NBER BCDC indicators, other indicators, weekly indicators, nowcasts. As someone who noted the high probability of a recession in August 2024, I don’t see any downside to the current (preliminary) data.

Figure 1: Nonfarm Payroll (NFP) activity from CES (blue), mean NFP from the first benchmark (blue), employment (orange), industrial production (red), personal income excluding current transfers in -Ch.2017$ (bright green), production and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (blue), and monthly GDP in Ch.2017$ (pink ), GDP (green bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q2 version 3/annual update, S&P Global Market Insights (macroeconomic advisors, IHS Markit) (10/1/2024), and author’s calculations.

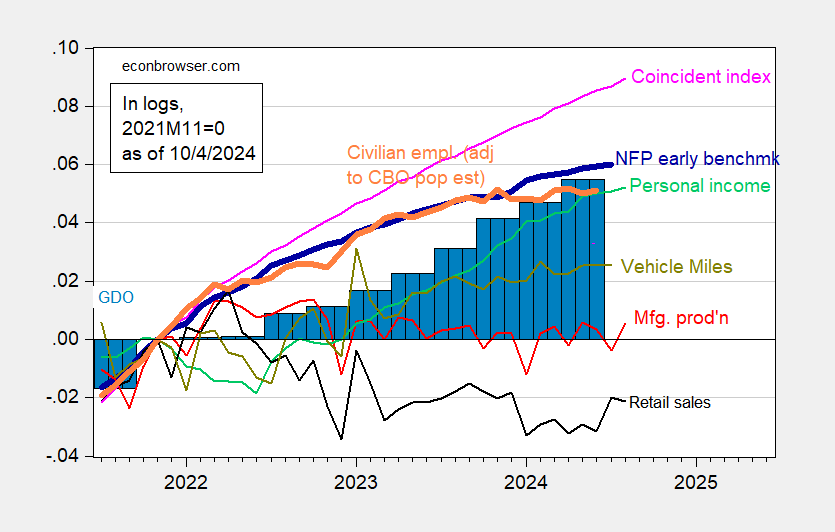

Figure 2: Preliminary Nonfarm Payroll (NFP) benchmark (dark blue), employment adjusted using CBO immigration estimates through 2024 (orange), manufacturing output (red), personal income excluding current transfers by Ch.2017$ (light green), retail sales in 1999M12$ (black), vehicle miles traveled (chartreuse), and coincident index (pink), GDO (green bars), all logs tend to be -2021M11=0. The early benchmark is the official NFP which is adjusted by the ratio of total states to CES total states. Source: Philadelphia Fed, Federal Reserve, NHTSA via FRED, BEA 2024Q2 third release / annual update, and the author’s calculations.

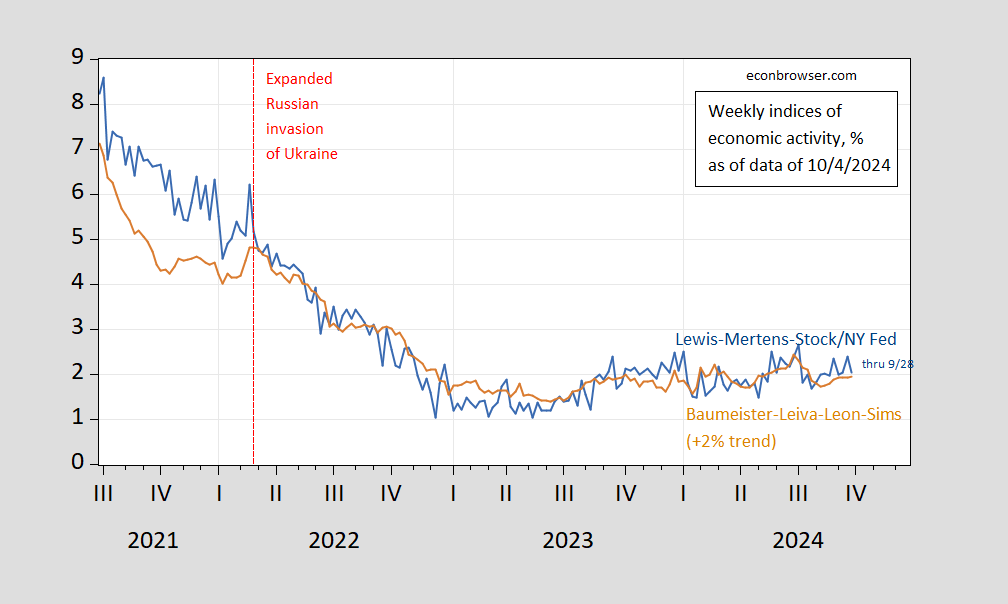

Figure 3: Lewis-Mertens-Stock Weekly Economic Index (blue), and Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US and 2% trend (tan), all y/y growth rate in %. Source: NY Fed via FRED, WECI, accessed 10/6, and author’s calculations.

