Never look at the title number. The “why” is the story. GDPNow fell from 3.3% q/q AR to 2.8%, while GS tracked at 3.0%

.

Source: Rindels, Walker, “US Daily: Q3 GDP Preview,” Goldman Sachs Global Investor Research, October 29, 2024, Exhibit 2.

2.8% or 3% is lower than the previous forecasts, but still above the recession levels (think of EJ Antoni, who thought that the recession might start in July or August).

If one looks at the dynamics of the GDPNow forecast (as of 29 October 2024), one sees that the main reason for the decline in the nowcast is the large imports. How does one interpret this?

The interpretation highlights the difference between accounting and economics. A high rate of growth in imports (not due to exchange rate appreciation) may mean faster growth is expected now and in the future (more goods sold for consumption and investment where both are forward-looking variables). However, an increase in the current level of imports that has caught up with the ongoing transmission of other components of GDP (GDP ≡ C+I+G+X-IM) means that the GDP nowcast has been lowered (h/t my old colleague at CEA Steve Braun for teaching me this).

Here, imports are surprising. From the release of the economic indicators in advance:

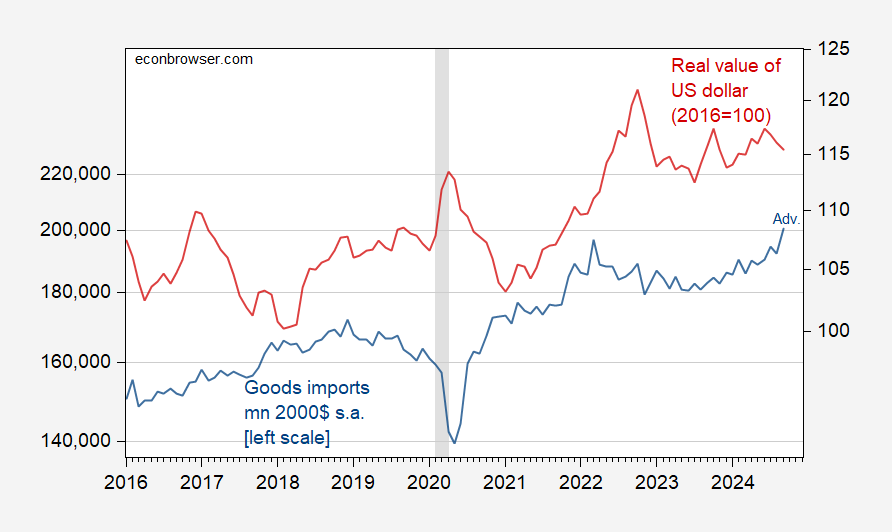

Figure 1: Import of real goods, in mn. 2020$ (green, left log scale), and the real value of the US dollar (red, right log scale). Amortization of imports using the BLS import price. The NBER has defined recession days as shaded in gray. Source: Census and Federal Reserve via FRED, NBER, and author’s calculations.

So, this quarter’s numbers are down, while the implied growth rate (ceteris paribus) is up for the next quarter.

Source link