Yves here. This post contains a careful and honest analysis of how marked deviations from normal temperatures (here in tropical Mexico) raise default levels, leading to delayed borrowing some time later. The impact is small, at the municipal level and not across the country. The authors offer suggestions, mostly about credit/finance, but there is not much you can do to improve low crop yields and labor productivity.

By Sandra Aguilar-Gomez, Assistant Professor of Economics Universidad De Los Andes. Originally published at VoxEU

A recent report from the International Panel on Climate Change revealed a steady increase in extreme heat days, affecting agriculture and more. Economic consequences include reduced labor productivity and increased operating costs. Recent research also emphasizes the impact of the climate finance sector, particularly on low- and middle-income economies. This column examines Mexico’s financial risks, revealing the connection between extreme heat and rising crime rates, especially among small and medium-sized businesses. Policy should address these risks, including climate resilience and improved access to credit for vulnerable firms.

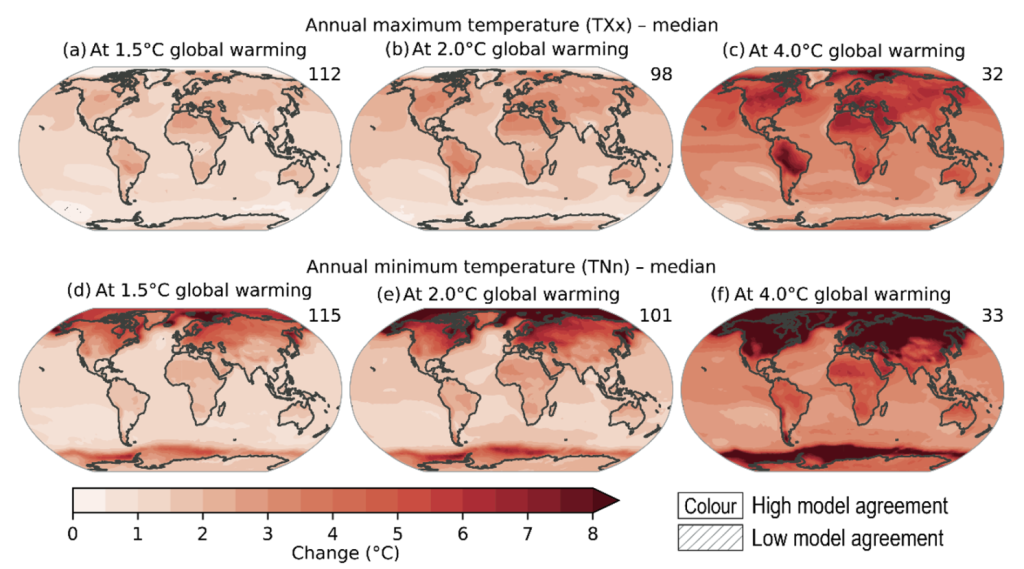

Climate change is expected to increase the frequency and intensity of extreme weather events. Heatwaves are a growing problem, year after year breaking heat records (IPCC 2021). Figure 1 shows the analysis of the most recent assessment report of the International Panel on Climate Change (IPCC AR6). During the past half century, there has been a steady increase in the number of days over 90 percent of the geographic distribution. In agriculture, it will come as no surprise that research has found that crop yields are adversely affected by deviations from optimal plant growth conditions. However, the economic impact of a hot country goes beyond the agricultural sector: high temperatures make work less pleasant and make some goods and services more attractive than others. High temperatures also make people more aggressive and worse at making decisions. Economists have found that these impacts translate into corporate profits through reduced labor productivity, increased absenteeism, and changes in local demand. Operating costs also increase if firms spend resources to reduce some of these impacts (for example, using more air conditioning and shorter shifts for tired workers). In a recent Vox column, Ponticelli et al. (2023) discuss empirical findings that crop production declines with warming in the US, resulting in moderate to small crop closures, increasing concentration in the manufacturing sector.

Figure 1 Linear trends for 1960–2018 for three temperature extremes: Annual maximum daily temperature (panel a), annual minimum daily minimum temperature (panel b), and annual number of days when the maximum daily temperature exceeds percent of 90 from the base period 1961-1990 (panel c)

The source: IPCC (2021) Figure 11.9.

Central banks and other financial institutions are increasingly concerned about the impact of these shocks on the financial sector (Reinders et al. 2023). The impact of adverse weather on costs and demand may cause a shortage of funds for firms which may cause solvency problems. In developing countries, several conditions suggest that firms may be more vulnerable. Suppose, for example, that a default caused by a shock increases lenders’ uncertainty about borrowers’ ability to repay their loans in the future. If so, they may charge higher interest rates for new loans and reduce the availability of credit, increasing corporate debt problems. This is especially important for types of loans where the ability to pay is highly uncertain, such as small and medium-sized enterprises (SMEs) with a poor credit history, or firms that need investment loans, with long-term growth and high uncertainty about the future. the return on investment. Overall, the effect of independent shocks and uniform distributions may be relatively long-lived in credit markets that deal with relatively little information asymmetries such as those in low- and middle-income economies.

In addition, it is important to note that warming is not expected to affect countries in the same way. Most developing countries are in regions with high baseline temperatures. Therefore, even uniform warming can have a disparate impact due to severe biological limitations on agricultural yields and human health. However, current models show significant variations in local warming, as shown in Figure 2. For all of the above reasons, understanding the impacts of extreme weather events on the financial sector in developing countries is very important for policy.

Figure 2 Projected changes in annual maximum temperature (panels a to c) and annual minimum temperature (panels d to f) at 1.5°C, 2°C, and 4°C of global warming compared to the baseline -1850–1900.

