Yves here. It is worth pointing out that the bond and stock markets have broken with Trump’s election win. Granted, one could argue that some of the big budget meetings are due to the fact that the popular vote margin means that Democrats won’t participate in a major change in power resistance. That, as many have pointed out, had the potential to be very disruptive. “Civil war” was an overstatement given Team Blue’s inability to help themselves (let’s start with their metropolitan areas especially where food is produced) or field weapons. But since Trump’s opponents instead of drowning in displays of personal trauma, such as agitation and what Aurelien calls epic sulking, the US has survived a major upheaval.

Generally, high bond yield depressed equity values. That’s why, for example, the stock market crashed during the 2014 “taper tantrum”, when Bernanke threatened that the Fed would start pulling out of extremely low interest rates, and more recently, when stock prices have risen on hopes the Fed will cut interest rates. .

That behavior is a result of the Treasury yield that serves as the basis for the valuation of financial assets. They provide a risk-free value to which analysts add a premium to reflect the riskiness of a particular investment. Then they discount the expected future cash flows by this rate. So higher interest rates mean that future expected income is worth less in present money terms.

One might wonder about this remarkable difference in learning. Maybe investors are waiting for some tax breaks. Trump seems to have gone so far down this route that it’s unclear how many more gimmies he can invent. Trump has also threatened to cut Federal spending, which will reduce consumer and business spending, hurting business income and profits.

If Trump keeps the deficit below or well below the yawning level under the Biden Administration, it will continue to keep the economy running at a feverish rate by many metrics (without going too far, that, as many have pointed out has really benefited the rich and not many ordinary people, hence the discontent that produced Trump’s victory). That will also tend to increase the rate of inflation, so the Fed will need to keep interest rates high, or else, they may lower them only to raise them soon.

In other words, bond investors appear to have better grasped the effects of the current economic climate and the lower odds of Trump finding an easy way out of Biden’s massive deficit. But as Keynes famously said, markets can stay irrational longer than you can stay in meltdown.

