Over the past few years, the persistently low level of consumer sentiment, as measured by the University of Michigan, the Conference Board, or Gallup polls, relative to mainstream economic trends has baffled analysts, including this one. [1] [2] [3] [4] [5]. This paradox is illustrated by the evolution of the U series. Michigan (FRED UMCSENT series), and values are entered using 2011M01-2024M08 unemployment and inflation data year by year.

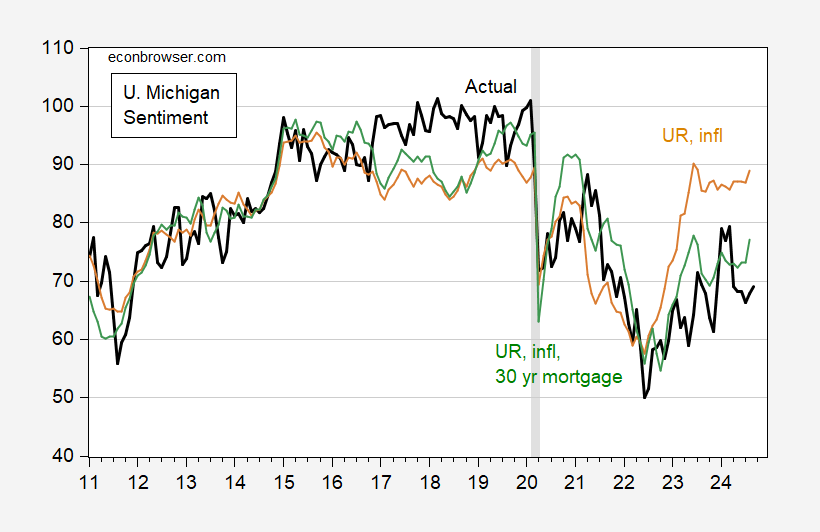

Figure 1: University of Michigan Consumer Sentiment index (bold black), values entered using unemployment and inflation (see text) (tan), +/- 1 standard error band (gray line). The NBER has defined recession days as shaded in gray. Source: University of Michigan via FRED, NBER, and author’s statistics.

Here are the regression results (where inflation is the 12-month growth rate, in %):

MCSEN = 104.12 –2.455 DO NOT MEASURE – 3.727 NFL

Adj-R2 = 0.51, SER 9.256, DW = 0.23, N=164, Sample 2011M01-2024M08. Bold indicates significance at the 10% level using HAC Newey-West standard errors.

The maximum gap is between 2023 and the end of 2023.

A partial correction is shown in the following figure, inspired by Bolhuis et al (2024).

Figure 2: University of Michigan Consumer Sentiment index (bold black), values indexed using unemployment and inflation (tan), using unemployment, inflation, and the 30-year mortgage rate (green). The NBER has defined recession days as shaded in gray. Source: University of Michigan via FRED, NBER, and author’s statistics.

The green line is equal using the base equation plus the 30-year mortgage rates.

MCSEN = 135.67 –3.669 DO NOT MEASURE – 3.328 NFL – 5.97 MORTGAGE30US

Adj-R2 = 0.73, SER 6.785, DW = 0.48, N=164, Sample 2011M01-2024M08. Bold indicates significance at the 10% level using HAC Newey-West standard errors.

Where MORTGAGE30US is the FRED series of 30-year mortgage rates in the US. Note that in both regressions, I used the HICP (which excludes housing costs) as my price index. The level of credit is almost as important as the rate of unemployment, according to the standardized coefficients (beta) (0.53 vs. 0.58, and 0.62 for inflation).

These results show that the 1.1 point decrease in MORTGAGE30US from October 2023 (through August) accounted for about a 6.5 point increase in UMCSENT.

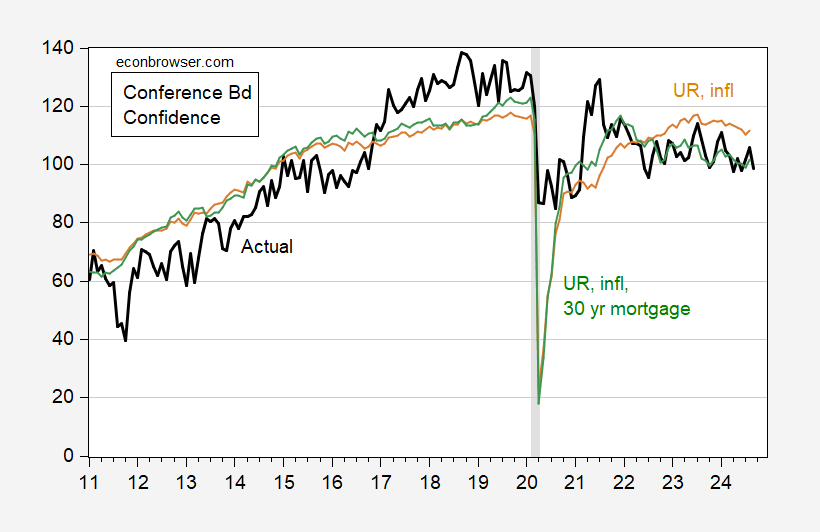

Similar results are shown by the Conference Board’s Index of Consumer Confidence (although HICP inflation y/y does not show statistically significant):

Figure 3: The Conference Board’s Consumer Confidence Index (bold black), values indexed using unemployment and inflation (tan), using unemployment, inflation, and the 30-year mortgage rate (green). The NBER has defined recession days as shaded in gray. Source: The Conference Board via Investing.com, NBER, and author’s statistics.

The regression results are:

CONFIDENCE_CONFBD = 175.28 –9.544 DO NOT MEASURE – 0.716 NFL – 4.984 MORTGAGE30US

Adj-R2 = 0.63, SER 13.640, DW = 0.40, N=164, Sample 2011M01-2024M08. Bold indicates significance at the 10% level using HAC Newey-West standard errors.

Why is this the only possible solution? If one extends the sample before 2011M01, the regression results decrease. The inclusion of MORTGAGE30US then reveals a positive coefficient, insignificant at first, and significant as the sample expands further back in time (see e.g. As this instability in the relationship is not associated with changes in the inclusion of housing costs in the CPI as noted by Bolhuis et al (2024), i think of this as the remaining puzzle. Maybe if house prices were also included, this would fix the problem (actually, i checked – it does).

Finally, note that loan rates go equally into UMCSENT for Democrats vs. Republican. Mortgage rates have a negligible effect on Democrats’ sentiment. The Trump dummy dominates both Republicans and Democrats, in terms of influence as measured by a standardized coefficient. Therefore, the inclusion of credit ratings does not explain all the seemingly strange behavior of sentiment indicators.

Source link