Industrial production at +0.6% m/m vs. +0.3% consensus (productivity +0.4 vs. + 0.2% consensus).

Figure 1: Nonfarm Payroll (NFP) from CES (blue), employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bright green), trade and sales in Ch.2017$ (black), consumption in Ch.2017$ (blue), and monthly GDP in Ch.2017$ (pink), GDP (green bars), all log normalized to to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q1 third release, S&P Global Market Insights (probably Macroeconomic Advisors, IHS Markit) (7/1/2024), and author’s calculations.

Scheduled to April 2023:

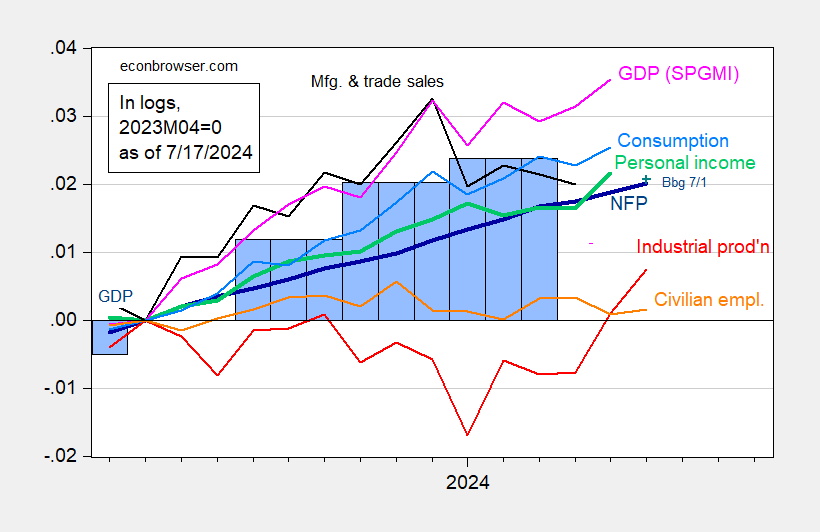

Figure 1: Nonfarm Payroll (NFP) from CES (blue), employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bright green), trade and sales in Ch.2017$ (black), consumption in Ch.2017$ (blue), and monthly GDP in Ch.2017$ (pink), GDP (green bars), all log normalized to to 2023M04=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q1 third release, S&P Global Market Insights (probably Macroeconomic Advisors, IHS Markit) (7/1/2024), and author’s calculations.

Other product references, work:

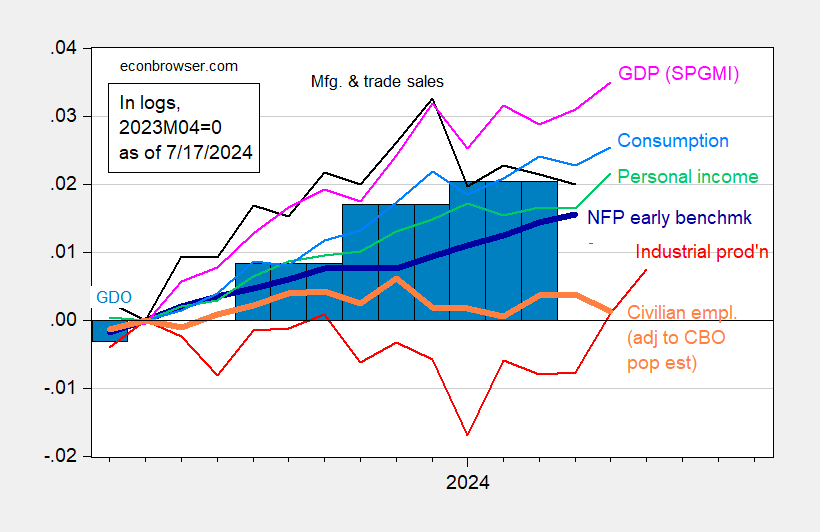

Figure 3: Nonfarm Payroll (NFP) Philadelphia Fed preliminary benchmark (highlight blue), employment adjusted for CBO immigration (orange), industrial production (red), personal income excluding current transfers in Ch.2017 $ (bright green), production and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (blue), and monthly GDP in Ch.2017$ (pink), GDO (green bars), all logs are normalized to 2023M04=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q1 third release, S&P Global Market Insights (probably Macroeconomic Advisors, IHS Markit) (7/1/2024), and author’s calculations.

GDPNow revised up to 2.7% in Q2.

Source link