Today, we present a guest post written by David Papell and Ruxandra Prodan-Boul, Professor of Economics at the University of Houston and Lecturer in Economics at Stanford University.

The Federal Open Market Committee (FOMC) lowered the target range for the federal funds rate (FFR) by ½ point from 5.25 – 5.5 percent to 4.75 – 5.0 percent at its September 2024 meeting and, in the Summary of Economic Forecasts (SEP) , is expected to further decrease with an FFR range of between 4.25 and 4.5 percent at the end of 2024 and between 3.25 and 3.5 percent at the end of 2025. Futures markets summarized the CME FedWatch tool after the meeting predicted an accelerated path to rate cuts with the FFR range between 4.00 – 4.25 percent by the end of 2024 and between 2.75 – 3.00 percent by the end of 2025.

We compare the FOMC forecast to the CME forecast with non-inertial policy rules where the FOMC reaches the desired rate immediately and passive policy rules where the FOMC smooths changes. The post is based on two of our papers. “Policy Rules and Guidelines Moving Forward Following the Covid-19 Recession,” published online in the Journal of Financial Stability, and “Other Policy Rules and Policy Feeds,” which use data from SEP’s for September 2020 to June 2024 to compare various many. of policy rules instructions with real rates and FOMC of FFR. In this post, we analyze the four policy rules that are relevant to the future path of the FFR, we review the instructions for the policy rules until December 2027 from the September 2024 SEP, and include future market projections.

Taylor’s (1993) law with the unemployment gap is as follows:

where is the statutory short-term federal funds rate, the inflation rate, the 2 percent inflation target, the 4 percent unemployment rate over time, and the current unemployment rate. a neutral real interest rate from the SEP equal to 0.5 percent between September 2020 and December 2023, 0.6 percent in March 2024, 0.8 percent in June 2024, and 0.9 percent in September 2024.

Yellen (2012) analyzed the balanced employment rule where the coefficient of the inflation gap is 0.5 but the coefficient of the unemployment gap is increased to 2.0.

The balance sheet rule received a lot of attention following the Great Depression and became the standard policy rule used by the Fed.

These rules are not inertial because the FFR adjusts fully whenever the target FFR changes. This is inconsistent with the FOMC’s practice of accelerating rate hikes when inflation rises. We specify internal versions of the rules based on Clarida, Gali, and Gertler (1999),

where is the degree of inertia and is the target rate of the federal funds rate set by Equations (1) and (2). We set it as in Bernanke, Kiley, and Roberts (2019). is equal to the rate prescribed by the law if it is positive and zero if the prescribed rate is negative.

