NFP +12K vs consensus +106K, private NFP -28K vs. +90K; but wage growth (0.4% vs. 0.3% m/m) and average weekly hours are both higher (34.3 vs. 34.2).

Figure 1: CES Nonfarm payroll (bold black), adjusted to add 41K to strikes as estimated by GS (red square), first CES NFP benchmark (blue), Philadelphia Fed early benchmark adjusted by author (green blue), CPS adjusted for NFP (teal) concept, all in 000’s, from Source: BLS, Philadelphia Fed, Goldman Sachs, and author’s calculations.

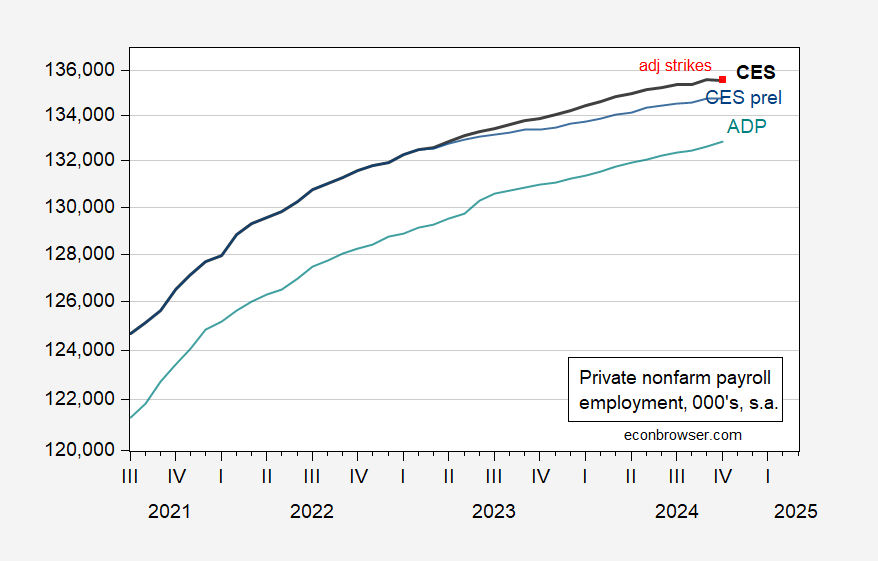

To put the 12K change in context, the total average revision in NFP employment change from the 1st to the 3rd release, 2003-present, is 57K. Here are private nonfarm payrolls from CES, the first benchmark, and ADP.

Figure 2: CES private Nonfarm payroll employment (bold black), adjusted to add 41K to strikes as estimated by GS (red square), CES private NFP benchmark (blue), private ADP for NFP (teal), all in 000, sa Source: BLS , ADP via FRED, Goldman Sachs, and author’s calculations.

Note that ADP registered +228K in October, while BLS CES showed -28K. This reflects differences in coverage (ADP has a heavy burden of small institutions in services) and time (storms that hit during the CES index).

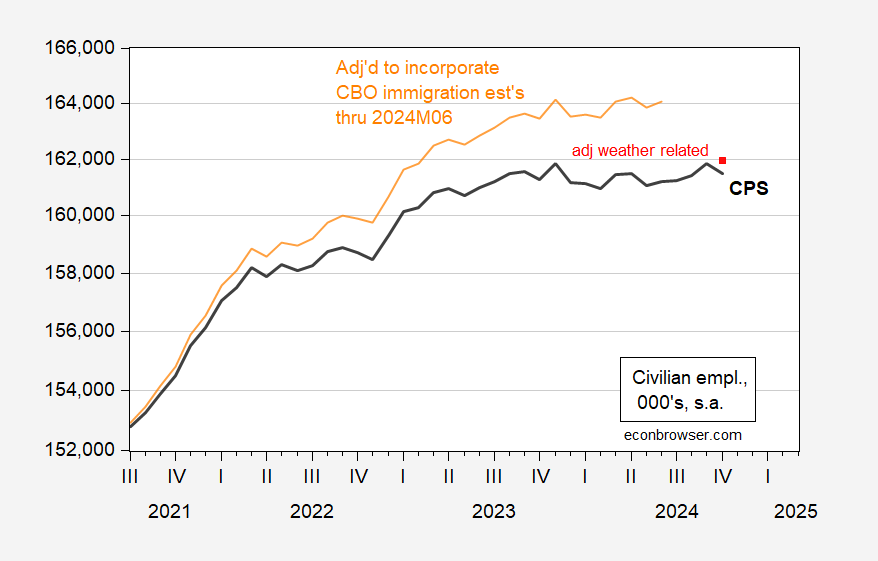

There is a CPS estimate of unemployment related to the weather. I add the change in the rate to the reported employment rate.

Figure 3: Employment adjusted for NFP assumption (bold black), adding 506K unemployed due to climate (red square), and employment adjusted to include author’s CBO immigration estimates (orange), all in the 000’s, sa Source: BLS, Goldman Sachs, author’s calculations.

The adjustment shows that it is possible that without the impact of the storms, the employment of ordinary people would have been changed.

In their analysis of today’s release, Goldman Sachs estimates growth of less than 150K.

Source link