Pascal Michaillat and Emmanuel Saez say a 40% chance, yes. From abstract to paper:

To answer this question, we develop a new Sahm-type index of recession that combines vacancy and unemployment data. The index is the minimum of the Sahm index— the difference between the next 3-month average of the unemployment rate and its minimum in the previous 12 months—and the same index made up of the vacancy rate—the difference between the follow-up after 3 months. the average number of vacancies and their maximum number in the last 12 months. We then propose a two-pronged recession rule: If our index reaches 0.3pp, a recession may have started; when the index reaches 0.8pp, the recession has definitely started. This new law was started before Sahm’s law: on average you get a recession 1.4 months after it starts, while Sahm’s law gets them 2.6 months after it starts. The new law also has a better historical record: it correctly identifies all recessions since 1930, while Sahm’s law was violated before 1960. With data for July 2024, our index is at 0.5pp, so the US economy is likely to have recovered. the recession is 40%. In fact, the recession may begin in March 2024.

Source: Michaillat and Saez (2024).

As far as I know, the authors are using last updated data, not real time. It would be interesting to see if the results are robust to the use of real-time data, given the large impact of population control especially in recent years.

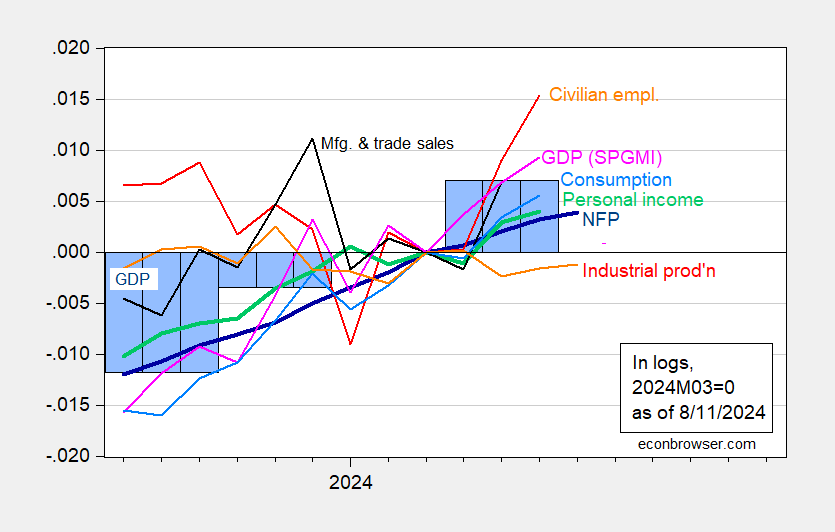

Normalizing the NBER indicators to 2024M03 as a peak, we have Figure 1:

Figure 1: Nonfarm Payroll (NFP) from CES (blue), employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bright green), trade and sales in Ch.2017$ (black), consumption in Ch.2017$ (blue), and monthly GDP in Ch.2017$ (pink), GDP (green bars), all log normalized to to 2023M04=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q2 advance release, S&P Global Market Insights (probably Macroeconomic Advisors, IHS Markit) (8/1/2024), and author’s calculations.

And some pointers:

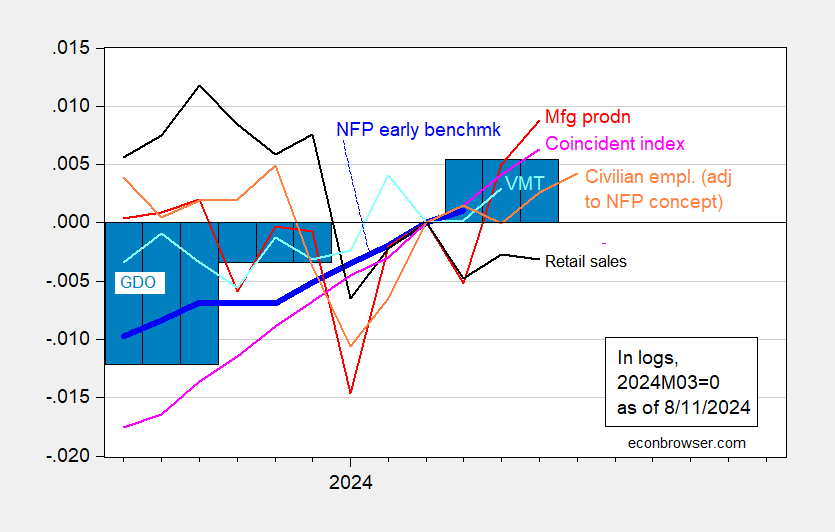

Figure 2: Nonfarm Payroll (NFP) Philadelphia Fed preliminary benchmark employment (blue), NFP-adjusted employment (orange), manufacturing output (red), retail sales (black), vehicle miles traveled (blue), and -Coincident Index (light pink), GDO (blue bars), all logs are normalized to 2023M04=0. The GDI used in calculating 2024Q2 GDO is estimated by forecasting the total 2024Q2 operating surplus using GDP, lagged surplus, residual differential surplus, 2021Q1-2024Q1. Source: BLS via FRED, Federal Reserve, BEA 2024Q2 advance releaseand the author’s calculations.

Source link