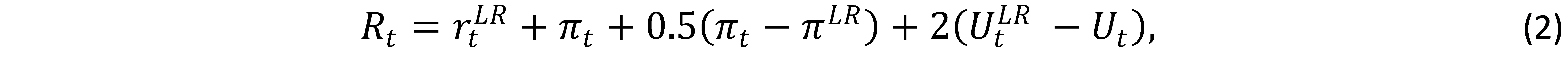

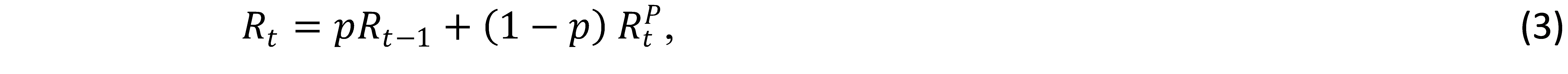

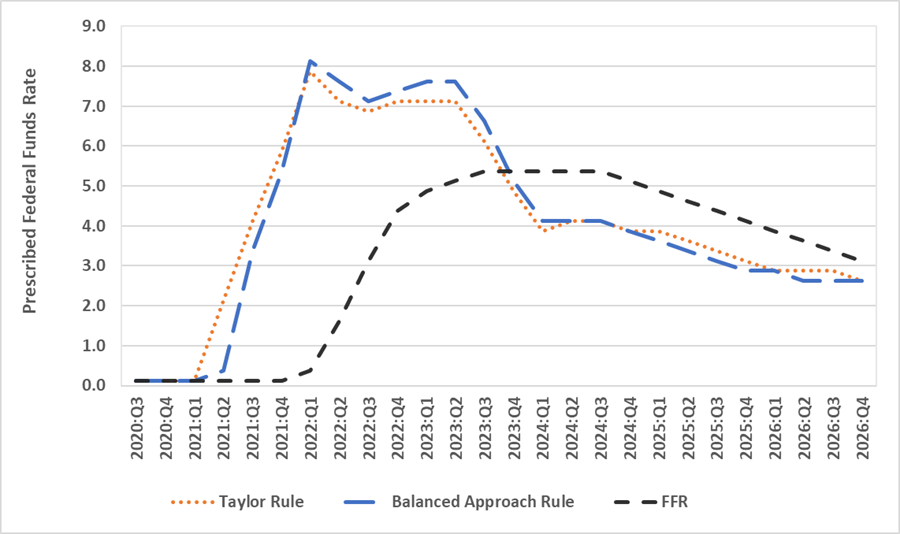

Figure 1 shows the midpoint of the target FFR range for September 2020 to September 2024 and the proposed FFR for December 2024 to December 2027 from the September 2024 SEP. Figure 1 also shows the instructions for the policy rules. Between September 2020 and September 2024, we use real-time inflation and unemployment data that were available during FOMC meetings. Between December 2024 and December 2027, we use inflation and unemployment projections from September 2024 SEP. The difference in the determined FFRs between the inertial and non-inertial laws is much greater than that between the Taylor and the balanced operating laws.

The prescriptions for the policy rules are reported in Panel A for the non-inertial Taylor and balanced policy rules. They are significantly higher than the FFR in 2022 and 2023 and are inconsistent with the FOMC’s tendency to slide rate hikes when inflation rises. Conversely, while the 2024 to 2027 policy orders from the September 2024 SEP remain lower than the FFR projections, the gap narrows significantly in 2026 and 2027. and 2022 than the one adopted by the FOMC. Between December 2022 and September 2024, the policy instructions are close to the FOMC’s forecast and, looking ahead, the instructions continue to be close to the forecast.