By Wolf Richter, editor at Wolf Street. Originally published on Wolf Street

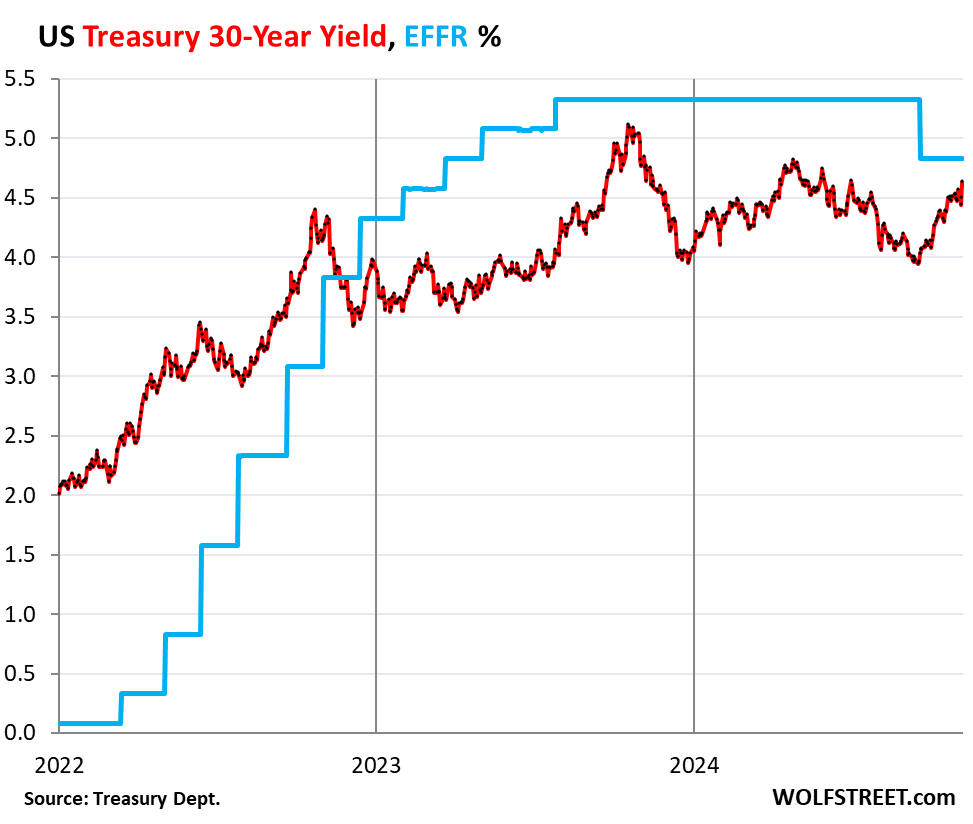

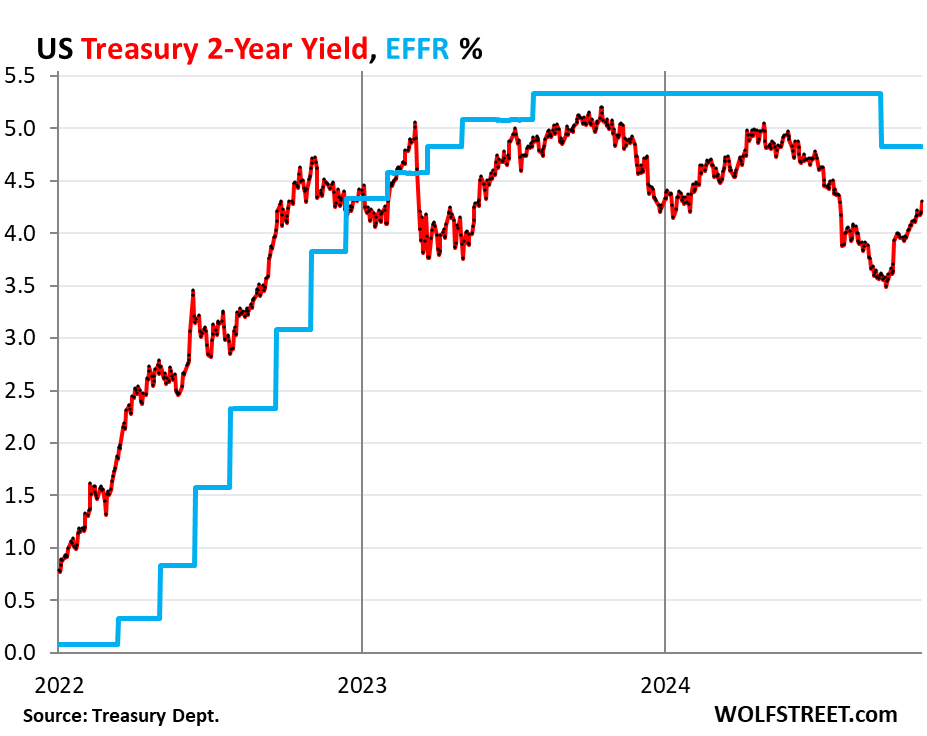

Long-term Treasury yields rose sharply this morning, on top of the increase since September’s rate cut. A spiking yield means lower prices, and it’s a bloodbath for bondholders.

10-year Treasury yield rose 20 basis points this morning, to 4.46% currently, the highest since June 10. Since the Fed’s rate cut on September 18, the 10-year yield has risen 81 basis points. 5% here we come?

The 30-year Treasury yield increased 20 points this morning, to 4.64%, the highest figure since May 31 May 30. Since the Fed rate cut on September 18, it has increased 68 points.

So the rest of the bond market needs to continue to be disrupted or more rate cuts?

2-year Treasury yield rose 10 points this morning, to 4.29%, the highest since July 31. Since the rate cut, it has risen 69 points.

