With the release of industrial production today (+0.8% vs. +0.2% m/m consensus), we have the following picture of the main series tracked by the NBER’s BCDC:

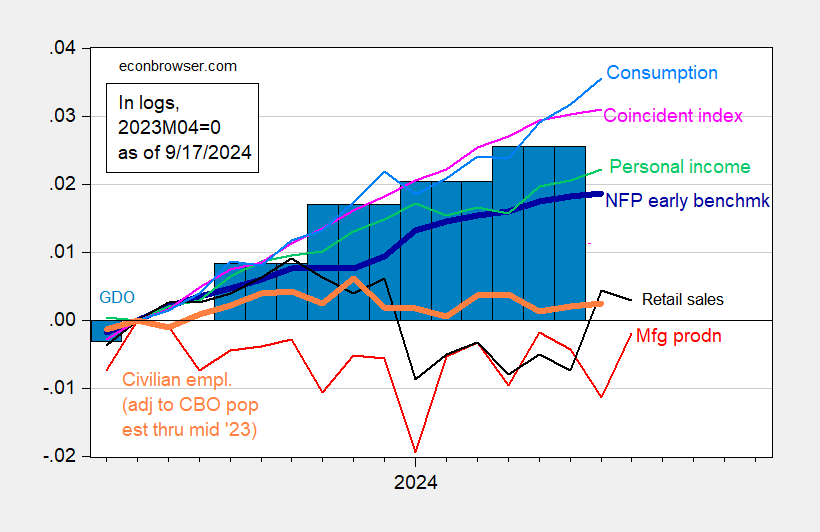

Figure 1: Nonfarm Payroll (NFP) employment from CES (bright blue), Bloomberg consensus 9/6 NFP (blue +), implied NFP from the first benchmark (blue), employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bright green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (green blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2023M04=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q2 2nd release, S&P Global Market Insights (with Macroeconomic Advisers, IHS Markit) (9/3/2024), and author’s calculations.

Note that the initial benchmark coverage (which may outpace the eventual NFP decline – see here) still shows continued growth through 2024M08.

Other indicators — the monthly GDP index, the Philadelphia Fed’s first benchmark of the official NFP (preliminary) NFP, industrial production, retail sales of manufacturing and sales in the commercial sector — in Figure 2. Retail sales +0.1% vs. – 0.2% m/m consistency).

Figure 2: Preliminary Nonfarm Payroll (NFP) benchmark (dark blue), employment adjusted using CBO immigration estimates through 2023 (orange), manufacturing output (red), personal income excluding current transfers by Ch.2017$ (light green), retail sales in 1999M12$ (black), consumption in Ch.2017$ (blue), and the corresponding index (pink), GDO (blue bars), all normal logs to arrive at 2023M04=0. The early benchmark is the official NFP which is adjusted by the ratio of total states to CES total states. Source: Philadelphia Fed, Federal Reserve via FRED, BEA 2024Q2 second release, and the author’s calculations.

There are no signs of a slowdown in August, although manufacturing – and recent retail sales – have shown a sideways trend. However, we still need to see personal income transfers (a key indicator tracked by the NBER’s BCDC) and consumption for August.

GDPNow as of today is 2.5% q/q AR in Q3. Goldman Sachs raised its tracking ratio to 2.8%.

Source link