Figure 1. Federal Funds Rate and Policy Instructions for September 2024

Panel A. Non-inertial Laws

Panel B. Inactive Rules

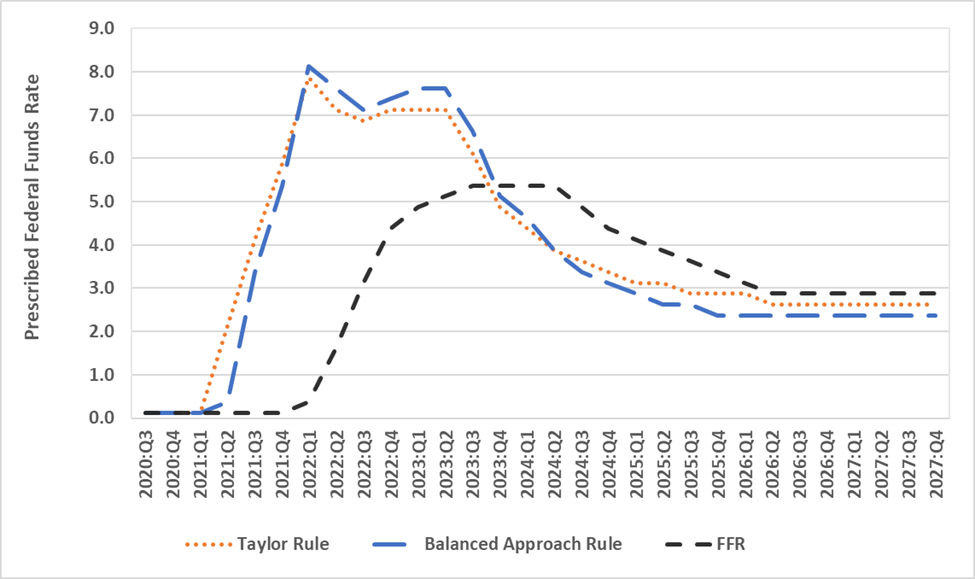

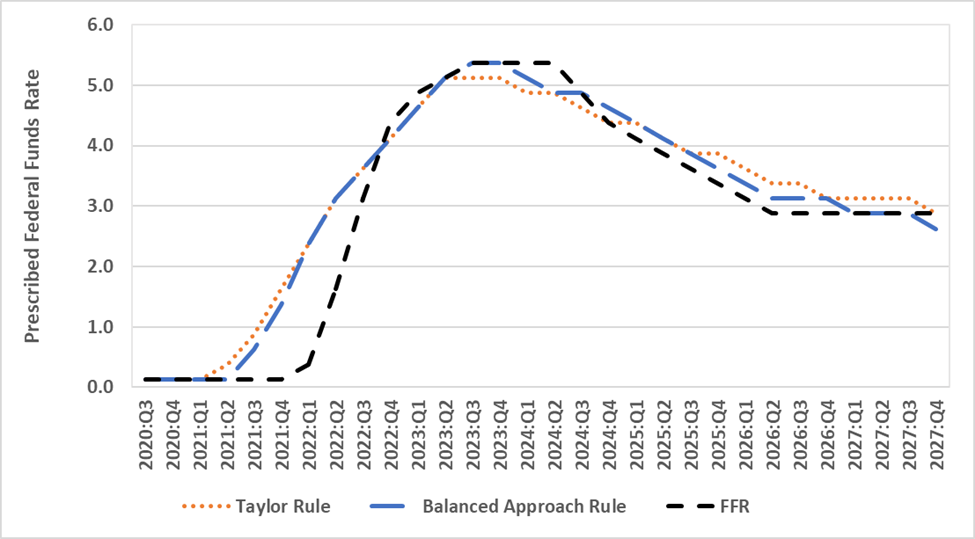

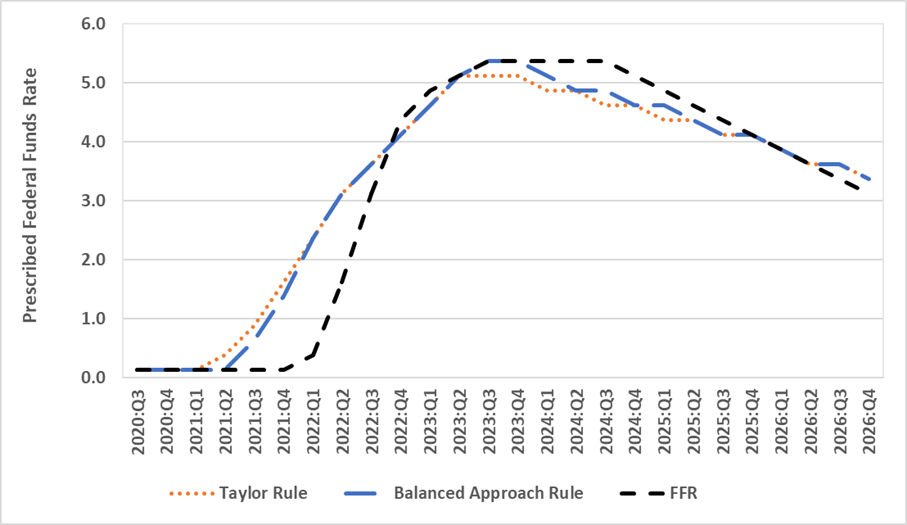

Figure 2 shows the federal funds rate forecast and policy orders from June 2024 SEP to see how much has changed over the past three months. Panel A shows the instructions from the non-inertial laws. According to Taylor’s law, the gap between the forecast and the forecast is almost the same in 2024 and 2025 for the SEP of June and September because the decline is almost equal. With the equilibrium employment law, the gap is smaller because forecast unemployment has increased between June and September SEP and the FFR is more responsive to an increase in the unemployment gap with the equilibrium law than with Taylor’s law. The gap between projections and predictions narrows by 2026 for both laws. Panel B shows instructions from passive rules. Although the size of the gaps is narrow and similar between the June and September SEP, FFR projections are generally above both policy instructions in June and below both instructions in September.

