Actually, no – but maybe it’s a fast food country in a recession. Arguing that the output has not been measured properly, so much so that it has been stagnant for the last four years, Peter St. Onge (Treasures) and Jeffrey Tucker (Brownstone Institute) write:

Various studies have shown that since 2019 fast food prices – the gold standard in financial markets for measuring real inflation – have exceeded the official CPI by between 25% and 50%.

The “different studies” cited are as far as I can tell a collection of newspaper articles. What if we measure GDP using fast food prices? Here is the evolution of the fast food (“limited restaurants”) CPI, compared to the GDP deflator, the CPI, and the food away from home component of the CPI:

Figure 1: GDP deflator (black), CPI (blue), food away from home CPI (brown), food away from home – limited restaurants CPI (tan), price of a Big Mac (green), all in log 2017M01=0. Big Mac prices based on price as close to the mid-year as possible. The NBER has defined recession days as shaded in gray. Source: SPGMI (Economic Consultants/IHS-Markit) 8/1 release, BLS via FRED, BLS, EconomistNBER, and author’s figures.

Some discussions of fast food prices here). My meal of choice is the Big MacTMused in many purchasing power estimation studies (including one published in Journal of Economics).

It is true that using the restaurant price index for limited services, prices have risen faster than the CPI (although the same is not true for the Big Mac.TMs!).

I plan different measures of GDP at the same time that St.Onge and Antoni planned.

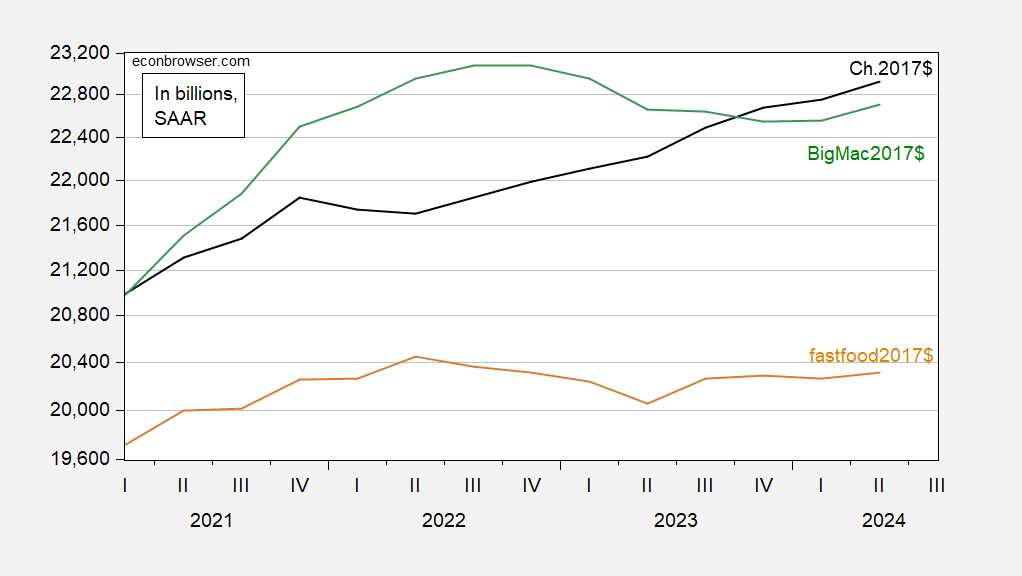

Figure 2: GDP in bn.Ch.2017$ (black), in bn.BigMac2017$ (green), in bn. restaurant food bundles 2017$ (tan), all SAAR. The big MacTM cumulative (cubic) values from the annual July observation. Source: BEA 2024Q2 second release, BLS, Economist, and author’s statistics.

Using a Big MacTM values, the real GDP has been decreasing since the end of 2022, although from a higher level than the estimated GDP in Ch.2017$. Using the food-away-from-home limited services section of the CPI, we have a picture that is somewhat consistent with the St. Of Tucker.

So…if all we ate, invested in, paid our military and government employees, and exported were burgers, sandwiches, fried chicken and tacos, then we might have been in a recession four years ago. (Fast food weighs 2.5% in the CPI-U, so if we assume consumption is 70 percent of GDP, then fast food consumption accounts for about 1.8% of GDP.)

Source link