In early April. Wisconsinites’ views of the state’s economy have fallen sharply, despite some positive indicators [0]. In explaining the possibility that the perception of the economic situation differs from the circumstances of the respondent. Another possibility is that we have not measured the economic conditions.

Figure 1: GDP (Ch.2017$) (dark blue), GDP (Ch.2012$) (blue), wages and salaries less PCE price index (tan), private sector hours (green), corresponding index (red), all in log 2021Q4=0. Hours are calculated by multiplying private employment by the average weekly hours adjusted for the season by the author using X-13. Source: BEA, Census, BLS, Philadelphia Fed, and author’s calculations.

For example, as of August last year, real GDP growth looked respectable in 2023Q1. However, with a comprehensive review of NIPA data that includes additional and revised data, GDP growth looks much weaker in 2023Q2. Growth picked up only in 20243Q3-Q4. Why is there a big gap? The extensive review notes do not shed light on the exact source of the difference. The truth is that, for example, the California series doesn’t show such a big change in performances, so I suspect it’s something to do with how more information affects Wisconsin. Total wages and salaries were revised down by about half a point. Another problem is that statewide prices are used in Wisconsin sector prices. Therefore, if prices in Wisconsin are systematically higher than the rest of the country, real GDP will appear lower than the true values.

Real wages and salaries picked up significantly in Q2 (here using the PCE deflator; using chained CPI, the cumulative increase in Q4 is only 2%). Finally, the index of the Philadelphia Fed began to rise again, after rising in 2023, in the first half of this year.

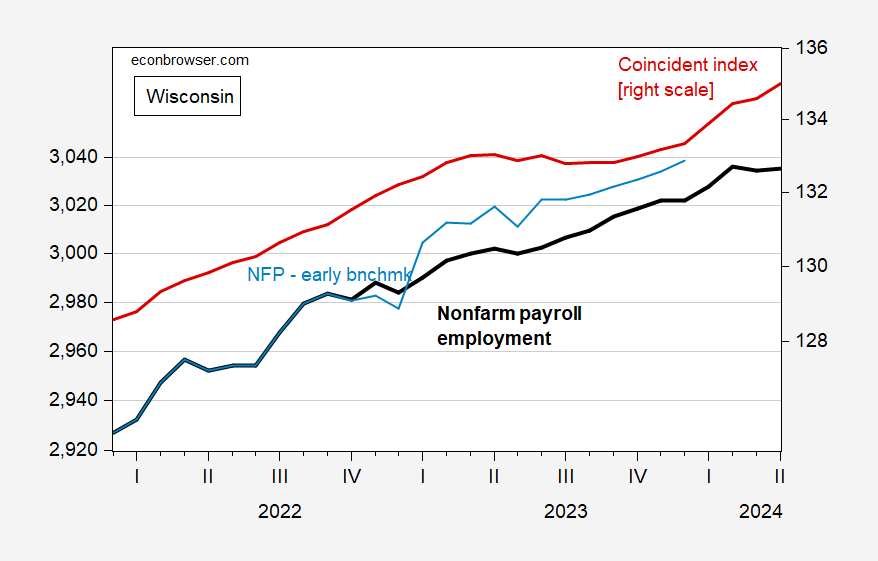

Although (for the first time) employment decreased in April, the casualty index – based on labor market indicators – increased.

Figure 2: Nonfarm payroll employment (bold black, left scale), the Philadelphia Fed’s first benchmark (light blue, left scale), and the corresponding index (red, right scale). Source: BLS, Philadelphia Fed [1], [2].

Source link