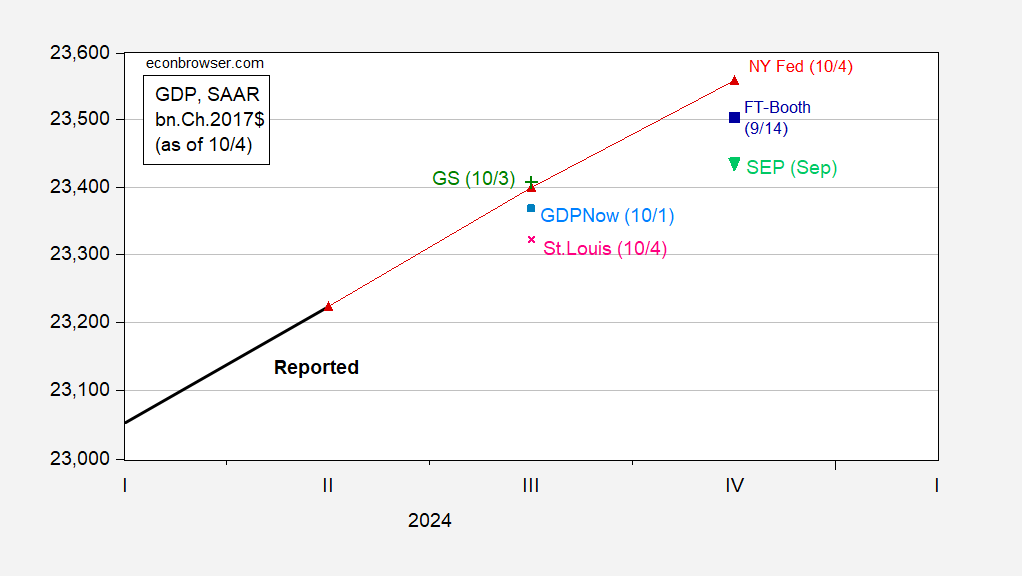

Figure 4: GDP (bold black), Summary of Economic Forecasts released for the third time (green inverted triangle), GDPNow as of 10/1 (blue square), NY Fed now broadcast on 9/20 (red triangles), St Louis Fed news now on 10/4 (pink x), Goldman Sachs tracking from 10/3 (green +), FT-Booth from 9/14 pronounced on the release of 3 (green square), all in bn.Ch. in 2017 US dollars. The rates are calculated by multiplying the growth rate by GDP rates, except for the Survey of Professional Forecasters. Source: BEA 2024Q2 2nd Release, Atlanta Fed, NY Fed, Philadelphia Fed, Federal Reserve September 2024 SEP and author’s calculations.

Even taking the first NFP benchmark at face value, most indicators are rising – even in other ways (except maybe sales). High frequency (weekly) indicators are close to the trend with data available as of 9/28. Finally, nowcasts, except for St. Louis Fed’s, showing above growth (2%) in Q3.

Addendum (12:25 PT):

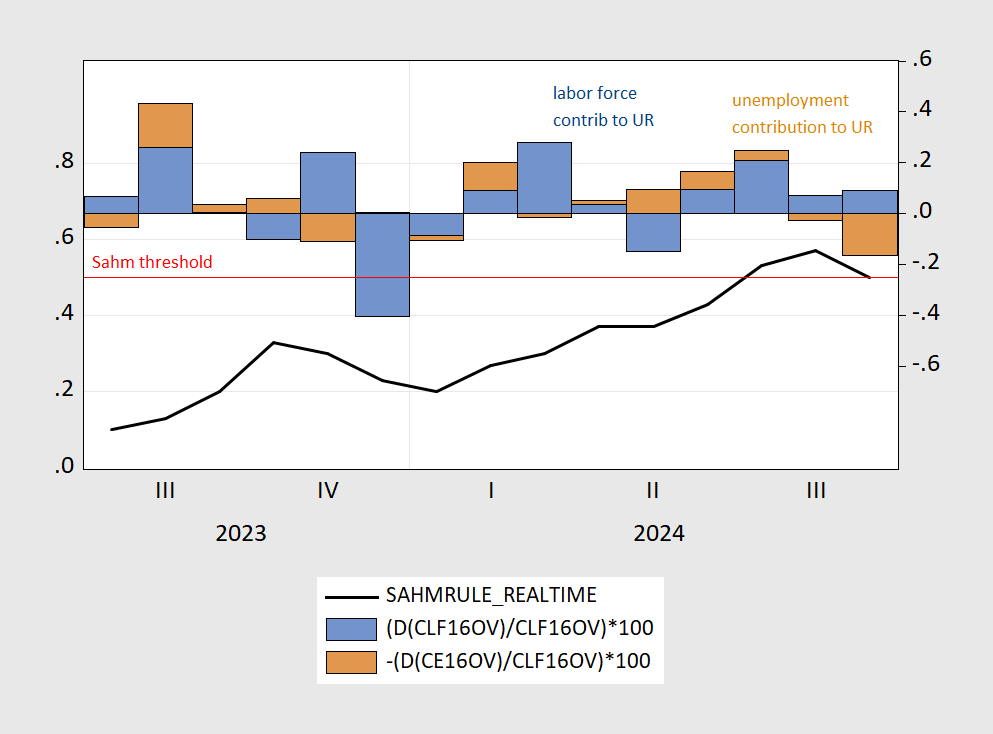

Bonus Tip: Sahm’s Law (real time) rejects the limit. Note that the higher index is due to an increase in the number of workers, rather than unemployment (as was the case in previous episodes, see the discussion here).

Figure 5: A real-time indicator of Sahm’s law (black bar, left scale), and the contributions to change in the unemployment rate, from labor force growth (blue bar, right scale), from the number of unemployed (brown bar, right scale), all in percentages. Source: FRED, BLS via FRED, and author’s statistics.

Source link