NFP +142 against consensus +166. Employment is almost certainly down (remembering that this is the first release). What does this look like?

Figure 1: Nonfarm payroll (NFP) from CES (blue), Bloomberg consensus assuming no revisions to previous months (light blue), early benchmark NFP (tan), total QCEW covered by adjusted employment per season by author using X-13 (red), employment adjusted to NFP concept (green), all in logs, compared to 2023M03. Source: BLS, Bloomberg, Philadelphia Fed, and author’s calculations.

In last months review, the “miss” in approval is 108K, not 24K. On the other hand, the CPS version of NFP employment (people, not jobs) was +178 (vs. +142K from CES). Given the high variance in CPS-based series, I won’t find much comfort in this.

What about the impact of the first benchmark? As I have noted before, this has a large – perhaps very large – effect on the level of relative employment.

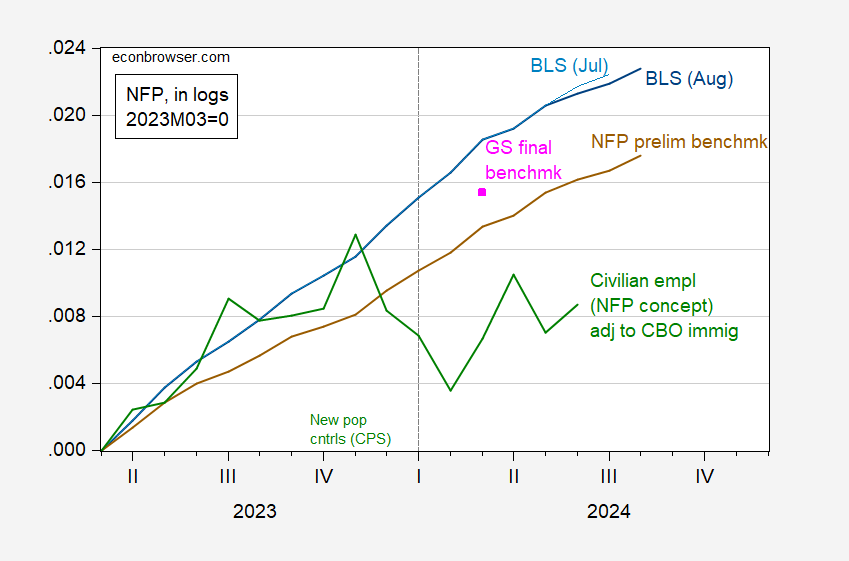

Figure 2: Nonfarm payroll (NFP) from August CES (blue), from July CES (blue), Bloomberg consensus assumes no updates in previous months (blue), suggests preliminary NFP benchmark (brown) , NFP-adjusted employment, adjusted by author using CBO’s estimate of net immigration to mean employment (green), Goldman Sachs’ estimate of NFP-estimated employment (pink square), all in log, compared to 2023M03. Source: BLS, Bloomberg, Philadelphia Fed, and author’s calculations.

I adjusted the BLS’s NFP separate employment series with my adjustment to the CBO-estimated peak employment estimate (see discussion here), except that I applied for the June 2024 adjustment (2024 fiscal year for immigration reporting). ), instead of June 2023.

With these figures, employment is still growing year after year, even for CPS-based series. Since the graphs are displayed on a log scale, then it is clear that the series is decreasing in growth, as the Fed intends.

Source link