Torsten Slok presents this graph, and writes “The bottom line is that consumer spending on homeowners and equity holders is important, especially when combined with record high cash flows from fixed income.”

Source: Torsten Slok/Apollo, 19 July 2024.

This made me wonder if we have seen NBER peaks in areas where home equity has been rising. The net household value series is short, so I use the total net household value and non-profit, reduced by the consumption denominator.

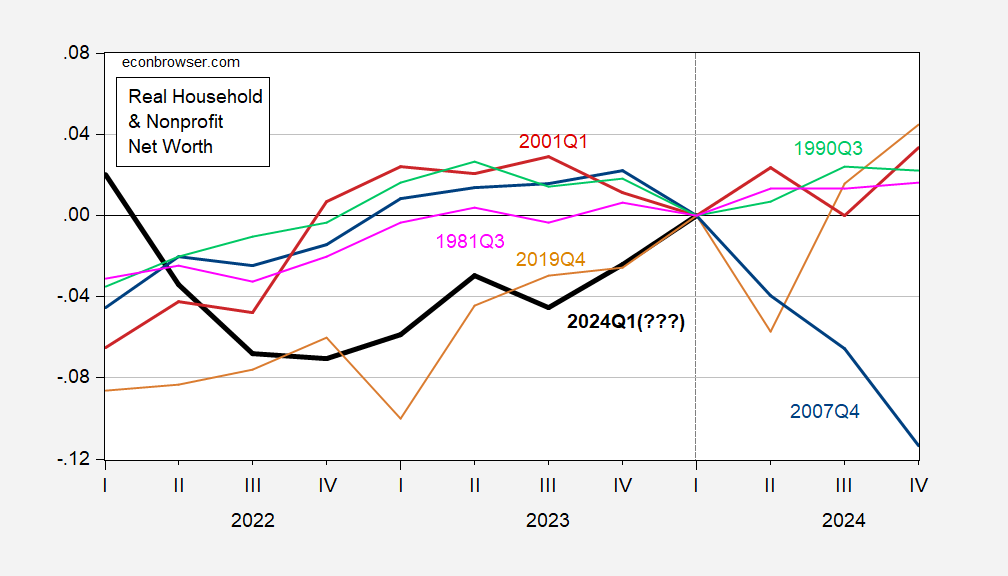

Figure 1: Total family and non-profit net worth, in logs normalized to NBER’s business cycle peak. The latest cycle (bold black) peaks in 2024Q1. Source: Fed Flow of Funds, BEA via FRED, NBER, and author’s calculations.

In the previous five recessions, real home equity has fallen to the NBER’s peak four times. The exception was the pandemic-related recession of 2020. In contrast, in 2024Q1, the real rate increased by 10% (q/q AR).

Source link