Order to the graph of EJ Antoni (apologies to Keats). The total interest payments have increased significantly, and this is reflected in the alarming picture:

Figure 1: Government interest payments, bn.$, SAAR (black). The NBER has defined recession days as shaded in gray. Source: BEA via FRED, NBER.

But perhaps it helps to think about how our ability to pay for economic output has changed. Perhaps we should look at government interest rate payments outside of GDP (green line below).

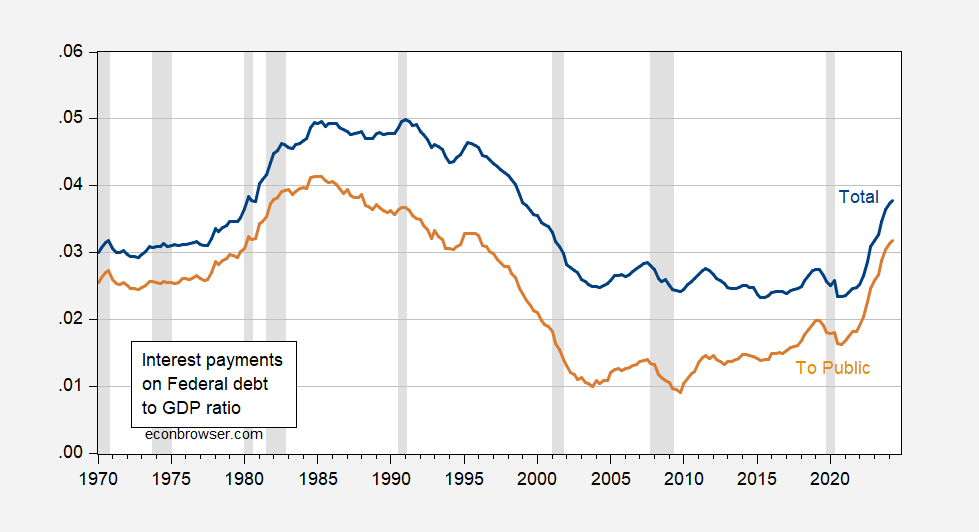

Figure 2: Federal interest payments as a share of US GDP (blue), Federal interest payments to the Commonwealth as a share of US GDP (brown). Public interest payments are calculated by taking the effective interest rates on Social Security debt multiplied by the non-public debt, and subtracting it from total government payments. The NBER has defined recession days as shaded in gray. Sources: BEA, NBER, Social Security Administration [1], [2].

Then, perhaps we should consider how much of the interest payments will fund Social Security, rather than going out to the public.

Still a scary picture. however, it is remarkable to see how much interest payments have risen as a share of GDP during the Trump administration, even with low interest rates. We were back to GW Bush years ago before this pandemic. I’d say, time to raise some tax revenue, maybe some adjustment (not elimination) of Social Security, is fine.

Source link