High frequency indicators (PMI, etc.) suggest – and have suggested – a decline in productivity. However, some indicators show a sideways trend. Here’s a picture, which includes just the amount of production that was added in Q2, and the work that includes the first benchmark update.

Figure 1: Manufacturing output (blue scale, left scale), implied employment from the first benchmark (tan, left scale), aggregate hours (green, left scale), and real value added (red), all in log, 2021M07=0, and production energy consumption , in % (black, right scale). Source: BLS via FRED, Federal Reserve, BLS, BEA via FRED, NBER.

I wonder a little about the extrapolation from manufacturing to the rest of the economy. While productivity may be the leading indicator (that’s doubtful), it has been a declining share of overall economic activity decades.

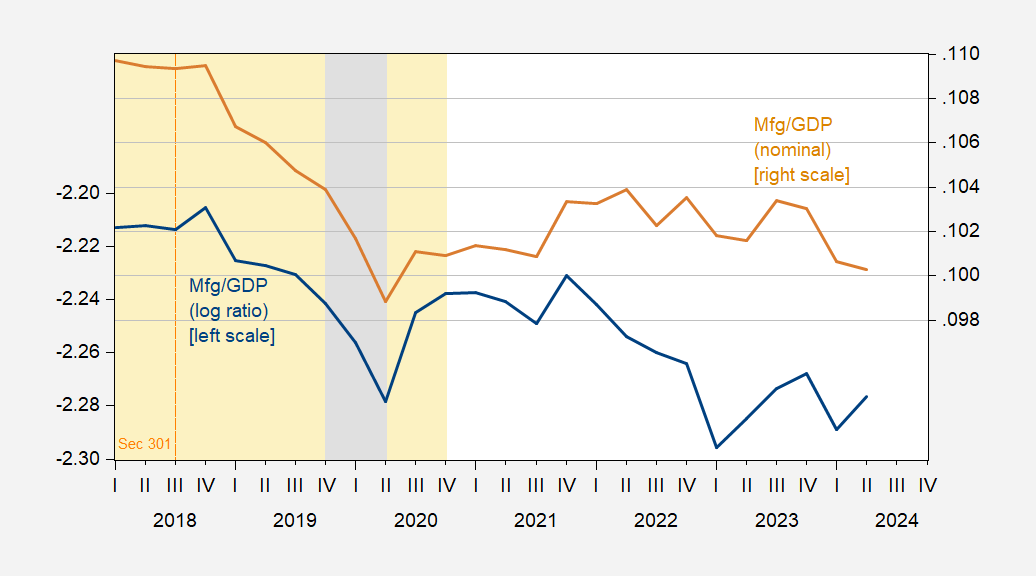

Figure 2: Average of the log of real manufacturing value added to GDP (blue scale, left scale), and production share of GDP (tan, right scale). The NBER has defined recession days as shaded in gray. Orange shading denotes the Trump administration. Source: BEA 2024Q2 release/annual update, NBER, and author’s calculations.

In fact, the value added manufacturing industry has fallen significantly in Trump’s trade war (even before the pandemic). Therefore, we should be interested in manufacturing to the extent that it is a large share of the economy (about 10% in additional terms). However, the manufacturing sector may be stagnant (however a recession is defined) without the entire economy suffering as a result (as defined by the NBER).

Source link