From a paper by Michele Andreolli, Natalie S. Rickard, and Paolo Surico (presented at the NBER Summer Institute Monetary Economics sessions):

Using newly constructed time series of consumption, prices and income in essential and non-essential sectors, we document three important generalities in post-WWII US data: (i) non-essential spending is more sensitive to the business cycle than spending. in important matters; (ii) salaries in non-core sectors are more in line with those in core sectors; (iii) low earners are more likely to work in non-essential industries. We develop and estimate a structural model with a non-homothetic preference for two cost goods, hand-to-mouth buyers and variation in labor productivity consistent with these findings. We use the model to revisit the transmission of monetary policy and find that the interaction of cyclical product demand and cyclical labor demand formation significantly increases business cycle volatility.

Here are two important pictures.

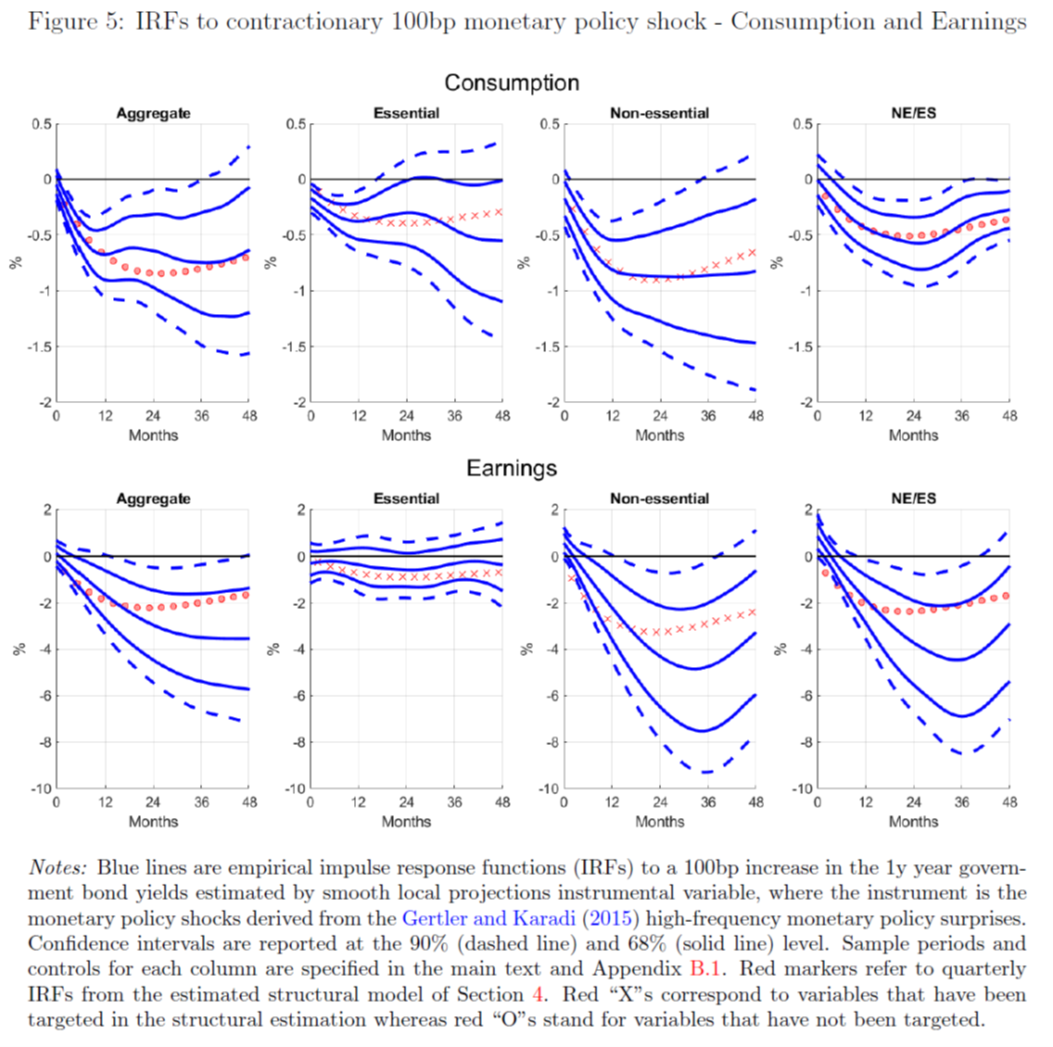

Source: Andreolli et al (2024).

