From the National Corn Growers Association:

US soybeans and corn are the main targets of the tariffs. As our country’s top two exports, together they account for one-fourth of total US agricultural exports. Therefore, the repeated palm-based approach to dealing with trade with China targets both US soybeans and corn. Farmers and rural economies are paying the price as a result.

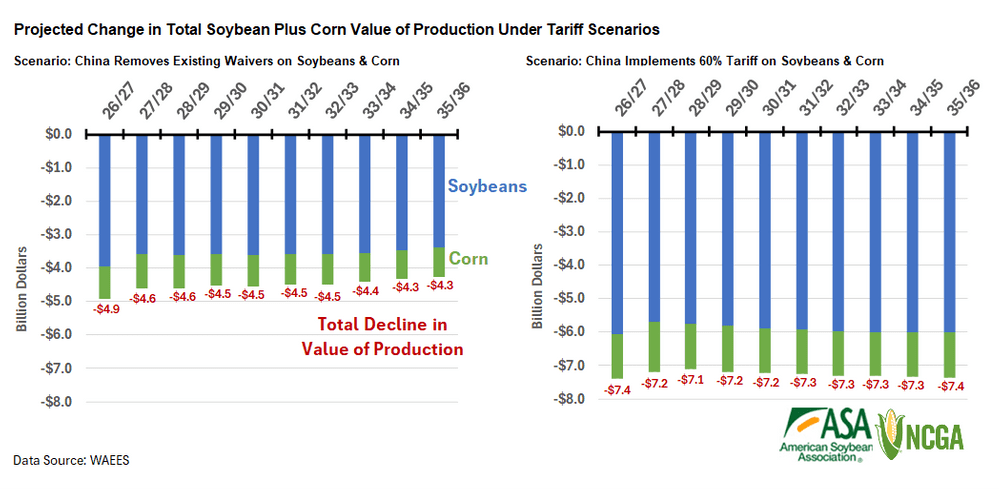

The main conclusion of the report (read the whole study for the assumptions, model, etc.):

Research Findings

US Soybean and Corn Sales Fall While Brazil Gains Market Share

If China cancels its waiver and returns to the tariffs already on the books, US soybean exports to China would fall between 14 and 16 million metric tons annually, an average decline of 51.8% from baseline levels expected for those years. US corn exports to China fell by about 2.2 million metric tons annually, an average decline of 84.3% from baseline expectations. Although the decline in the export price is much lower for corn than for soybeans, reflecting the smaller amount of corn exported to China, the relative change from the base price is significant for corn.

While it is possible to shift exports to other countries, there is not enough demand from the rest of the world to offset the huge loss of soybean exports to China. At the same time, Brazil and Argentina are gaining global market share through increased exports. The US loses a combined 2.3 to 3.7 million metric tons of soybean and corn exports annually, while Brazil gains an average of 4.6 million metric tons of soybean and corn exports annually.

Chinese tariffs on soybeans and corn from the US but not from Brazil provide an incentive for Brazilian farmers to expand production much faster than base growth. Expansion is maximized because some land in Brazil can be used to grow soybeans and corn in the same year. The land converted to production in Brazil will remain in production. The impact on US soybean and corn farmers is not limited to short-term price shocks: This is a long-term adjustment that changes the structure of global supply.

The retaliatory tariff rate of 60% reinforces the shock, resulting in the loss of more than 25 million metric tons of soybean exports to China and nearly 90% of corn exports to China. In this scenario, the US loses a combined total of 2.9 to 4.6 million metric tons of soybean and corn exports annually, while Brazil gains an average of 8.9 million metric tons of annual soybean and corn exports. over the projection timeline.

Here’s their assessment of the impact on US manufacturing in both cases.

Overall, farmers will see their cash income decrease while costs increase.

