Be prepared. It doesn’t look good for Wisconsin (just like Trump 1.0 didn’t but this time there’s no $18 billion bailout for bean farmers).

Source: McClelland et al. (2024).

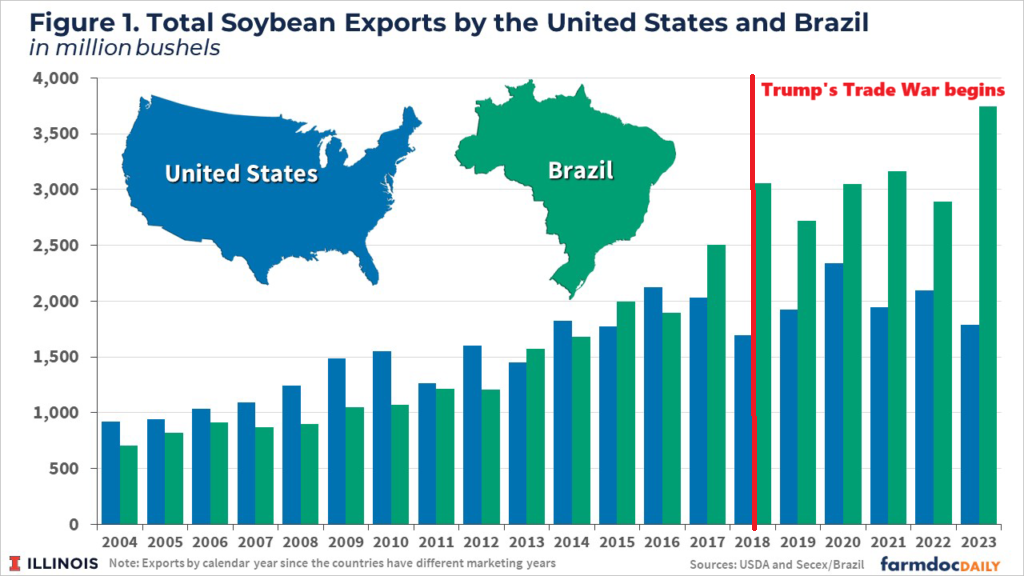

These estimated impacts are import-related and may result in some industry job growth, but will almost certainly cause industry-wide employment declines as input costs rise (remember, estimates are that 2018 prices are worth 175,000 manufacturing jobs). For major impacts across the country see this post. What happened last time when Trump raised tariffs was that China (and other countries) retaliated. China retaliated by imposing tariffs on soybeans, along with a whole range of other manufactured goods and commodities.

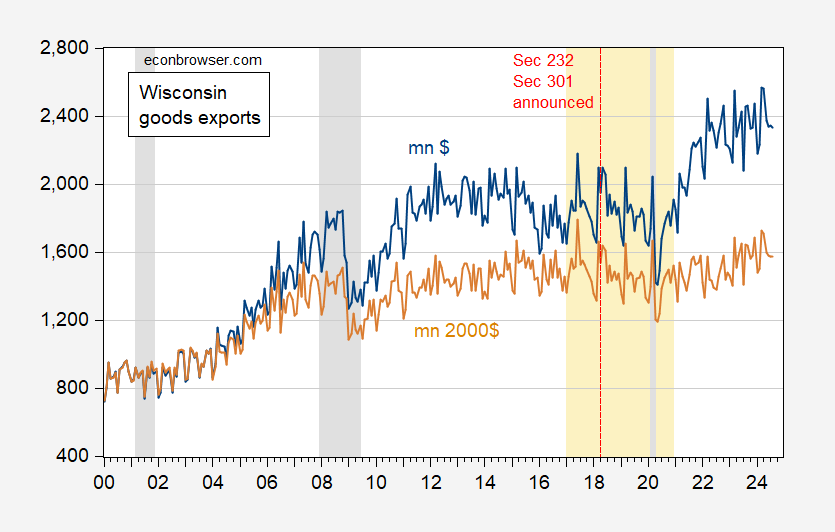

Figure 1: Wisconsin exports $ million (blue), $2000 million (tan), nsa Wisconsin exports minus the US export price index, 2000=100. The NBER has defined recession days as shaded in gray. The Trump administration has put the color orange. Red dashed line in announcement of Section 232, 301 actions. Source: Census, BLS via FRED, NBER, and author’s calculations.

The original shipment from Wisconsin was rejected (transactions and goods) as the retaliation continued.

Regarding soybeans, here’s a picture of the volume of US soybean exports – Brazil actually came in.

Source: Colusi, et al. (2024). Marking the trade war in 2018 by the author.

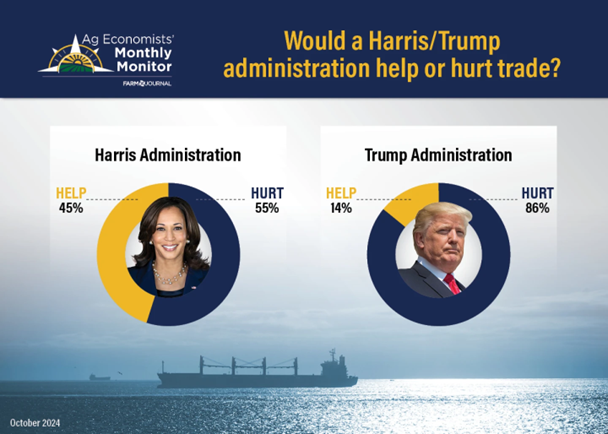

Interestingly, agricultural economists believe Trump’s policies will hurt the agricultural sector more than Harris’ policies (AgWeb farm magazine), at a time when more than half of agricultural economists believe the agricultural economy is in trouble.

Source: Agweb (Oct. 10, 2024).

Source link