The probability is high, using a normal distribution model.

Here is an updated assessment of the likelihood of a recession (next 12 months), which includes data through June 2024, and assumes no recession has occurred since July 2024.

Figure 1: Estimated economic recession for the next 12 months, using the 10yr-3mo spread and 3-month average (blue), the 10-3mo spread, the 3-mo average, and the non-financial private sector debt service ratio ( tan), and the 10-3mo spread, the 3mo average, the non-financial private sector debt service ratio, and the foreign currency spread (green). Measurement sample 1985M03-2024M06. The NBER has defined recession days as shaded in gray. Source: Author’s calculations, and NBER.

The pseudo-R2 of the specified debt service ratio, also including the external time spread and the debt service ratio, is 0.56 vs. 0.58.

The forecasted probability in July 2024 is from 60% (time spread, short ratio) to 20% (time spread, short ratio, debt service ratio).

The diminishing possibility of improved models of debt service depends on the slowing of the rate of increase, which I have indicated in the first six months of 2024.

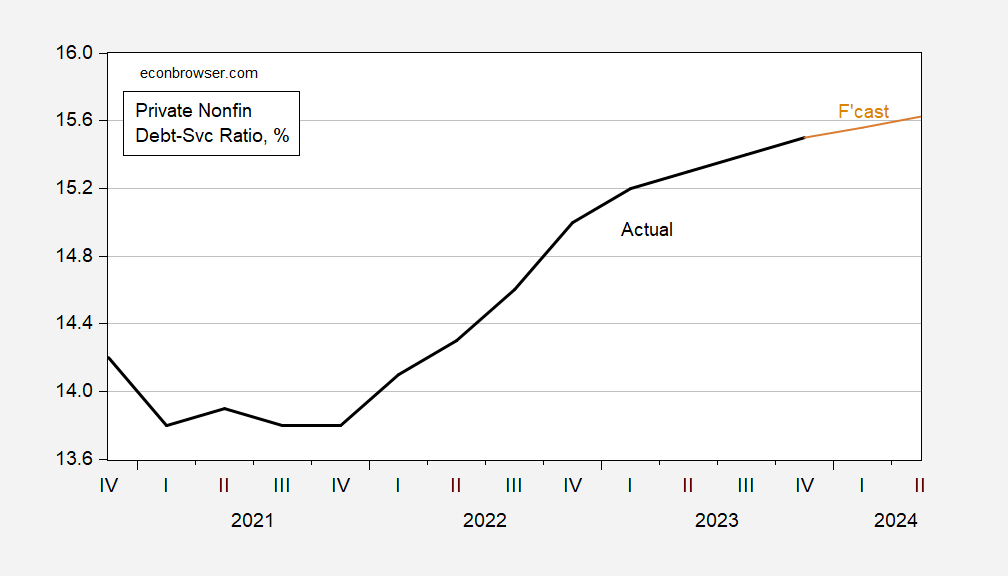

Figure 2: Debt service rates for the non-financial private sector (black), forecasted on the variable (tan), both in %. 2024Q1-Q2 is estimated using interest rates (see here). The NBER has defined recession days as shaded in gray. Source: BIS, Dora Fan Xia, NBER, and author’s calculations.

Source link