Note that the nonessential share was shrinking before the pandemic (even as overall consumption was rising). Functions of the response variables to a 100 bp currency shock show that disaggregation is important in identifying which components of consumption (and therefore the aggregate economy) respond.

Source: Andreolli et al (2024).

What is not important? The authors define items with an elasticity of demand greater than one (in absolute terms) as unimportant. Some obvious things: eating away from home, entertainment, public transportation.

Implications: Noncores respond more strongly to tightening monetary policy than do cores. That means that catching early on the diminishing effects of monetary policy requires looking at spending at a disaggregated level, and preferably at a higher frequency than a regular monthly series. What do these indicators look like?

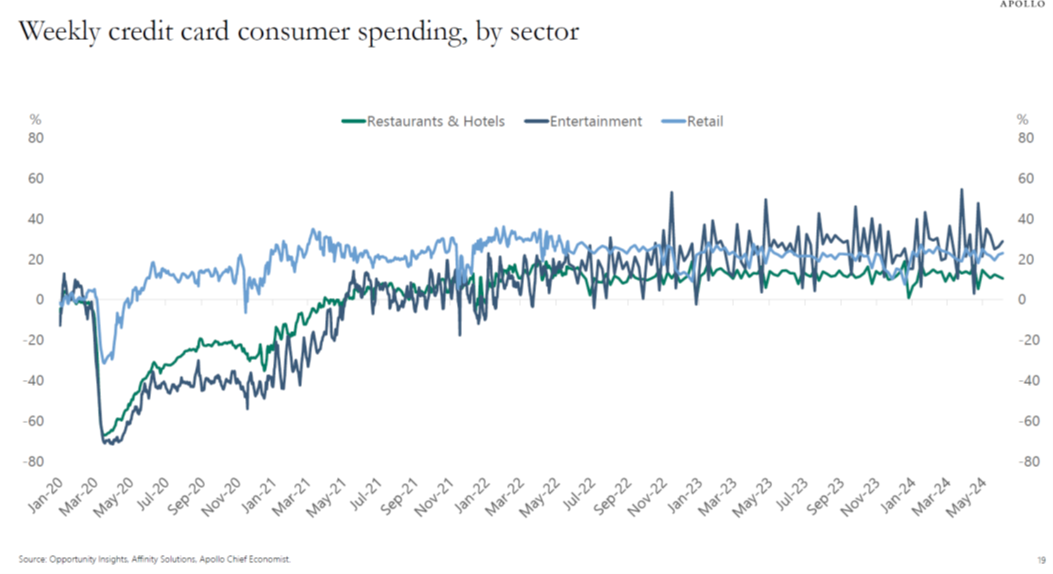

Here’s a breakdown of credit card spending, courtesy of Torsten Slok et al. Restaurants and hotels (representative of leisure travel) and entertainment are still growing, even taking into account inflation.

Source: Slok, Shah, Galwankar, “Daily and weekly indicators of the US economy,” Apollo, 17 August 2024.

From Slok’s communication today, about these high frequency non-significant indicators:

If you look at the latest daily and weekly data it shows that … restaurant bookings are strong, air travel is strong, hotel occupancy rates are high, … and Broadway show attendance and box office totals are strong. …What is important is that there are no signs of recession in the incoming data…

This is contra Michaillat-Saez based on monthly data through July, discussed in this post, and the individuals on this list.

Source link