Yves here. Wolf Richter points out why the revision of unemployment statistics does not look suspicious or suspicious, but that the exaggerated reporting is transparent and agenda-driven. Which is not to say that mistaking the Fed for an inflation fire brigade is a good idea.

By Wolf Richter, editor at Wolf Street. Originally published on Wolf Street

Our Favorite Recession Index shows the next recession going forward.

This is kind of funny. Initial claims for unemployment insurance fell by 8,000 to 215,000 in the current reporting week, after falling by 9,000 the previous week, according to Labor Department data this morning.

Funny the headline treatment received by the jump two weeks ago (May 9) to 232,000: It was raised as a sign that the labor market is suddenly weakening, and that the Fed will start cutting rates soon (obviously pooh-poohed at that point).

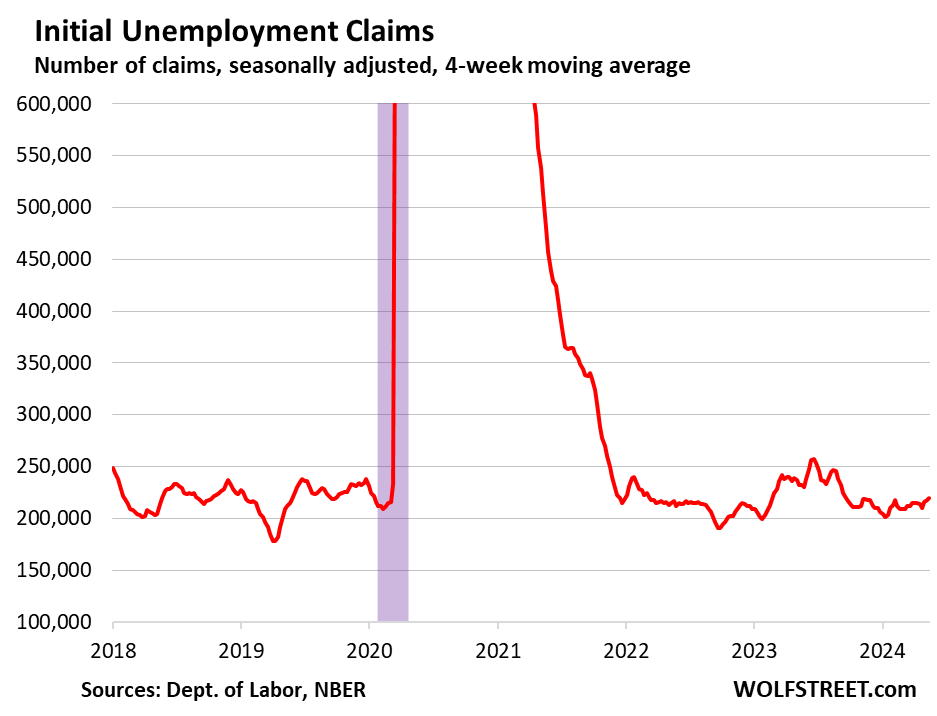

So today, initial jobless claims are back at historically low levels that have been around for the past two years, another sign that the labor market is relatively strong. We take this seriously because the data is an ingredient in our Favorite Recession Index (more on that in a second):

One of the main reasons why this initial jobless claims data fluctuates so much from week to week is that this is raw data from recently laid off unemployment insurance claims filed by federal agencies, and that federal agencies then process and submit weekly. deadline of the Department of Labor.

When they miss the deadline, those claims then roll over into the following week, reducing the number of claims for the current week and increasing the number of claims for the next week. When Rhode Island does it, no one notices the difference. But when one of the big states does it, it leads to big changes from one week to the next.

That’s why the Department of Labor also releases a four-week moving average, which removes those shifts between weeks.

On May 9, the four-week moving average of initial claims reached 215,000, which was a historic low, as we said at the time.

Today, the four-week moving average reached 219,750, a historic low. The small hump that now disappears between February 2023 and September 2023 was the result of technological and telecommunications layoffs:

