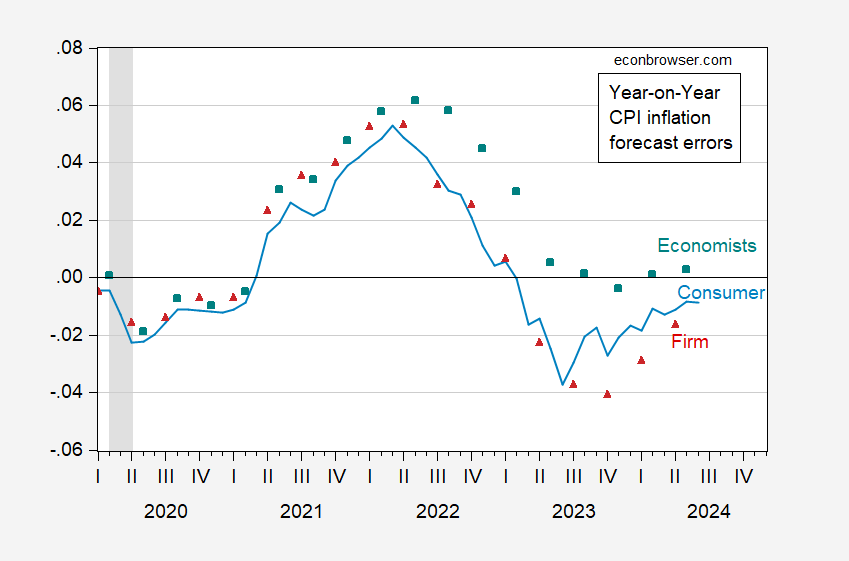

The forecast errors look like this:

Figure 2: Year-to-date CPI inflation forecast errors and 1-year-ahead inflation expectations from the NY Fed consumer survey (green line), from the Coibion-Gorodnichenko survey (red triangle), from the Survey of Professional Forecasters (teal squares). The NBER has defined recession days as shaded in gray. Source: BLS via FRED, NY Fed, Cleveland Fed, Philadelphia Fed, NBER, and author’s statistics.

While expert forecasts have missed inflation, they have reached an actual decline from May 2023 onwards.

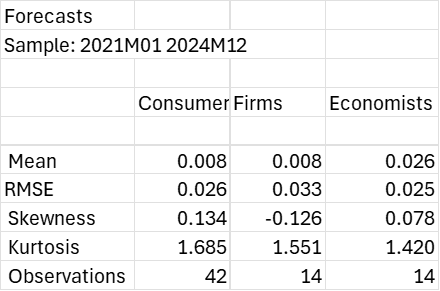

Although economists were more biased in their expectations in this period, under-predicting inflation in one year, the root mean square error (RMSE) of economic forecasts was lower than that of firms, and almost the same as that of consumers. Of these three measures, only the strict expectation fails to reject the no-bias null.

On the other hand, conservative CEOs predict an overshoot in inflation in the near future.

In terms of correcting forecasts in response to errors, consumers move slowly (as measured by the AR(3) of errors, close to unity). Firms are next, at 0.89, and economists are fastest at 0.81.

Source link