We have a bunch of competitive tests starting today. From the three Federal Reserve Banks and Goldman Sachs.

Figure 1: GDP (bold black), August Survey of Professional Forecasts (tan), GDPNow (blue square), NY Fed (red triangle), St. bn.Ch.2017$. Nowcasts are dated 9/6 unless noted; nowcast rates are calculated as the cumulative growth rate to report GDP rates for 2017Q2 2nd release. Source: BEA 2024Q2 second release, Philadelphia Fed SPF, Atlanta Fed (9/4), NY Fed (9/6), St. Louis Fed (9/6), Goldman Sachs (9/6), and author figures.

Additionally, S&P Global Monthly Insights (formerly Macroeconomic Advisers) reports growth of 2.0% as of 9/3, slightly below the 2.1% from GDPNow.

An upward revision to GDP for Q2 and subsequent information has made forecasts now more consistent than the average SPF forecast (reported in early August). It is difficult to see how short-horizon assessments of the likelihood of a recession have grown. For comparison, here are the early August predictions that may come from SPF:

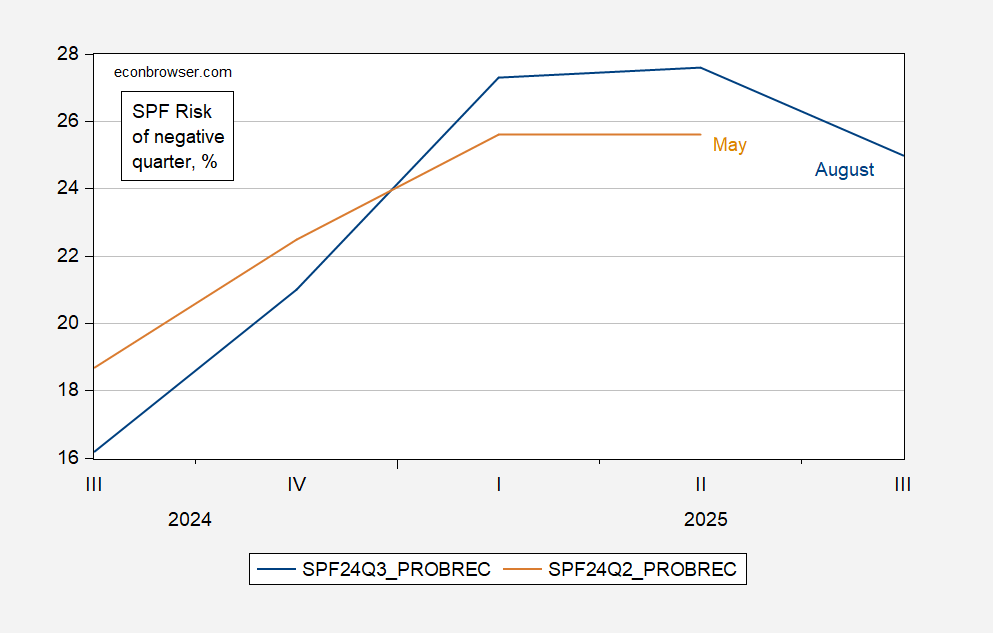

Figure 2: Risk of negative quarterly growth, from August survey (blue), from May survey (tan), both in %. Source: Philadelphia Fed.

The probability of a recession decreases in the near term (Q3, Q4), higher in the long term (2025Q1, Q2).

Source link