EJ Antoni (Inheritance) is skeptical about GDPNow’s (and other current coverage) Q3 growth. From X aka Twitter today:

Latest Q3 Nowcasts: ATL 2.5% (2.0% prev) NY 2.49% (1.94 prev) STL 2.05% (1.65 prev) Strong consumer spending numbers will be needed in Aug and Sep to make this happen:

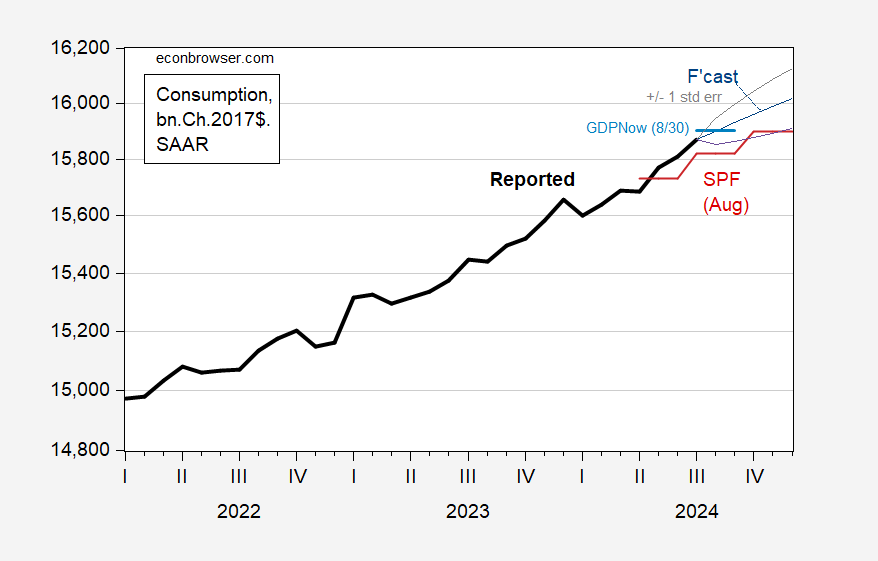

I wondered about this, given the limited acceleration in real consumption growth (m/m AR 4.6% in July). GDPNow reports the current growth of the elements, as used to check the nowcast. GDPNow’s 30 August has a growth rate of 3.8% q/q penciled in. What does the picture look like?

Figure 1: Consumption (bold black), GDPNow nowcast as of 30 Aug (green line), August SPF median (red line), and ARIMA(0,1,0) forecast (green line), +/- 1 standard error band (gray lines ), all in bn.Ch.2017$, SAAR, log scale. Estimated forecast in first log difference, 2021M07-2024M07. Source: BEA, Philadelphia Fed, Atlanta Fed, and author’s calculations.

Granted, GDPNow’s projected consumption is now above the August SPF median (although this forecast was made in early August). However, based entirely on a simple autoregressive model, 3.8% q/q AR consumption growth would not be surprising at all, statistically speaking.

Source link