Peter Schiff today:

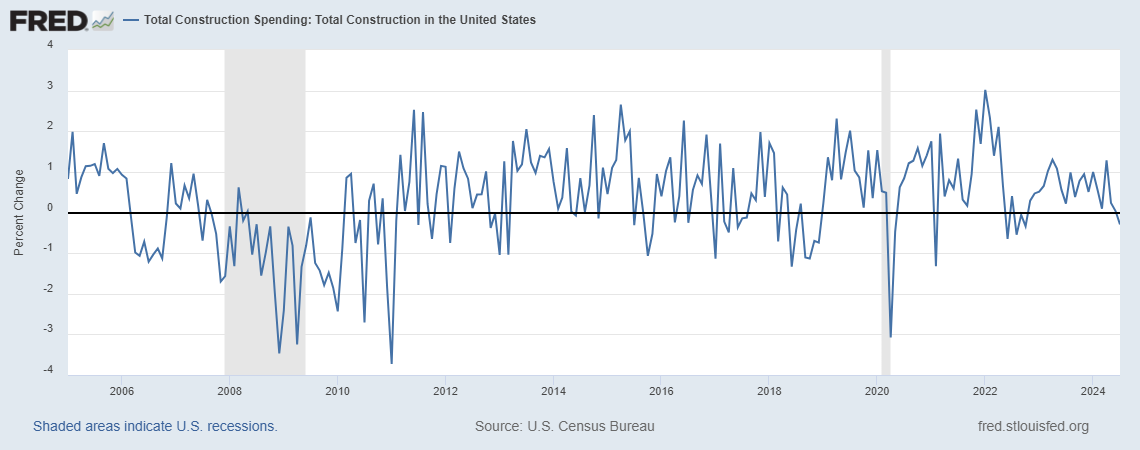

This morning saw a trifecta of weak economic data. Aug. The manufacturing PMI and ISM both came out weaker than expected, while July consumption fell sharply. It is becoming clear #the economy enters a #recession just as #inflation ready to go up.

Bloomberg shows manufacturing PMI was 47.9 vs. 48 consensus, ISM manufacturing was 47.2 vs. consensus. 47.5. Over the past year, the standard deviation of forecast errors is 0.5, so a surprise of -0.3 is not statistically different from an average surprise of 0.17. Construction costs fell 0.3% m/m vs +0.1% consensus. The standard deviation of the errors is 0.4 ppts, so again the slope is within one standard deviation and not statistically different from zero.

Regarding construction costs:

The answer comes from Goldman Sachs:

. General construction spending fell 0.3% (mom sa) in July, compared with expectations for a 0.1% rise. Spending growth was revised up in June (+0.3pp to lower) and May (+0.6pp to +0.2%). Private construction costs fell 0.4% in July, as private residential costs (-0.4%) and private non-residential costs (-0.4%) both declined. Public construction expenditures rose in July (+0.1%), reflecting an increase in non-residential public spending (+0.2%) but a decrease in public housing expenditures (-2.6%). Construction costs rose 0.6% in July (the mother of the Census estimate), indicating that construction costs fell 0.9% in real terms.

Maybe a recession is coming. I’m not sure if these give off any persuasion. Note: Mr. Schiff has been predicting a recession since November 2023.

Source link