There are now several statistical models and prediction markets that generate predictions for the upcoming presidential election, and they point to a very close race. Harris has the edge in the FiveThirtyEight and PredictIt forecasts, but is behind in the Silver Bulletin and Polymarket forecasts. The Economist has taken part in the race.

Some political scientists argue that these predictions are meaningless, that it will take decades if not centuries to accumulate enough data to prove convincingly that they are more accurate than a coin flip. I disagree with this assessment, but it is certainly true that both models and markets have some serious limitations. Models are built and calibrated based on historical results and run into deep trouble when we enter uncharted waters. And markets are subject to overreaction and manipulation.

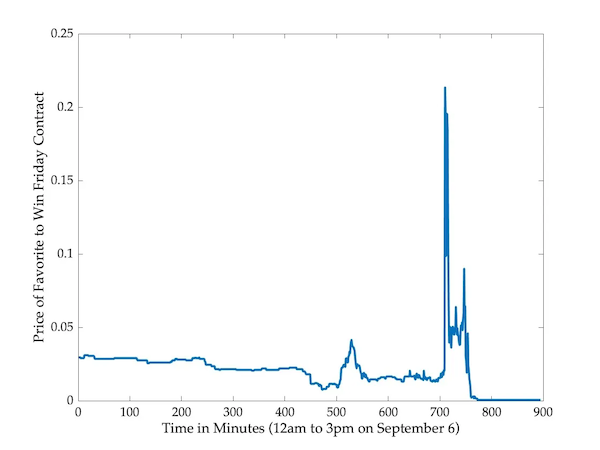

There was an amazing attempt at manipulation at Polymarket yesterday, and you can see evidence of it in the following sharp price movements:

What happened is this. The group of traders bet heavily on Harris and Trump in an attempt to pressure him into a few-hour lead. The sums involved were quite large, with one dealer betting around $2.5 million. The goal was to ensure that the Harris contract would have the highest price for the majority of minutes during the three-hour period between noon and 3pm EST on Friday, in order to benefit the derivatives market reflecting the prices of the primary market.

Specifically, the favorite to win at Polymarket on Friday listed contracts that would have paid a dollar if Harris had been ahead of the majority of 180 minutes in the specified period. These contracts were trading around 3 cents earlier in the day, but will rise above 20 cents around the start of the three-hour window:

One trader spent more than $11,000 buying these contracts at an average price of 8 cents each, aggregating about 140,000 contracts. If the fraud attempt had been successful, there would have been an estimated profit of 130,000 dollars. This would have been offset by losses in the underlying markets, assuming prices would have returned to pre-manipulation levels. Still, it looks like a six-figure profit in one day on a $2.5 million investment would have been secured.

Despite the fact that the attempt failed, most of the amounts spent on the primary market could not be recovered. The would-be scammers lost a few thousand dollars, but nowhere near the millions they bet on the scheme.

Andrew Gelman argues that such manipulation is tantamount to “subverting democracy.” And you see his point, since beliefs about election results can be self-fulfilling. Lack of confidence about a candidate’s performance leads to lower morale, fundraising, volunteer effort, and turnout, all of which make defeat more likely.

Markets that refer to the prices of other markets are common in the financial world of course—all stock options and index futures have this place. But when it comes to election prediction markets, I see no reason for such derivative contracts. They serve no legitimate purpose and open up obvious manipulation techniques. And even if attempts at deception are ultimately unsuccessful, they still raise suspicions and sow confusion.

Derivative contracts of this type continue to be listed on Polymarket. It would be a good thing if they were cut off.

Source link