Michigan 67.8 vs 66.7. A huge jump in expectations 72.1 vs. 68.5 (contrary to the current situation).

Figure 1: University of Michigan Consumer Sentiment (blue), Conference Board Consumer Confidence (tan), Shapiro, Sudhof and Wilson (2020) Daily News Sentiment Index (green). all deflated and normalized by standard deviation (sample period shown).News Index View for August through 8/11/2024. The NBER has defined recession days as shaded in gray. Source: U.Mich via FRED, The Conference Board via Investing.com, SF Fed, NBER, and author’s statistics.

But aggregates miss part of the story.

Research director Joann Hsu comments:

Overall, expectations have strengthened for both personal finance and the five-year economic outlook, which reached its highest reading in four months, consistent with the fact that electoral developments may influence future expectations but are unlikely to change current assessments. Survey responses often include who, at the moment, consumers expect to be the next president.

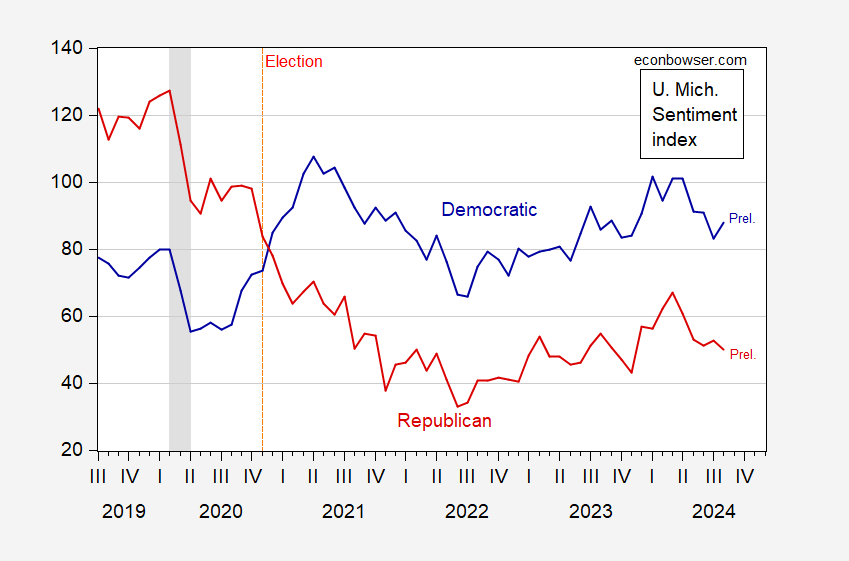

Here is the team breakdown:

Figure 2: University of Michigan Consumer Sentiment for Democrats (blue) and Republicans (red). The NBER has defined recession days as shaded in gray. Source: U.Mich and NBER.

In August, opinion polls are split, with Democratic and independent respondents showing an increase in sentiment, while Republicans are declining. The increase for Democrats in August is about a standard deviation from the average.

Hsu notes:

As election developments dominate the headlines this month, sentiment among Democrats rose 6% after Harris replaced Biden as the Democratic presidential nominee. For Republicans, sentiment went the other way, down 5% this month. The mood of the independents, who live in the center, increased by 3%. The survey shows that 41% of consumers believe that Harris is the best economic candidate, while 38% chose Trump. In comparison, between May and July, Trump had a 5-point advantage over Biden on the economy.

Source link