The source: IPCC (2021) Figure 11.11.

In our recent study (Aguilar-Gomez et al. 2024), I and other authors use a robust methodology and a comprehensive dataset that includes information on all loans extended by commercial banks to the private sector in Mexico over a decade. This allows us to assess potential climate risks within the Mexican financial system. Specifically, we estimate the impact of unexpected days above the 95th percentile of the temperature distribution on the financial distress of companies, with our main focus on the delinquency rate, measured as the ratio of non-performing loans to total outstanding loans in the region.

Our research revealed three main results:

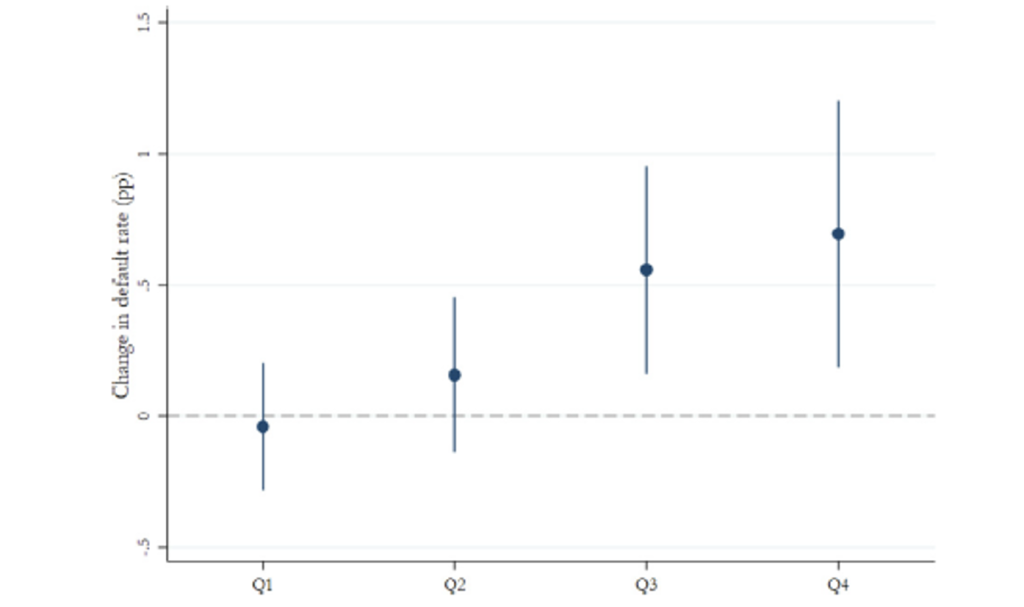

- Extreme heat in the municipality increases the rate of credit piracy, an effect driven entirely by small firms defaulting on loans. In general, ten unusual days of extreme heat during the last three months increase the default rate of SMEs by 0.17 percentage points, which is equivalent to 4.4% of the observed sample mean (3.9%). Figure 3 illustrates this phenomenon by plotting the relationship between default value and extreme heat days in the previous quarter. It also indicates that the heatwave must be long enough to cause significant damage (ie 11 days). These findings are consistent with the view that SMEs in developing countries are less equipped to deal with extreme temperatures, making it more difficult to obtain additional credit in times of financial distress. Consistent with theory and previous research (eg Schlenker and Roberts 2009, Blanc and Schlenker 2017), we find that the negative impact of extreme heat is strongest on agriculture.

- The story of regional economic formation. Extreme heat also has major effects on non-agricultural industries in regions with a sufficiently large share of the agricultural workforce. In addition, results in the non-agricultural sector are concentrated in services and trade, that is, non-tradable sectors that rely heavily on local demand. The findings suggest that adverse conditions in agriculture lead to reduced local spending, which causes spillover effects in non-agricultural industries.

- By using different methods of integrating markets in agricultural production, we find that climate shocks have a strong impact on credit defaults among agricultural firms in integrated markets. This result is consistent with the idea that price increases partially offset the decline in domestic production caused by extreme weather in isolated markets. Interestingly, this evidence suggests that financial institutions may not be vulnerable to temperature shocks in distant markets.

- One might not worry too much about these effects if our data show that firms recover and do not bear the long-term effects of short-term shocks. We get that temperature shock reduces the number of firms that receive loans from the municipality concerned for a certain period of time. The composition of credit also changes after a climate shock: we find a decrease in credit to investment and new firms, and an increase in interest rates on new loans. Specifically, exposure to extreme heat translates into increased interest rates for new loans within the same company, higher collateral requirements, and denial of credit access. Taken together, the firm- and market-level results show that in response to the shock, banks tighten credit for two to three quarters, preventing access to financial flexibility when firms need it most. This finding is contrary to what is found in advanced economies, especially in the US, where evidence suggests that firms use credit lines to manage capital shortages during bad weather (Brown et al. 2021, Collier et al. 2020). Mexican SMEs seem unable to use the new loans in the same way.

Figure 3 Effects of extreme temperatures on crime rates

Our findings provide strong support for concerns about the potential impacts of extreme weather on the financial system described, for example, in Reinders et al. (2023). Responding to accumulating evidence, regulatory authorities, and major banks around the world are calling for improvements in measuring and monitoring climate risks, so that relevant actors can manage such risks (Litterman et al. 2020). The policy implication of our results is that policies that seek to reduce the direct exposure to climate variability on banks’ balance sheets may be implemented alongside other complementary policies, particularly in developing countries. Such policies can compensate for unintended consequences by deepening small and medium-sized firms’ access to credit, especially if firms face the effects of climate shocks.

Source link