Ad hoc time series analysis.

The average 30-year mortgage and 10-year perpetual maturity Treasury yields have been rising for the past 8 years. Johansen’s maximum likelihood test (proceeding to the cointegration equation, in VAR, 4 lags of difference) rejects the null of cointegration using Trace statistics (and only one cointegrating vector, so both series may be stationary) for the period 1986-2024M08 .

The null hypothesis of (1 -1) including the vector is not rejected (point averages (1 -1.02).

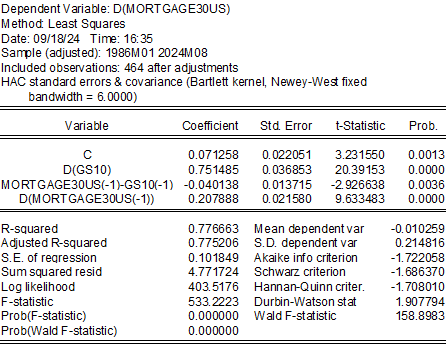

Using a single equation error correction model (assuming homogeneity) yields:

These estimates show mortgage rates about 7 ppts above 10-year Treasuries. A one percentage point drop in the 10-year yield results in a 0.75 percentage point drop in mortgage rates when it has an impact (here, per month). The deviation from the mean is a half-life of about 4.5 years.

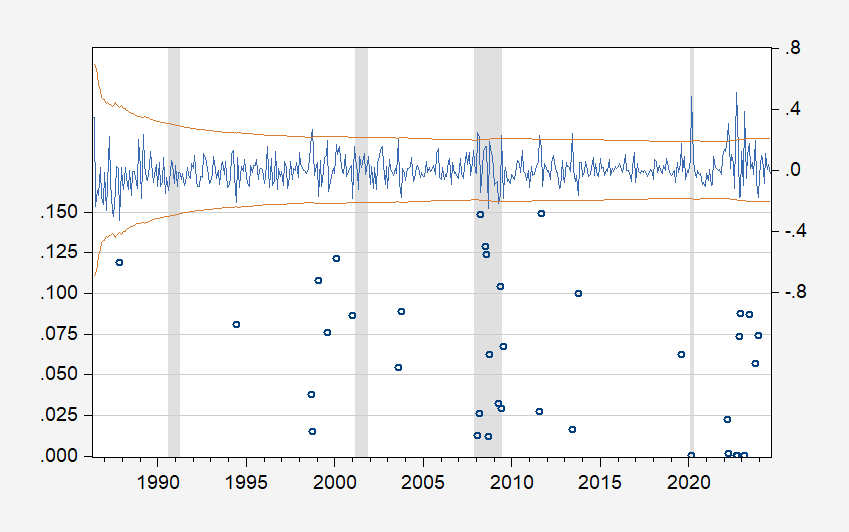

The relationship is subject to a structural break, as indicated by Chow’s one-step multiple regression test, especially around September 2022.

Figure 1: Probability of one-step forward Chow multiplicative test without break (left scale), multiplicative residuals (right scale). The NBER has defined recession days as shaded in gray.

If a 100 bps reduction in the Fed funds rate (currently the year-end speech) results in a 30 bps reduction over ten years, this means a 23 bps reduction in loan rates by the end of the year (ballpark!).

Source link