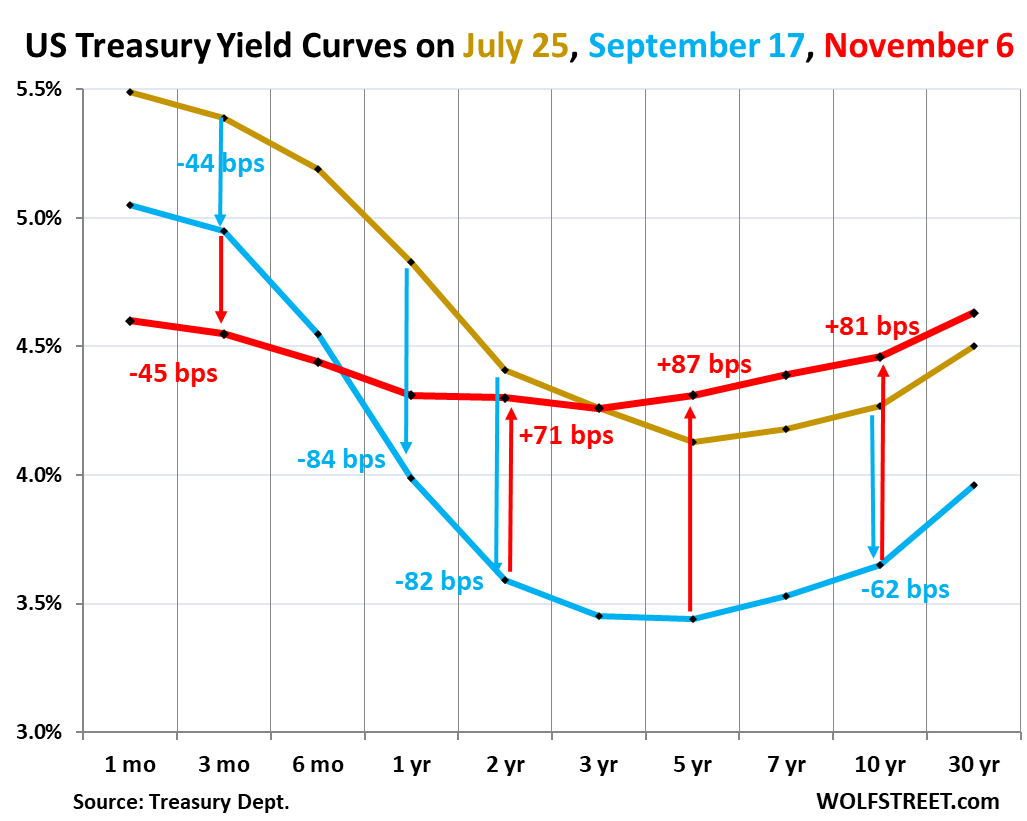

The yield curve Invariance continued for another big jump today, continuing the trend of volatility, driven by increases in long-term yields and decreases in short-term yields.

The general shape of the yield curve is that the long-term Treasury yield is higher than the short-term yield. The yield curve is considered “inverted” when long-term yields are below short-term yields, which began in July 2022 as the Fed increased policy rates, raising short-term Treasury yields, while long-term yields are rising. little by little, and thus he fell behind. The yield curve is now in a normalizing process, with long-term yields rising and exceeding short-term yields.

The chart below shows a “yield curve” with Treasury yields across the maturity spectrum, from 1 month to 30 years, for three key dates:

- Gold: July 25, 2024, before labor market data hits the current revised peak.

- Blue: September 17, 2024, the day before the Fed’s mega-rate cut.

- Red: This morning, November 6, 2024 after the election results.

The 30-year yield is now higher than all other yields, and is completely unchanged. The 10-year yield is a few basis points of absolute volatility.

Notice how much those long-term yields have risen since the September rate cut (blue line). Yields from 3 to 10 years have increased by more than 80 basis points since the September rate cut, a U-turn that dragged on, fell in two months, quickly reversed again in seven weeks, in the middle of the big one. volatility in the Treasury market.

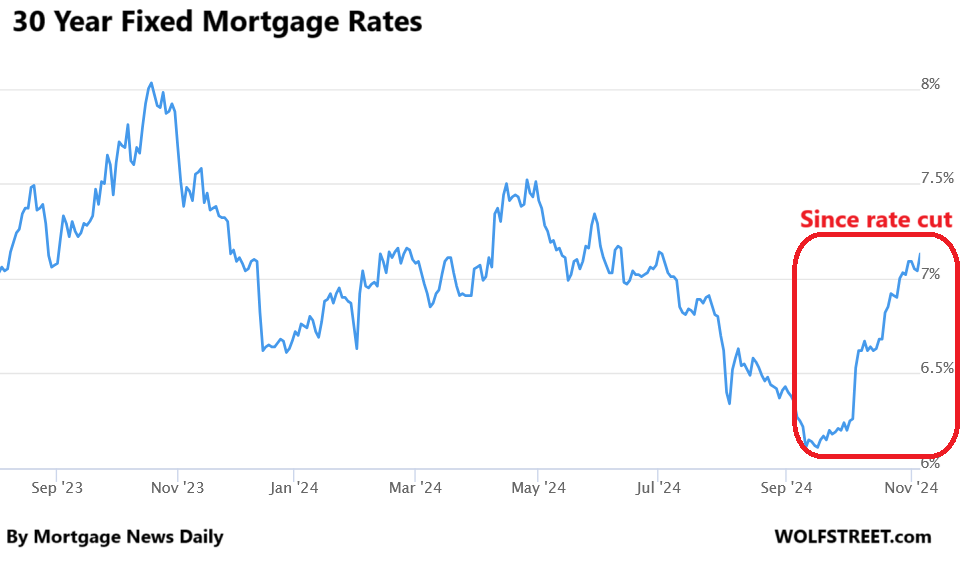

Home mortgage rates too. They’re about the same as the 10-year yield, and today they’re up 7.13%, according to Mortgage News Daily’s daily average.

Home loan applications in the latest reporting week, which did not last two days, have already fallen sharply from previously frozen levels, driving down demand for existing homes, which is set to hit its lowest level since 1995 this year. .

For the real estate industry, and for real estate agents, this U-turn was a painful slap in the face. At this rate, the yield curve will soon enter the normal range – but in the opposite direction that the real estate industry had hoped. There was hope that the Fed would cause short-term yields to fall to record lows overnight, which would drag down long-term yields, and subsequently mortgage rates.

But mortgage rates have already dropped from around 8% in November of last year to 6.1% in mid-September of this year, without rate cuts, on a wing and a prayer, thus reducing rates on all types of value and more. And since the rate cut, most of the wing-and-pray entry into long-term yields has changed, that’s all that’s really happened.

The real estate industry was expecting 5.x% mortgages around this time, and they were already around mid-September with 6.1% mortgages, and some were talking about 4.x% mortgages during the spring sales season, even today. they are looking at 7.13% mortgages.

Source link