This Thursday at 4:30 CT at UW:

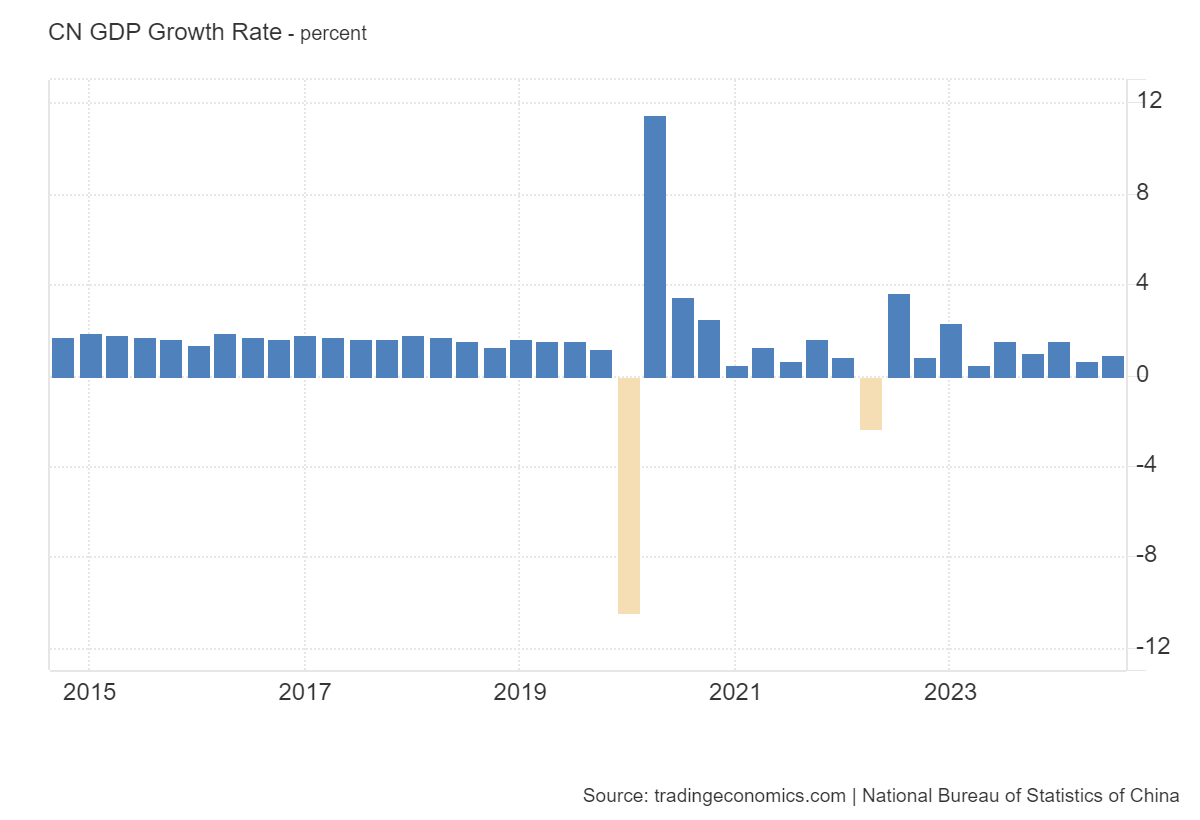

China’s GDP growth in Q3:

BOFIT updates the latest update steps:

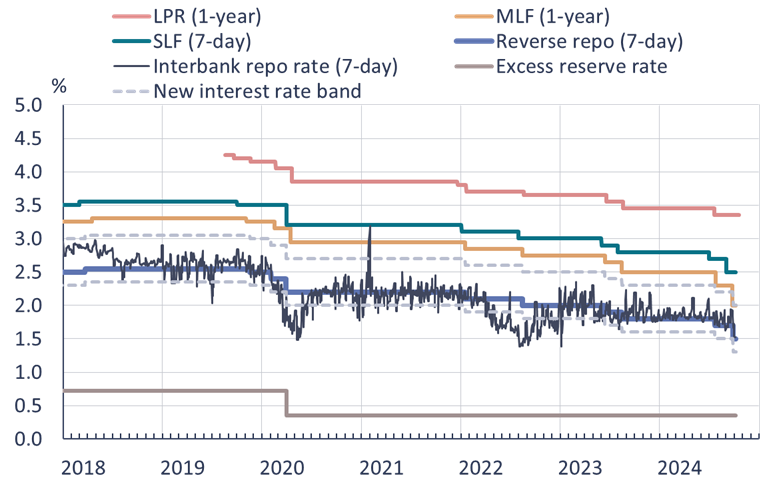

What I see is that the failure of the CCP to release a large monetary stimulus means that one should not expect a large increase in the cycle (and certainly no measures have been announced or taken into account factors affecting the country’s trend, including continuous statistical policies for other purposes). For example, from Natixis today:

• Two major events followed the Third Plenum in July. First, a series of economic data releases showed that the plenum did nothing to improve the country’s short-term outlook. Second, a series of stimulus measures have been announced over a two-week period, which have so far failed to revive the economy.

• The government is unlikely to make the necessary reforms to support credit spending due to high public debt and limited fiscal capacity, as doing so would require cutting off the basic support of the country’s industrial policy. This will go against Xi Jinping’s focus on innovation.

• The People’s Bank of China may need to continue to intervene in both the sovereign bond market and the stock market, although this may reduce the interest of foreign investors in China’s capital markets.

• Government stimulus measures to date have been largely aimed at stabilizing commodity prices rather than addressing the deeper issues of demand and excess capacity.

I don’t think Lardy agrees with this idea (or the issue of loose usage in general), so it’s a good idea to listen!

Source link