From X, Thursday:

This is more than funny: industrial production and energy use saw another major downward revision, and Jul’s print still comes in negative M/M – manufacturing is in a recession:

Note: Dr. Antoni used industrial production, energy consumption in the graph above, rather than production.

This struck me as an unusual feature, so I sorted the data at the same time (using manufacturing instead of industrial classification).

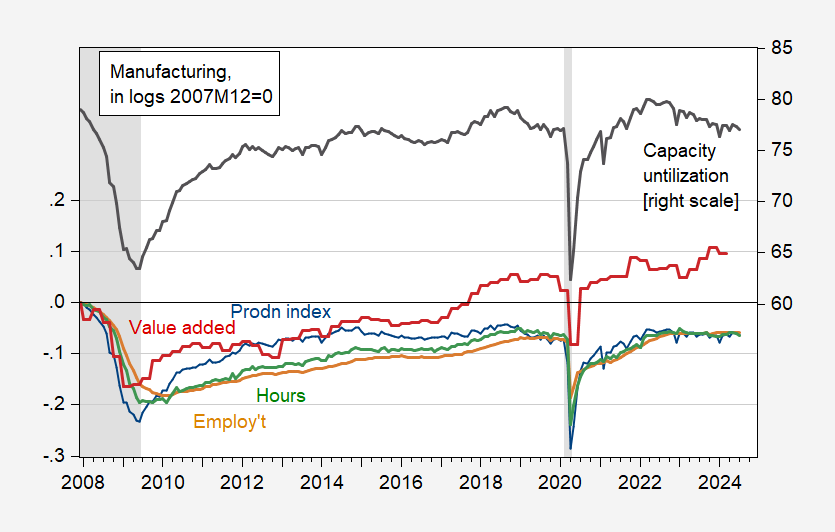

Figure 1: Manufacturing output (blue, left scale), employment (black, left scale), aggregate hours (green, left scale), and real value added (red), all in log, 2007M12=0, and energy consumption in production, in % (black, right scale). The NBER has defined recession days as shaded in gray. Note: 2007M12 is the peak of the NBER business cycle. Source: Federal Reserve, BLS, BEA via FRED, NBER.

The figure highlights two points: (1) production output (Fed index) and value added differ, as the first is total, the last net; (2) employment and hours are problematic indicator measures since productivity in manufacturing is higher than in the economy as a whole.

Although energy consumption has decreased, it is still higher than the pre-pandemic level.

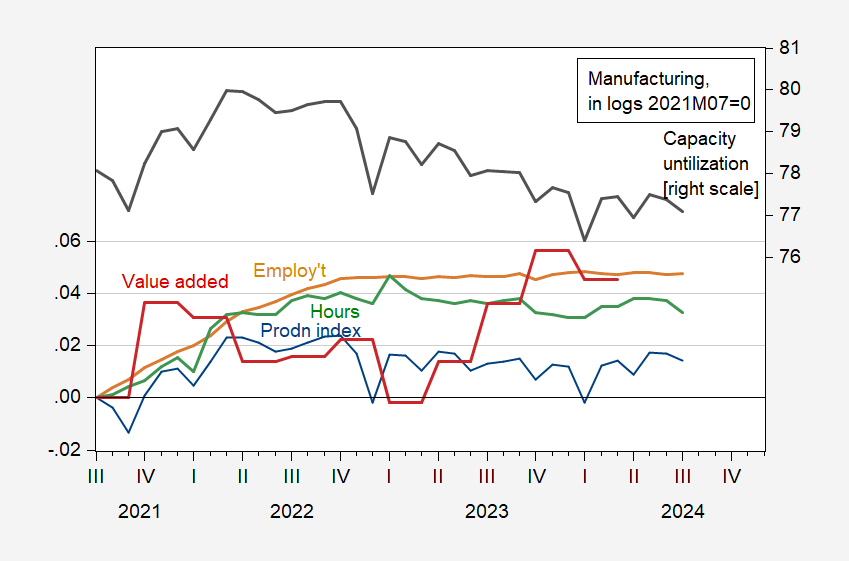

It’s hard to see what happened recently, so I present the corresponding post-pandemic data in Figure 2:

Figure 2: Manufacturing output (blue, left scale), employment (tan, left scale), aggregate hours (green, left scale), and real value added (red), all in log, 2021M07=0, and energy consumption in production, with -% (black, right scale). Source: Federal Reserve, BLS, BEA via FRED.

We don’t have value added for Q2, but we have production and employment until July. These preliminary figures show a decline, but it is not clear to me that they are in recession territory (whatever a recession is).

Source link