Charles Payne joins the recession camp.

Current indicators do not strongly support an imminent recession:

Figure 1: Nonfarm Payroll (NFP) employment from CES (blue), NFP explains preliminary benchmark (blue), employment (orange), employment plus the number of workers showing unemployment due to weather (orange square ), industrial production (red), personal income excluding current transfers in Ch.2017$ (bright green), sales and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (blue) , and monthly GDP in Ch.2017$ (pink ), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q3 1st release, S&P Global Market Insights (with Macroeconomic Advisers, IHS Markit) (11/1/2024), and author’s calculations.

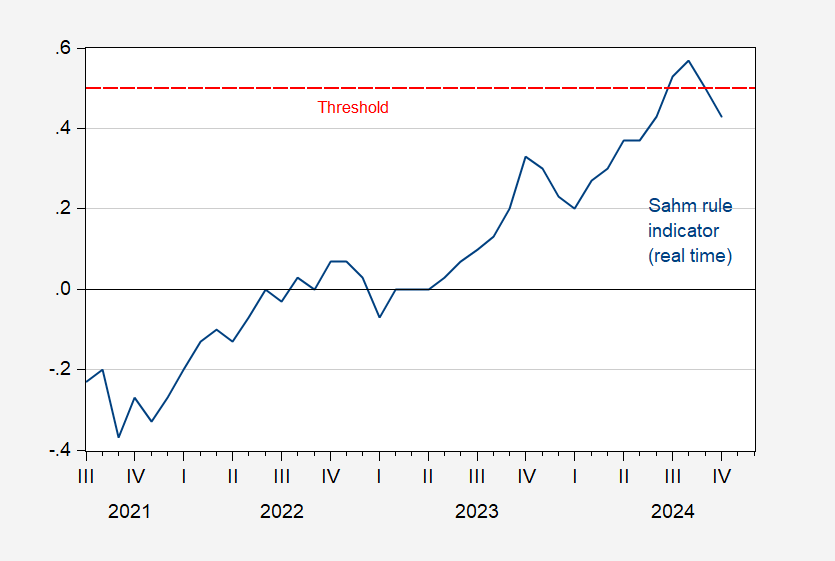

Other indicators show a similar story. And the Sahm rule (real time) is now below the trigger level:

Figure 2: Sahm rule indicator (real time), % (blue). Start at 0.5 ppts. Source: FRED.

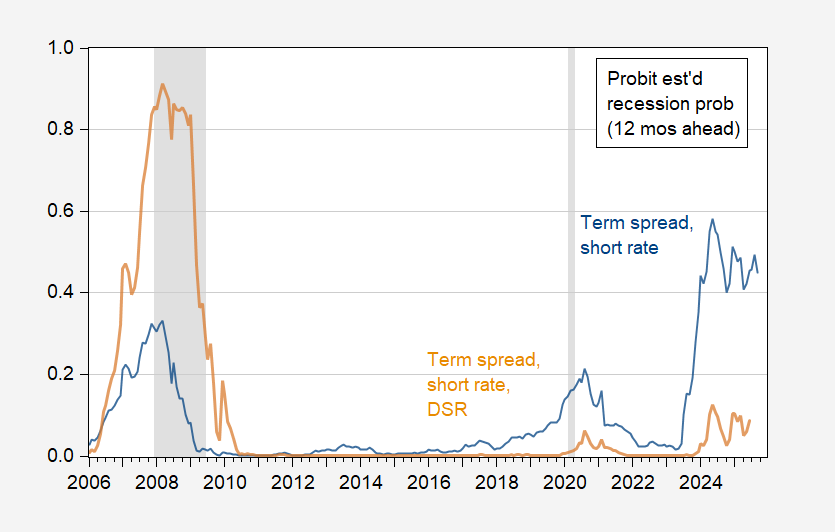

And (my favorite – a variation on Chinn-Ferrara (2024)) predicts a figure that shows a recession in the near future, although the simple term distribution model still shows a warning (see discussion here).

Figure 3: Average 12-month prior probability of a recession, from the narrowing margin in the time spread and the short rate, 1986-2024 (blue), in the time spread, the short rate and the debt service ratio (tan). The NBER has defined recession days as shaded in gray. Source: Treasury via FRED, BIS, NBER, and author’s calculations.

Source link