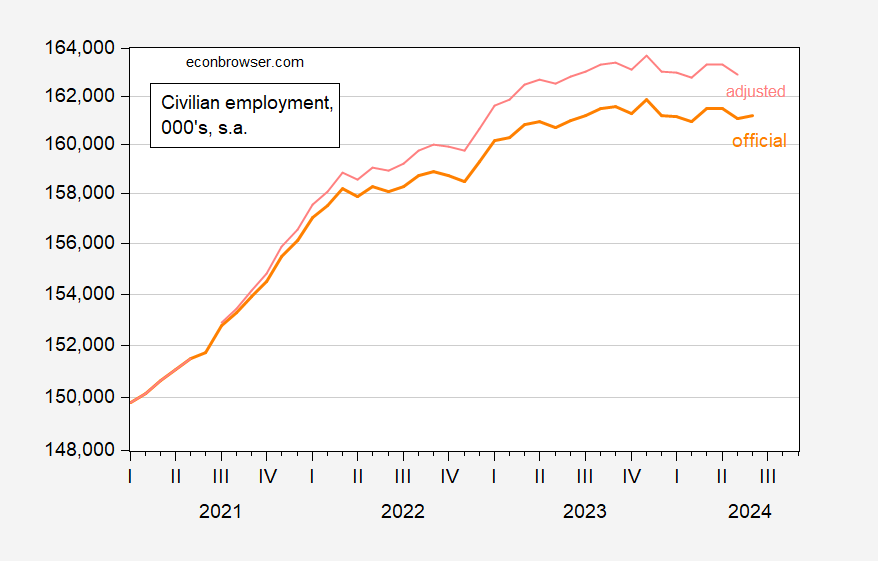

Several observers pointed out the gap between estimated employment as measured by the CPS, and nonfarm employment numbers obtained from the CES. The CPS measure includes new population controls, which depend on limited arrivals. The CBO estimates more immigrants than the Census, which when applied to employment changes our perceptions of employment.

From Orrenius et al. (2024).

Source: Orrenius et al./Dallas Fed (2024).

Over 2022-23, CBO estimates 3.9 million more immigrants than the Census. Extrapolating this number to the 2021M07-23M06 population, using the same labor force participation rate and labor force employment rate as observed in 2023M06 reveals the following picture.

Figure 1: Employment of citizens as reported (bold orange), adjusted for the addition of 3.8 mn immigrants (pink). Consumption reported an increase in employment in 2023M07-06. Source: BLS, Dallas Fed, and author’s statistics.

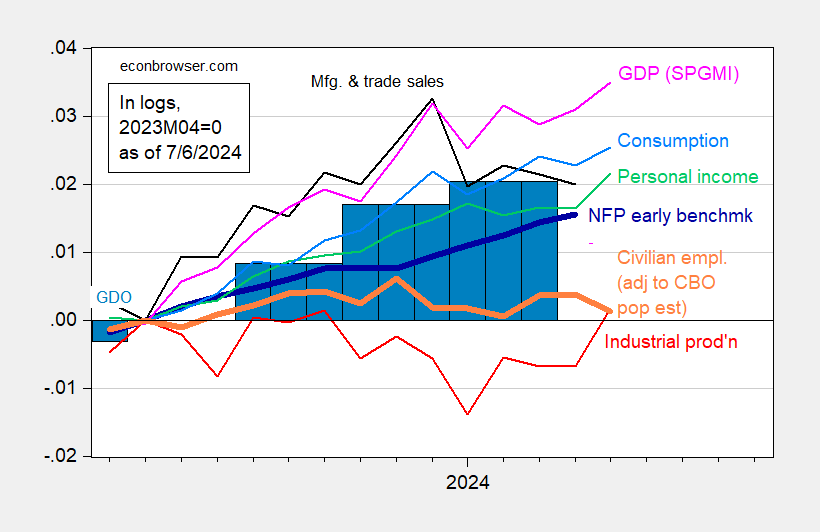

This changes the picture of business cycle indicators including other employment methods:

Figure 2: Nonfarm Payroll (NFP) Philadelphia Fed preliminary benchmark (highlight blue), employment adjusted for CBO immigration (orange), industrial production (red), personal income excluding current transfers in Ch.2017 $ (bright green), production and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (blue), and monthly GDP in Ch.2017$ (pink), GDO (green bars), all logs are normalized to 2023M04=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q1 third release, S&P Global Market Insights (probably Macroeconomic Advisors, IHS Markit) (7/1/2024), and author’s calculations.

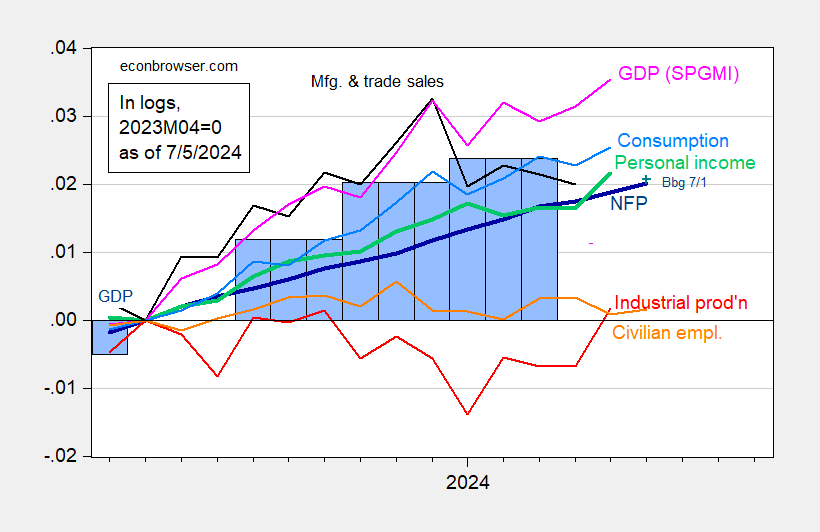

Here is a picture of the standard indicators, for comparison:

Figure 3: Nonfarm Payroll (NFP) from CES (blue), employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bright green), trade and sales in Ch.2017$ (black), consumption in Ch.2017$ (blue), and monthly GDP in Ch.2017$ (pink), GDP (green bars), all log normalized to to 2023M04=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q1 third release, S&P Global Market Insights (probably Macroeconomic Advisors, IHS Markit) (7/1/2024), and author’s calculations.

Note that the change in employment does not make much difference as the index is normalized to 2023M04. Getting used to it up to the day before can dramatically change the structure of the work.

Source link