NBER BCDC key indicators, other indicators, weekly indicators:

Figure 1: Nonfarm Payroll (NFP) from CES (blue), employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bright green), trade and sales in Ch.2017$ (black), consumption in Ch.2017$ (blue), and monthly GDP in Ch.2017$ (pink), GDP (green bars), all log normalized to to 2023M04=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q2 advance release, S&P Global Market Insights (probably Macroeconomic Advisors, IHS Markit) (8/1/2024), and author’s calculations.

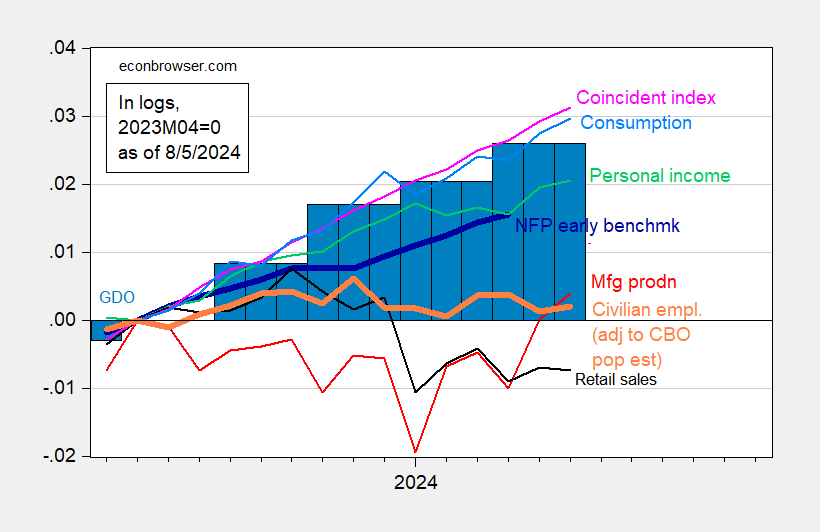

Figure 2: Initial benchmark Nonfarm Payroll (blue), CBO-adjusted employment adjusted for immigration (orange), manufacturing output (red), personal income excluding current transfers in Ch.2017$ (bright green), retail sales in 1999M12$ (black), consumption in Ch.2017$ (light blue), and the corresponding index (pink), GDO (green bars), all logs normalized to 2023M04=0. 2024Q2 GDO uses limited GDI. Source: BLS via FRED, Federal Reserve, BEA 2024Q2 advance release, Philadelphia Fedand the author’s figures.

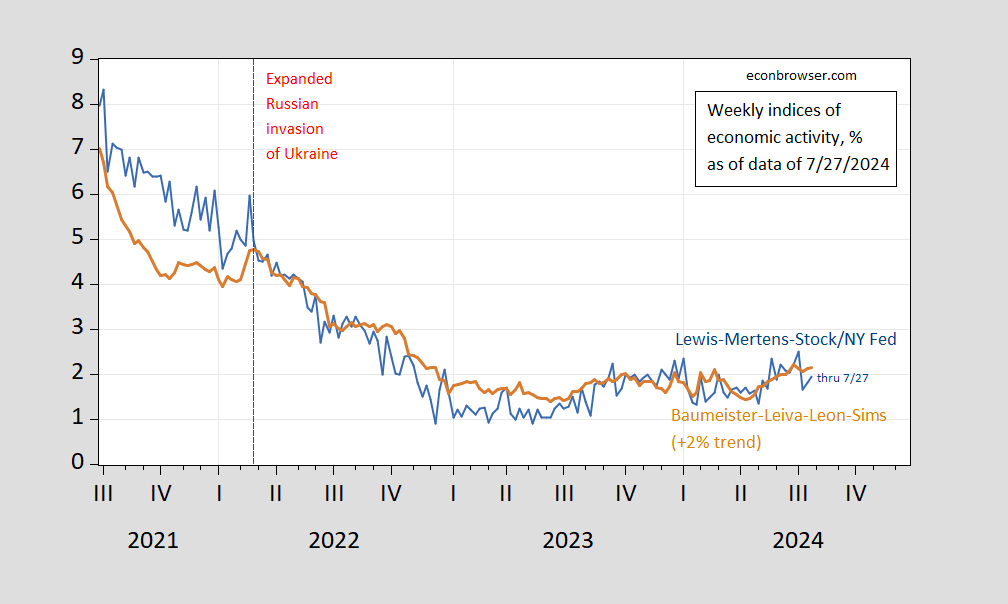

Figure 3: WEI (blue), WECI and 2% (tan), in %. Source: NY Fed via FRED, Baumeister et al.

For a long-term view, for all macro aggregates:

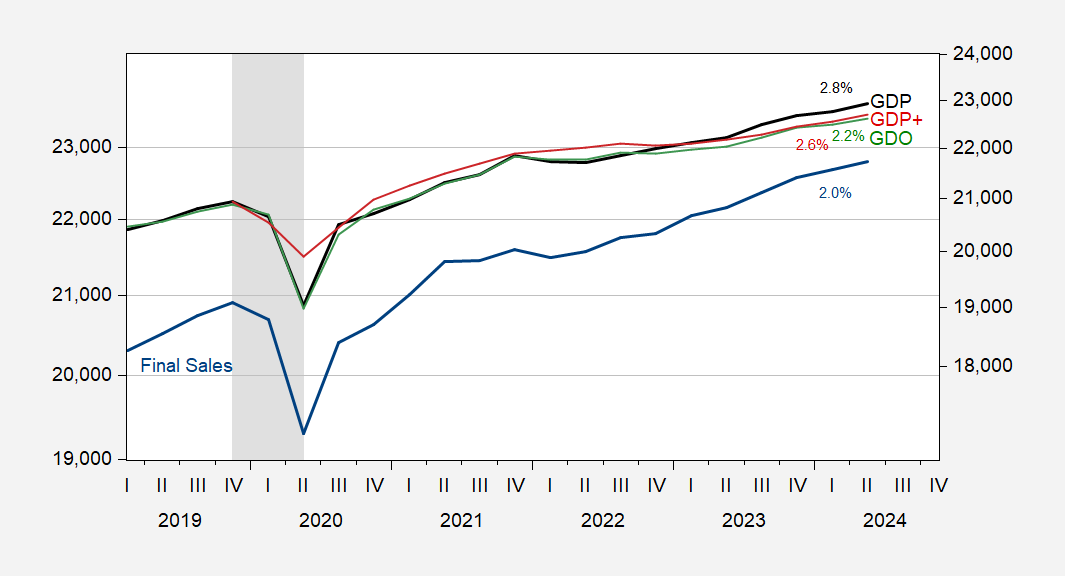

Figure 4: GDP (bold black, right scale), GDO (green, right scale), GDP+ (red scale, right scale), final sales (blue scale, left scale), all in bn.Ch.2017$ SAAR. GDP+ is a multiple of 2019Q4 GDP. The GDI used in GDO is estimated by the author. The NBER has defined recession days as shaded in gray. Source: BEA, Philadelphia Fed, NBER, and author’s calculations.

As of today, the GDPNow nowcast for Q3 stands at 2.9% SAAR.

Source link