From EJ Antoni (Heritage), the article “The next recession may already be here” at Boston Herald (8/21):

“…a growing number of indicators suggest that a recession has hit the broader economy.”

Here are the key indicators tracked by the NBER Business Cycle Dating Committee:

Figure 1: Nonfarm Payroll (NFP) employment from the CES (blue), NFP mean first benchmark revision (blue), employment (orange), employment using CBO’s estimates of foreign nationals (bright orange) , industrial production (red), personal income excluding current transfers in Ch.2017$ (bright green), production and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q2 advance release, S&P Global Market Insights (probably Macroeconomic Advisors, IHS Markit) (8/1/2024), and author’s calculations.

For a review of the first benchmark, see here; for other public employment using CBO’s immigration estimates, see here. Note that I used CBO estimates for 2024 in these estimates as well; in the previous iteration, I used CBO estimates up to 2023M06.

Of these indicators, I can only count employment from the household survey and perhaps industrial production as indicating a possible recession.

Here are some pointers. Note that the vertical scale is the same in Figure 2 as in Figure 1, for comparison purposes.

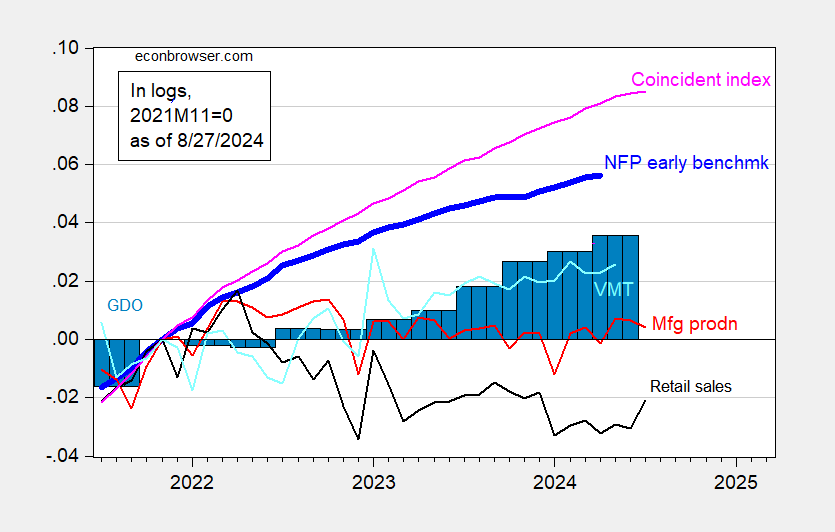

Figure 2: Nonfarm Payroll early benchmark (NFP) (bold blue), industrial production (red), ales ales in 2019M12$ (black), vehicle miles traveled (light blue), and coincident index (pink), GDO (blue bar) , all log normal to 2021M11=0. Source: Philadelphia Fed, Federal Reserve via FRED, BEA 2024Q2 third release, S&P Global Market Insights (macroeconomic advisors, IHS Markit) (9/1/2024), and author’s calculations.

Among these indicators, retail sales and manufacturing production may indicate a slowdown in the economy, although the former started in the latest available month. The coincident index increased by 1.8% annually in the last three months reported.

The usual caveat applies – all of these series are subject to revisions, especially the GDP series, which is why the NBER BCDC does not place primary reliance on these series (see how the 2001 recession fits in briefly with the sequential rule of thumb, here).

One indicator that favors a recession call is Sahm’s law. The caveat here is that the index is being pulled up by a large increase in the workforce, rather than a decrease in employment, as shown in this post. Last year, I noted that standard deviation models show a high probability of a recession in the middle of 2024, so I don’t want to say that the view is safe now, despite the fact that the weekly indicators (eg, WEI, for data 8/17) still show growth in -2.32%. Still, it’s not ready to be put in the recession camp, just yet.

Source link