Yes! From Rashed Ahmed and Menzie Chinn, just published in the Journal of Money, Credit and Banking.

This paper was discussed earlier in this post; the updated version (August 2023) is here.

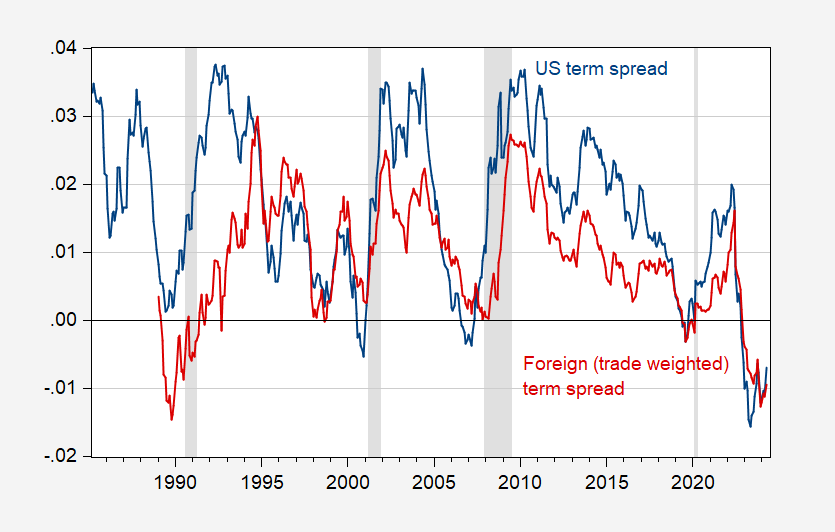

The foreign term spread (vs. US) is shown below. (Foreign spreads are trade-weighted US spreads using long- and short-term rates set by the Dallas Fed, but in recent years have been closer to the Ahmed-Chinn foreign term used in the paper.)

Figure 1: US 10-year term spread-3mo (blue), foreign long-term spread-3mo (red). The NBER has defined recession days as shaded in gray. Source: Treasury via FRED, Dallas Fed DGEI, NBER and author’s calculations.

Source link