WSJ July forecast related to CBO, IMF WEO update, and GDPNow from yesterday:

Figure 1: GDP as reported (bold black), WSJ July survey mean (tan), CBO June projection (blue), IMF WEO July forecast (red square), and GDPNow for 7/17 ( blue square). Source: BEA 2024Q1 3rd release, WSJ July survey, IMF WEO July update, Atlanta Fed, and author’s calculations.

Interestingly, the CBO forecast from June is above the 20% upper cut (2024 q4/q4) in the WSJ survey:

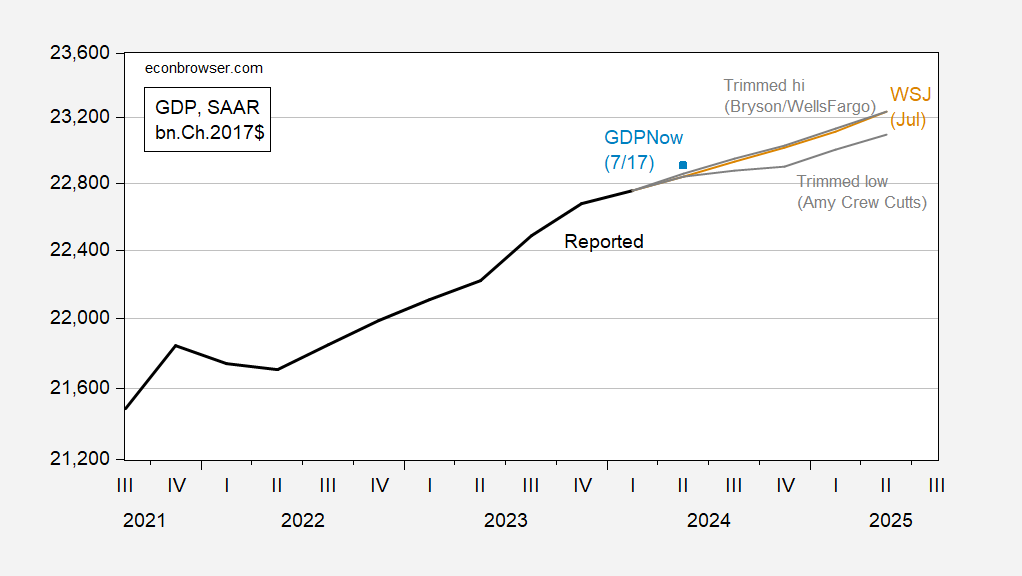

Figure 2: GDP as reported (bold black), WSJ July survey mean (tan), 20% cut hi/low range based on 2024 q4/q4 growth (gray lines), and GDPNow of 7/ 17 (blue square). Source: BEA 2024Q1 Issue 3, July WSJ survey, Atlanta Fed, and author’s calculations.

GDPNow as of 7/17 registers an AR growth rate of 2.7% in Q2, on target to reach the CBO projection. Interestingly, the IMF and CBO trajectories are very similar for 2025Q4.

According to recession forecasts, the estimated probability of a recession in the next 12 months dropped by one point, to 28%. On a related point, only two respondents (out of 68 for GDP growth) predicted two consecutive quarters of negative growth: Nicholas Van Ness (Credit Agricole CIB), and Andrew Hollenhorst/Veronica Clark (Citigroup). In the April survey, 5 respondents were in this group (Van Ness was the overlap).

Source link