With the release of Fed industrial production (-0.6% m/m vs. -0.3% consensus) and retail sales (+1.0% m/m vs. +0.4% consensus), we have the following images, the first of the indicators tracked by the NBER’s Business Cycle Advisory Committee , and monthly GDP.

Figure 1: Nonfarm Payroll (NFP) from CES (blue), employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bright green), trade and sales in Ch.2017$ (black), consumption in Ch.2017$ (blue), and monthly GDP in Ch.2017$ (pink), GDP (green bars), all log normalized to to 2023M04=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q2 advance release, S&P Global Market Insights (probably Macroeconomic Advisors, IHS Markit) (8/1/2024), and author’s calculations.

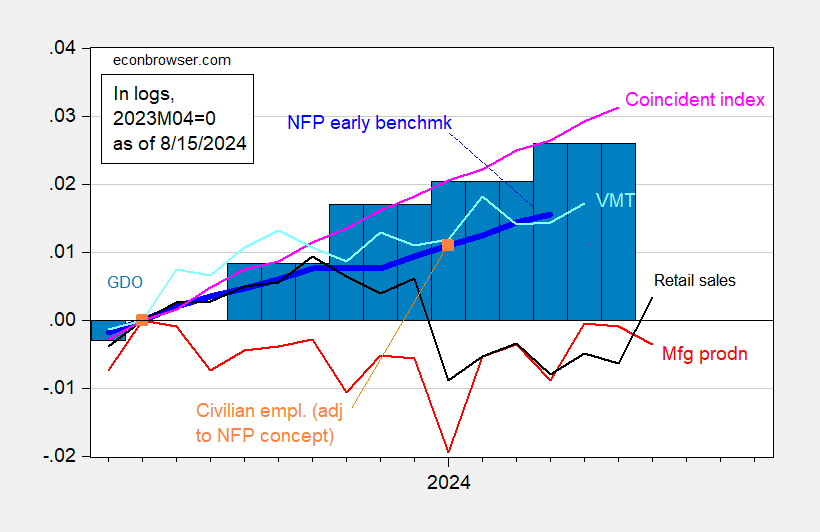

Industrial production fell more than expected. The same is true for productivity. In Figure 2, I show a series of different indicators, including manufacturing output, retail sales, and other employment, and GDO.

Figure 2: Nonfarm Payroll (NFP) Philadelphia Fed first benchmark (bright blue), employment adjusted using Edelberg and Watson population estimates (see text) (orange square), industrial production (red), per capita income personal net current transfers in Ch.2017$ (green), production and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and the Coincident Index (light pink ), GDO (green bars), all log normalized to 2023M04= 0. The GDI used to calculate 2024Q2 GDO is estimated by forecasting the total 2024Q2 operating surplus using GDP, lagged surplus, outstanding balance, 2021Q1-2024Q1. Source: BLS via FRED, Federal Reserve, BEA 2024Q2 advance releaseEdelberg and Watson (2024) population data provided in personal communication, and author’s calculations.

I used labor force participation rates of indigenous and foreign populations from other population estimates from Edelberg and Watson (2024). As they write in their report:

In our previous work, we provided evidence that CPS data underestimated the recent increase in the number of non-institutionalized persons in the United States aged 16 and older (hereafter referred to as the population). That piece presented estimates of combined population and job growth that were greater than published CPS data.

I then use the reported unemployment rates for native and foreign populations from other labor force statistics to generate employment rates for each category. Summing the two gives another employment rate, which I then reverse to match 2021M01 (pre-pandemic) rates. To measure the 2023M04 level (used for normalization), I performed a geometric translation of the 2023M01 and 2024M01 differential levels.

GDPNow for Q3 as of today is 2.4%. Lewis-Mertens-Stock NY Fed WEI is reading 2.29% for data released on 8/10/2024.

Source link