Figure 2. Federal Funds Rate and Instructions for the June 2024 Policy Rules

Panel A. Non-inertial Laws

Panel B. Inactive Rules

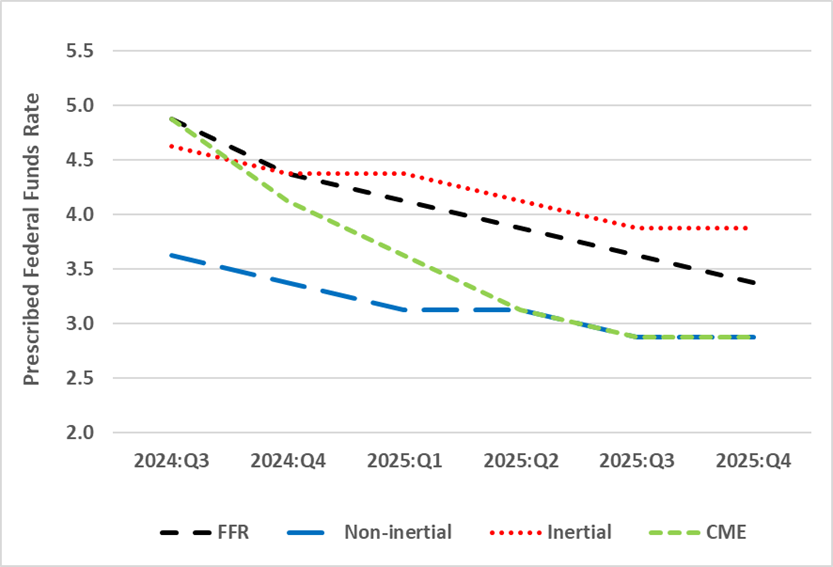

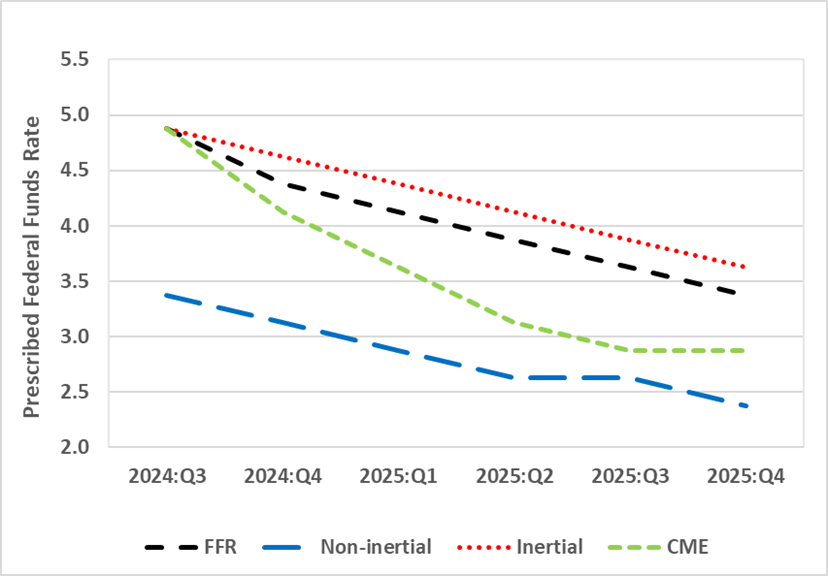

Figure 3 shows the average projections from the futures markets in the CME FedWatch Tool for the day following the September 2024 FOMC meeting until the end of the CME forecast in September 2025. The futures markets are predicting a sharper decline in the FFR than the FOMC projections. We add to this discussion by including instructions from the policy rules. Figure 3 shows that, for both the Taylor rule and the balance of the approach, the inertial policy prescriptions for December 2024 to December 2025 exceed future market forecasts. With Taylor’s non-inertial law, orders are subject to future market forecasts until June 2025 and are equal thereafter. With the law of the balanced non-inertial approach, orders are always subject to future market forecasts. The comparison between future market forecasts and prescriptions for policy rules depends more on the choice between passive and informal rules than on the choice between Taylor and balanced approach rules.

Figure 3: Federal Funds Rate, CME FedWatch Tool and Policy Rule Instructions

Panel rules A. Taylor

Panel B. Balanced Path Rules

This post was written by David Papell again Ruxandra Prodan-Boul.

Source link