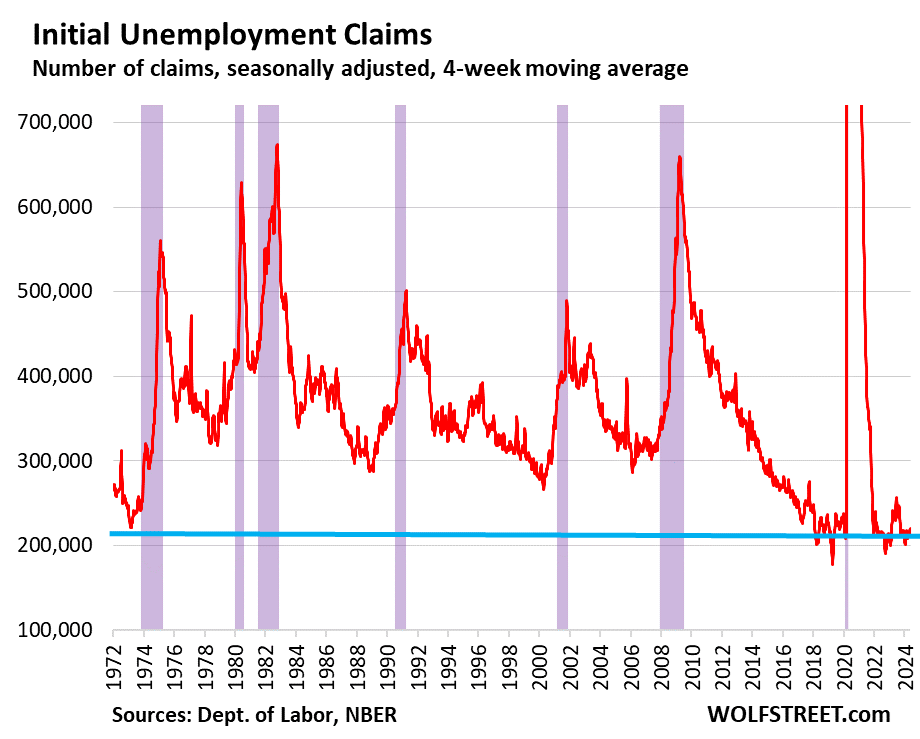

A long-term view (recession marked in purple) shows how historically low these unemployment insurance claims have been, especially considering that employment and the number of workers have increased over those decades, as well as the population:

Our Favorite Recession Indicator

We’ve been looking at a recession here shortly after the Fed starts raising rates in March 2022. The National Bureau of Economic Research (NBER), which calls the recession in the US, has been defining it as a broader economic downturn that includes a slowdown in the labor market.

So we’re looking for a sharp increase in weekly claims for unemployment insurance benefits (charts above), and a sharp increase in ongoing claims for unemployment insurance (charts below).

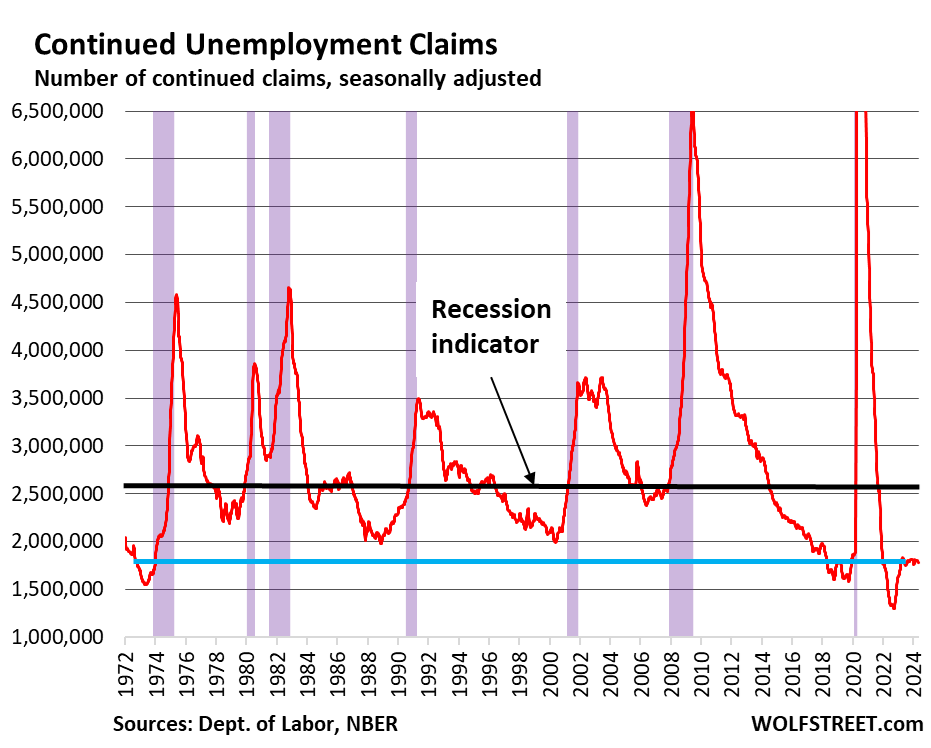

The number of people still seeking unemployment insurance benefits at least one week after the first application — people who have not yet found a job — was at its lowest level since mid-2023.

In the current reporting week, 1.79 million people are still seeking unemployment insurance. The four-week moving average was almost steady at around 1.78, and down slightly from December’s levels of 1.81 million.

The high level of ongoing claims suggests that it takes people who have lost their jobs longer on average to find a new job.

This “frying pan” pattern, as we have come to call it, has been growing in many economic details, created by the undershoot from the pandemic, and then returning to normal:

Our Index (Below) Points to an Upcoming Recession as the Green Line Approaches the Black Line

The recession from the Great Depression back in the early 1980s began when ongoing unemployment insurance claims rose to the 2.6 million mark (black line in the chart below).

Today’s level of 1.79 million (green line) is well below economic levels (black line). It points to a labor market that is in the middle of some of the past 50 years and tells us that there is no recession expected yet.

Source link