From the article (published on 9/10), two important graphs:

So…

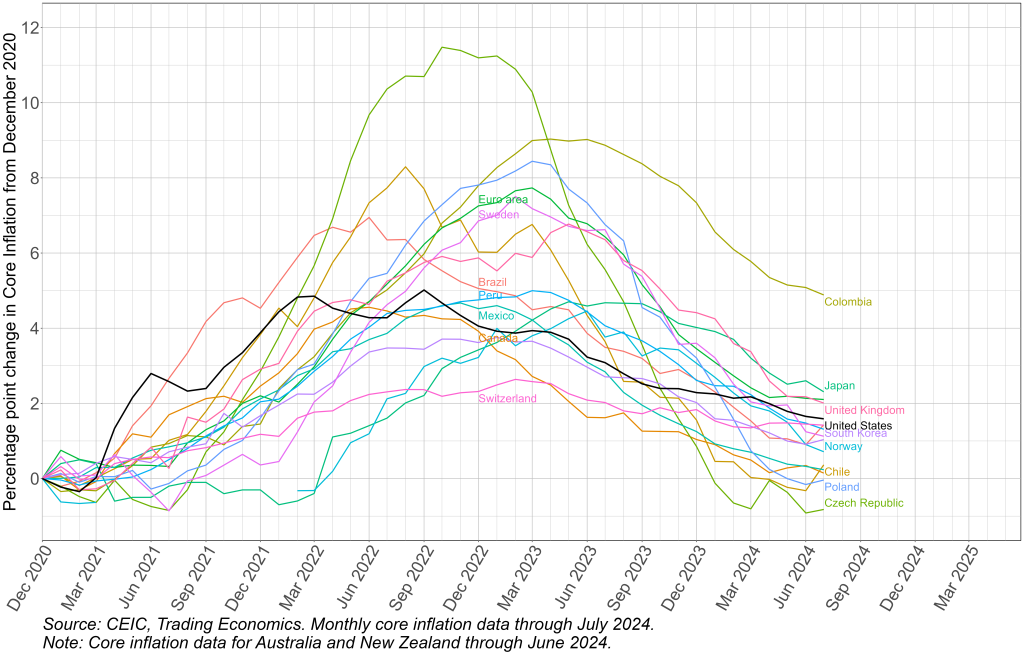

…because inflation has nearly fallen to target levels while signs of a recession are rising, the Fed could begin to unwind its exceptional monetary tightening.

So in today’s post, Kamin makes the case for a 0.5% cut:

If the economy is close to equilibrium and inflation is likely to decrease further, then interest rates should also be at normal levels. Economists refer to these as “neutral” rates, meaning “the short-term interest rate that will exist when the economy is at full employment and inflation is stable.” Neutral interest rates cannot be seen directly, but a reasonable estimate would be around three percent: two percent to compensate investors for inflation and an additional one percent to reflect the real return on capital. In fact, in the last forecast released in June, Fed officials put that rate at 2.8 percent.

Therefore, with inflation more contained and the economy balanced, interest rates should be closer to 3 percent than 5 percent. And even if there are bigger forces in the economy than most economists judge, or if the neutral interest rate is high, there is still a large margin between where interest rates are and where they need to be. This means that even a rate cut of 0.5 percent can be done with little risk of reviving inflation.

Source link