In the Fed’s recent assessment of the different recovery in the US compared to the Euro area, the UK and Canada, I was surprised that immigration did not appear to be larger, given my observations.

The KC Fed recently provided details on how immigration has helped exacerbate slack in the labor market (h/t Torsten Slok).

Source: Cohen/KC Fed (2024).

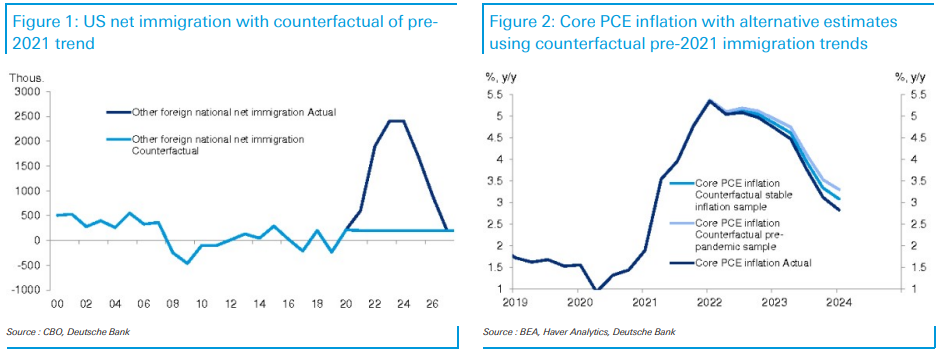

Deutsche Bank has taken a stab at assessing the impact of immigration on currencies by referring to the counterfactual.

Jim Reid at DB writes:

The conclusion [of Justin Weidner’s piece]: the labor market would be much stronger if it weren’t for the increase in immigration. A tightening of the labor market in the absence of immigration would lead to inflation. Using two inflation models, our economists find that core PCE inflation could have been 25-50bps higher (see second chart below), although they admit reasonable uncertainty about these estimates. Immigration wasn’t the only force slowing the US economy last year — to be sure, core PCE inflation is down 200bps in 2023 — but it was a significant contributing factor.

For a previous discussion of labor dynamics and immigration, see Edelberg and Watson (March 2024), and long-term implications in CBO (2024).

Source link