S. Ren at Bloomberg: “It’s getting flatter, giving rise to concerns about an ‘asset famine’ and a protracted recession.”

Whatever the reason, the inverted yield curve has a bad rap. In general, long-maturity notes offer higher rates to compensate lenders for pooling their money over a longer period of time. If those yields fall near or below the short, it is an indication that investors are pessimistic about economic growth. In the US, turnover was a reliable predictor of recession, at least in the pre-pandemic days.

Here is a picture of the Chinese yield curve as of today:

Source: WorldGovernmentBonds.com.

No flexibility in maturity 1 to 30 years. However, the 10yr-3mo spread is skewed.

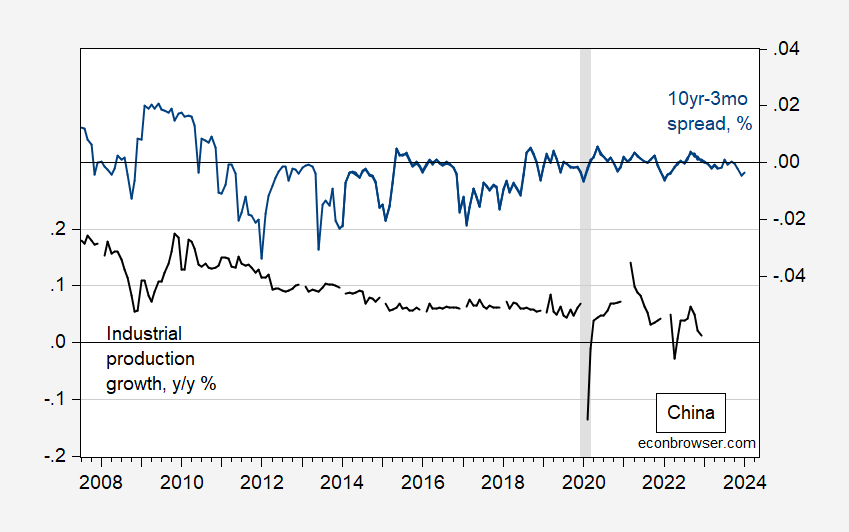

Figure 1: Year-on-year Chinese industrial production growth (black, left scale), and 10yr-3mo spread (blue, right scale). ECRI has defined the days of recession when the economy reaches the gray color. Source: OECD, and author’s figures.

Chinn and Ferrara (2024) examine the forecast of China’s economic slowdown and industrial production growth. Previously, no results could be obtained, given the lack of recession in periods when long-term interest rates were available (or appropriate, given financial stress). In the growth of industrial production from year to year, we find:

growth = 0.095 + 1.66 x spreading

Adj-R2 = 0.26, NObs = 131, Sample = 2007M07-2018M12 (growth to 2019M12). Bold indicates significance at 10% msl using robust HAC errors.

Although there is a statistically significant positive correlation between prevalence and growth, it is not a significant explanatory factor. This is perhaps not surprising since the long-term government bond market in China is not very large. Long-term bond yields are strongly related to expected short-term rates (ie, the expected term structure theory) if the long-term bond is liquid.

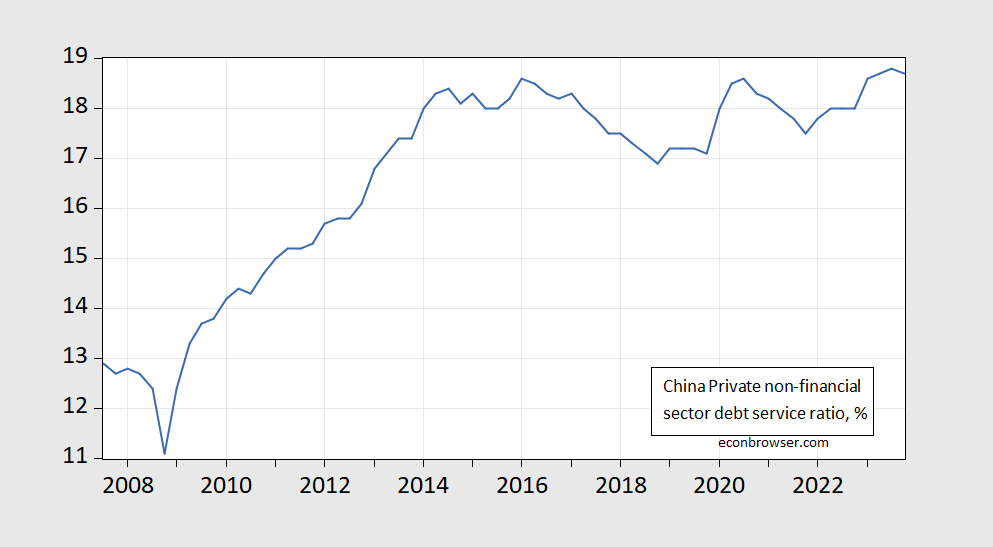

Adding in other financial factors – especially the debt service ratio and the foreign term spread – increases the adjusted R2 up to 0.77.

growth = 0.237 + 0.32 x spread – 0.98 × dsr + 1.44 x spread*

Adj-R2 = 0.77, NObs = 131, Sample = 2007M07-2018M12 (growth to 2019M12). Bold indicates significance at 10% msl using robust HAC errors.

Although the spread remains slightly important, in terms of fixed coefficients, the debt service ratio and the foreign currency spread have a significant effect (7 and 3 times more than the time spread, respectively).

Here is the BIS series of debt service ratio for the non-financial private sector, up to 2023.

Figure 2: Debt service ratio of China’s non-financial private sector, %. Source: BIS.

For signs of an impending recession – or recession – look to other indicators.

Previous post on China, here.

Source link