of 2022H1, due to his announcement of recession now. As of August 1, 2022, from Heritage Explains the “Biden Recession” episode:

In terms of how we define or what marks a recession, the basic understanding is that if the economy shrinks for two quarters in a row, say three months, and then another three months, that’s a recession. The reason the White House has been making so much hay, oh, that’s not the official explanation, blah, blah, blah. That’s right. I don’t think there is an official official definition, but I have taught many economics courses. That’s what we used in every class. That’s what you’ll see in most, if not all, economics books. That has been a coincidence for the last hundred years. So the idea that this is somehow new or untrue, I dismiss that out of hand.

As it happens, here is what I wrote that day:

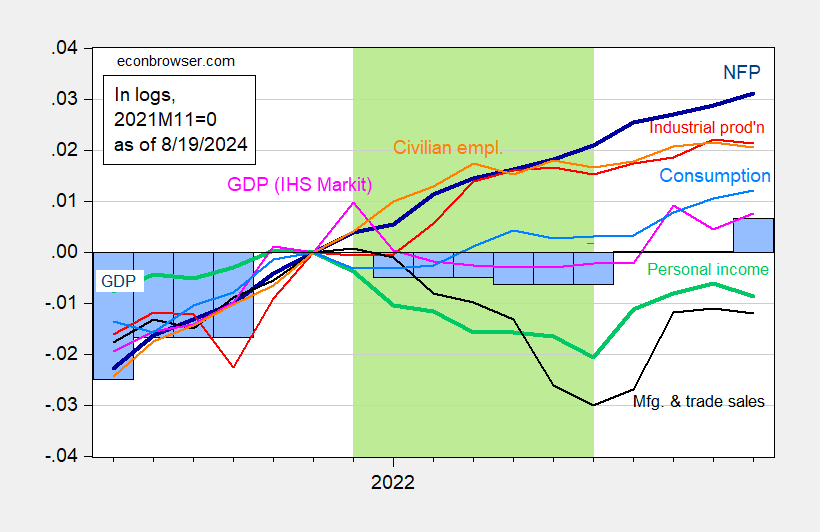

If one takes GDP as a proxy for the NBER’s prescribed business cycles, this is what the picture would look like (typical for mid-Q4):

Figure 1: Nonfarm payroll employment (bright blue), Bloomberg consensus as of 8/1 (blue +), employment (orange), industrial production (red), personal income excluding transfers in Ch.2012 $ (bright green), production and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (blue), and monthly GDP in Ch.2012$ (pink), GDP official, 2022Q2 advance (blue bars), all logs normalized to 2021M11=0 . Source: BLS, Federal Reserve, BEA with FRED, IHS Markit (nee Macroeconomic Advisers) (8/1/2022 release), NBER, and author’s statistics.

The six scheduled series are the focus of the NBER’s Business Cycle Estimation Committee, in addition to the official BEA GDP, and IHS Markit’s monthly GDP (which is not currently listed). Of the six key ones, non-farm (black) employment and those who transferred personal income are given more weight.

Note that this is “real-time” data (ie, what we actually knew at the time). While personal income tended to be on the sidelines, non-farm employment was rising sharply. Arguments that employment was actually falling seem to be misleading (even at the time).

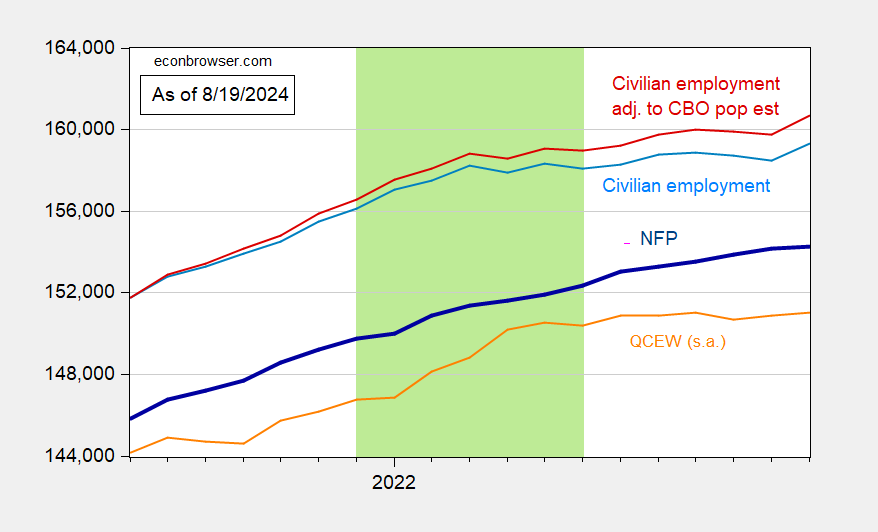

Here is a recent snapshot of economic activity during this period.

Figure 2: Nonfarm payroll employment (bright blue), civilian employment (orange), industrial production (red), personal income without transfers in Ch.2017$ (bright green), manufacturing sales and trade in Ch.2017$ ( black), consumption Ch.2017$ (blue), and monthly GDP in Ch.2017$ (pink), official GDP, 2024Q2 advance (blue bars), all logs are normalized to 2021M11=0. Hypothesized collapse 2022H1 shaded in light green. Source: BLS, Federal Reserve, BEA with FRED, IHS Markit (nee Macroeconomic Advisers) (8/1/2022 release), NBER, and author’s statistics.

Note that the contours look different in some series. This is a reminder that the data is being updated.