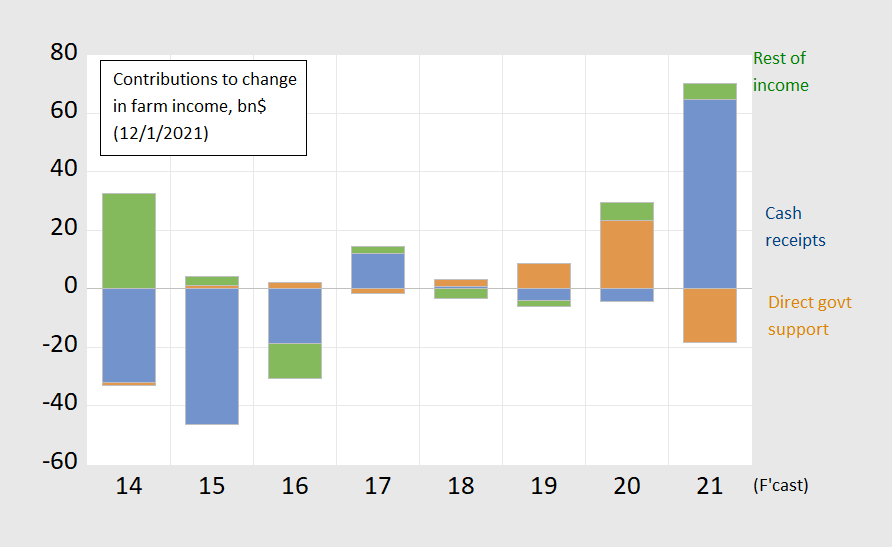

From the post of January 2022, one can see how much the transfer of the Trump administration had to do to improve farm income after that trade war, and how the income appeared in 2021. Therefore, despite low government support, total revenue is predicted to rise.

Figure 1: Change contributions to farm income from cash receipts from sales (blue bar), from direct government support (brown bar), and from all other sectors (green bar). Source: USDA, data as of 12/1/2021.

In this case, if Trump were to impose tariffs of 10-20% on all imports and a 60% tariff on Chinese imports, there would be more people in line for bailouts than last time. If you believe that farmers will be the first in the next round, then there is a bridge I want to sell you.

See more about the impact in the Midwest here.

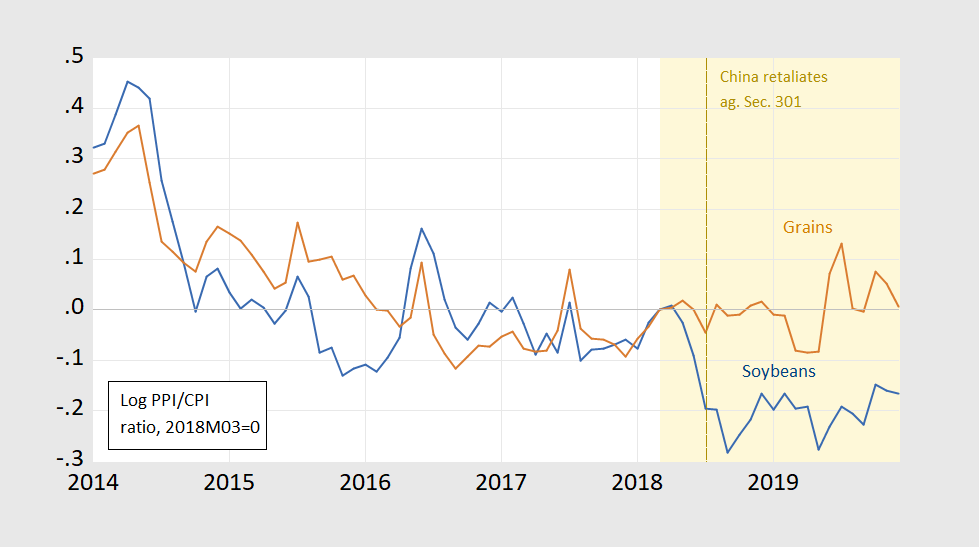

For an interesting trip down the event’s learning curve, check out this January 2020 post, with this graph:

Figure 2: CPI moderated PPI for soybeans (blue) and grains (brown), in logs 2018M03=0. The orange shading indicates the time when the China Section 301 action was announced/implemented. The brown dashed line is where Chinese tariffs on US soybeans take effect. Source: BLS via FRED, author’s calculations.

Source link