Including monthly GDP out today from S&P Global Market Insights, and the first NFP benchmark:

Figure 1: Nonfarm Payroll (NFP) from CES (dark blue), implied NFP from the first benchmark (blue), employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bright green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (blue), and monthly GDP in Ch.2017$ (pink ), GDP (green bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q2 2nd release, S&P Global Market Insights (with Macroeconomic Advisers, IHS Markit) (9/3/2024), and author’s calculations.

S&P GMI Notes:

Monthly GDP rose 0.4% in July following a weak reading in June that was revised down 0.2%. July’s increase was entirely (and almost equally) accounted for by increases in personal spending and fixed non-residential investment. Apart from these components, the jump in non-farm investment in July was almost offset by a decline in net exports.

Therefore, even taking the first benchmark literally (see this post about why you might not want to), the July indicators do not suggest a recession that will begin in July (remembering that the rest of the series will be updated later).

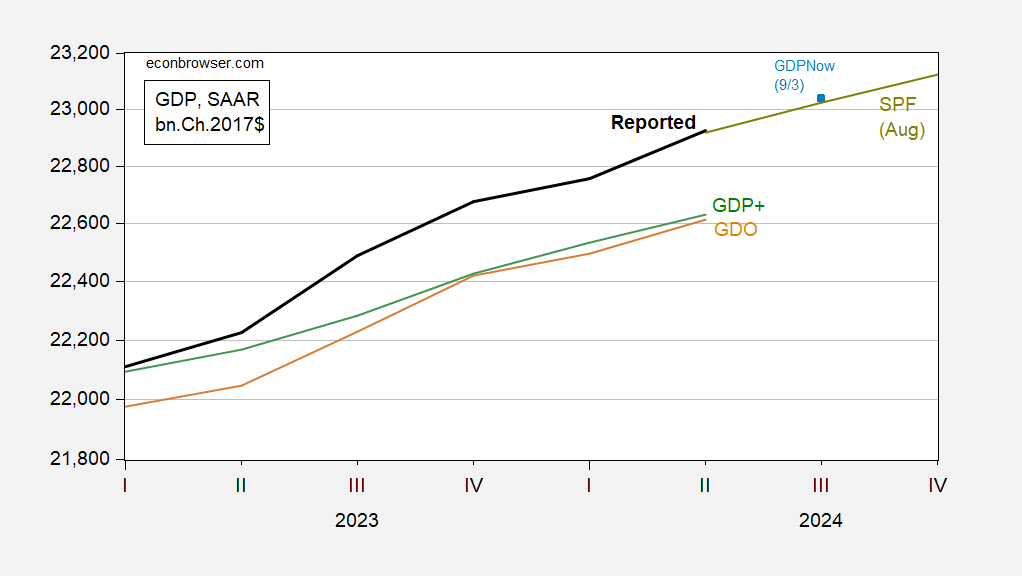

GDPNow for Q3 is now 2%, down from 2.5% on 8/30. 2% is still trend growth, so I would hate to say that the decline is here in Q3.

Figure 3: GDP as reported (bold black), GDPNow as of 9/3 (green square), median GDP forecast from the Survey of Professional Forecasters (chartreuse line), GDO (tan) , GDP+ (green), all in bn.Ch.2017$ SAAR. GDP+ is calculated by multiplying GDP+ figures by the 2019Q4 GDP level. Source: BEA 2024Q2 second release, Atlanta Fed, Philadelphia Fed (SPF 8/9), Philadelphia Fed (GDP+ 8/29), and author’s calculations.

Source link