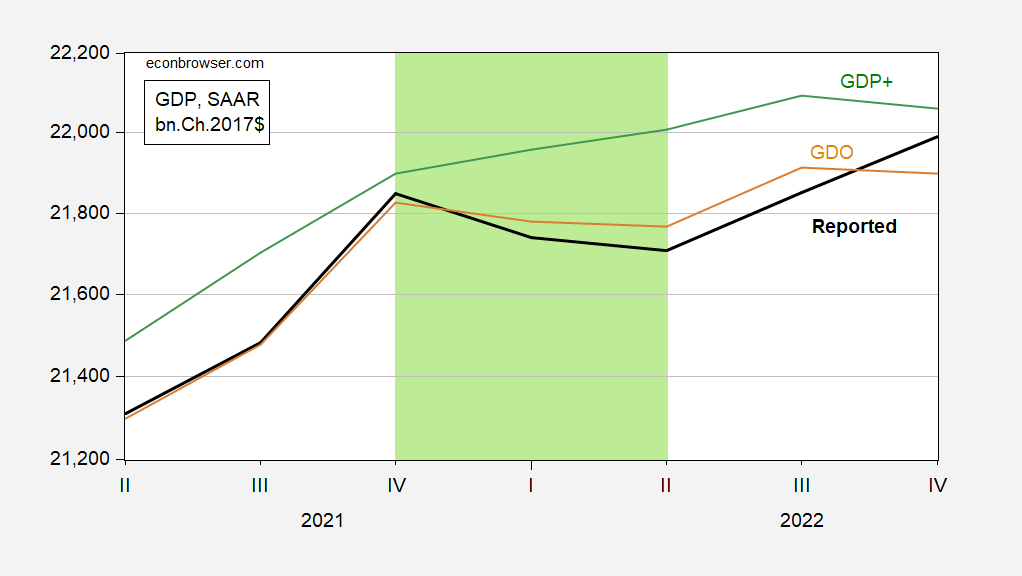

If you’re still worried about NFP (the birth-death model and all that stuff), remember that there has been a benchmark update since 2022 data. Here’s what the data looks like now, for NFP, QCEW and the population from the household survey.

Figure 3: Nonfarm payroll employment (bright blue), QCEW total employment covered (orange), resident employment as reported (blue), adjusted for the addition of 3.8 mn immigrants (red) (see text), all 000, which is adjusted periodically. QCEW is adjusted seasonally by the author using X-13 in the logs. Hypothesized collapse 2022H1 shaded in light green. Source: BLS, Dallas Fed, and author’s statistics.

The calculation of the adjusted employment series is reported in this post.

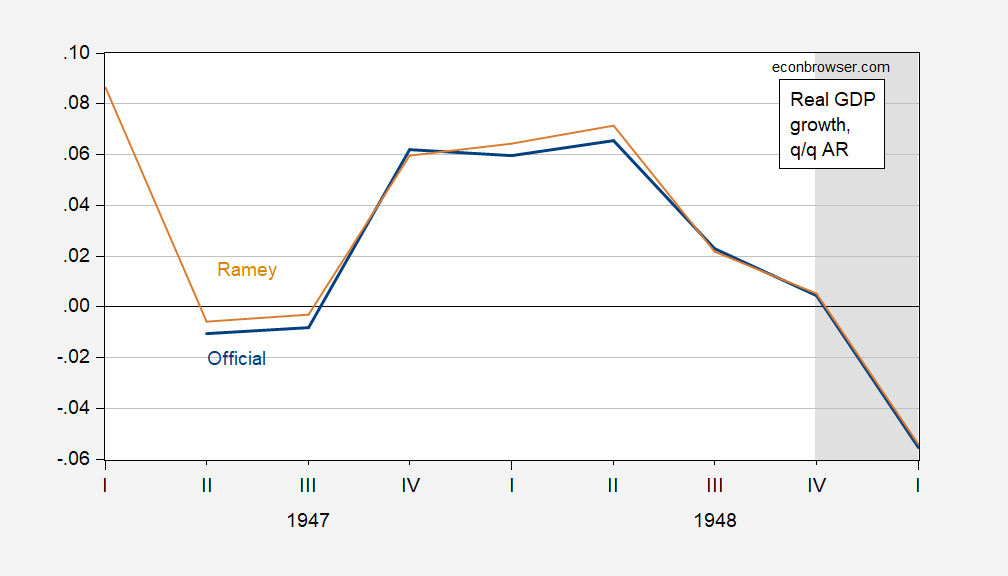

The argument of Dr. Antoni focuses on the GDP rule for two quarters. We know that GDP is subject to large revisions over time, so even if one is recorded in the two-quarter rule, one can get different answers over time. GDO and GDP+ are alternatives.

Figure 4: GDP (bold black), GDO (tan), and GDP+ (sky blue), all in bn.Ch.2017$ SAAR. GDP+ is measured in 2019Q4 GDP. Hypothesized collapse 2022H1 shaded in light green. Source: BEA, Philadelphia Fed, author’s calculations.

So, a recession in 2022? I do not think so. Finally, remember this assertion:

[The 2 consecutive quarter rule] it was what we used in every class. That’s what you’ll see in most, if not all, economics books. That has been a coincidence for the past 100 years.

Not true of the books I used. I do not know that Dr. What books did Antoni use? My suggestion. Look at the data, in particular, GDP growth over the long term.

Figure 5: Quarter-on-Quarter real GDP growth is annualized in the official series (blue), and the Ramey series (tan). The NBER has defined recession days as shaded in gray. Source: BEA, Valerie Ramey, NBER, and author’s calculations.

Note that the NBER did not mention a recession in 1947, when there were two consecutive quarters of negative growth.

Source link