Yves here. Corroborating Wolff’s account of the reaction to the unexpectedly strong new jobs report and an update to the labor force data, the money market acted as if a Fed rate cut was off the table just yet. Emergency market funds have declined significantly.

By Wolf Richter, editor of Wolf Street. Originally published in Wolf Street

The distortions of the epidemic and the sudden influx of millions of migrants into the labor market, which are difficult to track, have caused serious damage to the accuracy of labor market data.

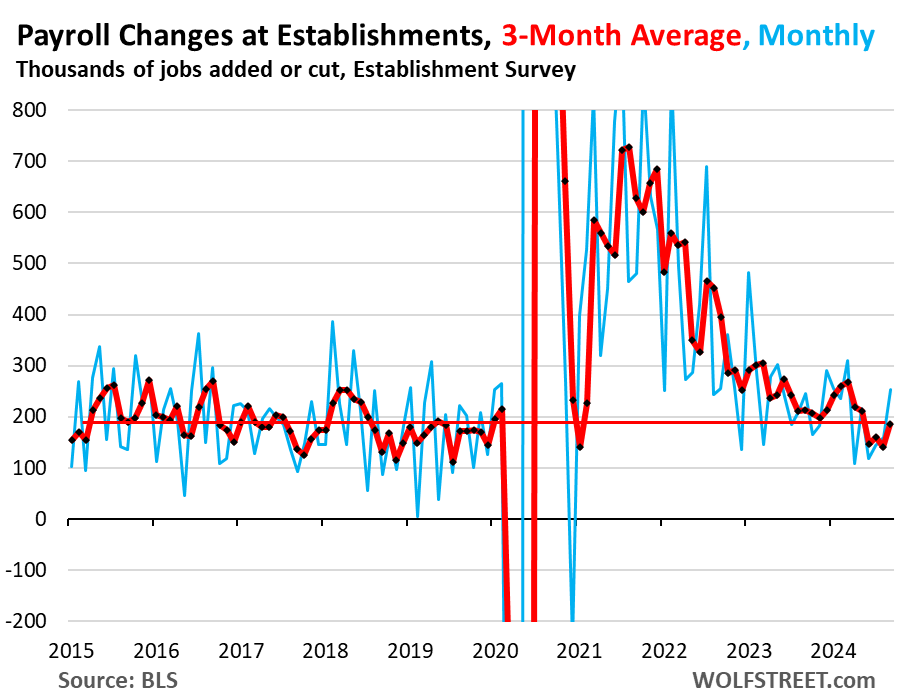

Employer payrolls rose by 254,000 jobs in September, while July’s downward revision was revised higher, and August was revised higher, so the three-month average rose to 186,000 jobs created in September. And the three-month average for August – which was reported as 116,000 at the time, a shocking and sudden collapse with revisions that caused a lot of confusion – was revised to a respectable 140,000.

It turned out that the sudden downturn of the previous two months was a false alarm. The labor market is good, creating a decent but negative number of new jobs, and the unemployment rate is down for the second month in a row, and wages are jumping, and the Fed doesn’t need to cut any more, given inflation. pressures are building up again – either they will decrease significantly, or perhaps at a slower pace than previously expected.

The green line shows the three-month average of jobs created as reported today. The red segment shows the three-month average as reported last month:

Here’s the long view, as updated: The three-month average is right in the sweet spot for a strong labor market in 2018 and 2019.

Apparently, the intense pace of recruitment after the end of the epidemic, and the shortage of workers has ended. The pace is returning to strong healthy job growth.

This picture is consistent with other data showing that layoffs and exits remain very low. Companies are collectively creating jobs at a decent pace, and holding on to the workers they have.

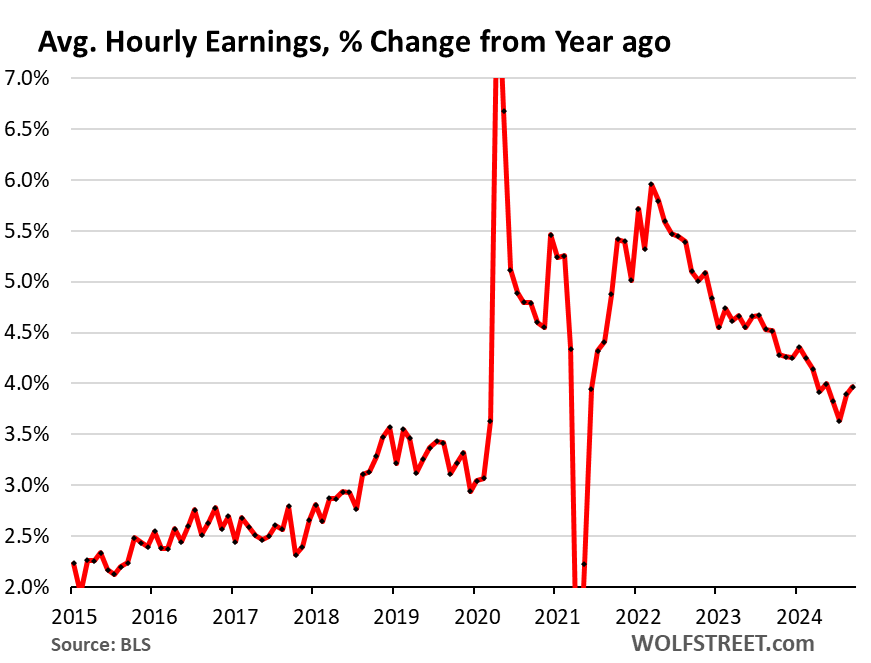

Average hourly wage were revised higher in August to a record 5.6% month-on-month, up from 4.9%. And in September, they rose another 4.5% year-over-year from August’s revised high, resulting in a three-month average increase of 4.3%, the highest since January. The three-month average has been steadily increasing since April (red line). This is based on institutional research.

The 12-month increase in average hourly earnings rose to 4.0% in September, and August was revised up to 3.9% (from 3.8% as reported last month). Those two months combined represent the fastest acceleration since March 2022, and are well above the peaks of the 2017-2019 period.

So in terms of inflation – and what the Fed has been worried about – this rapid growth in wages is no longer going in the right direction.

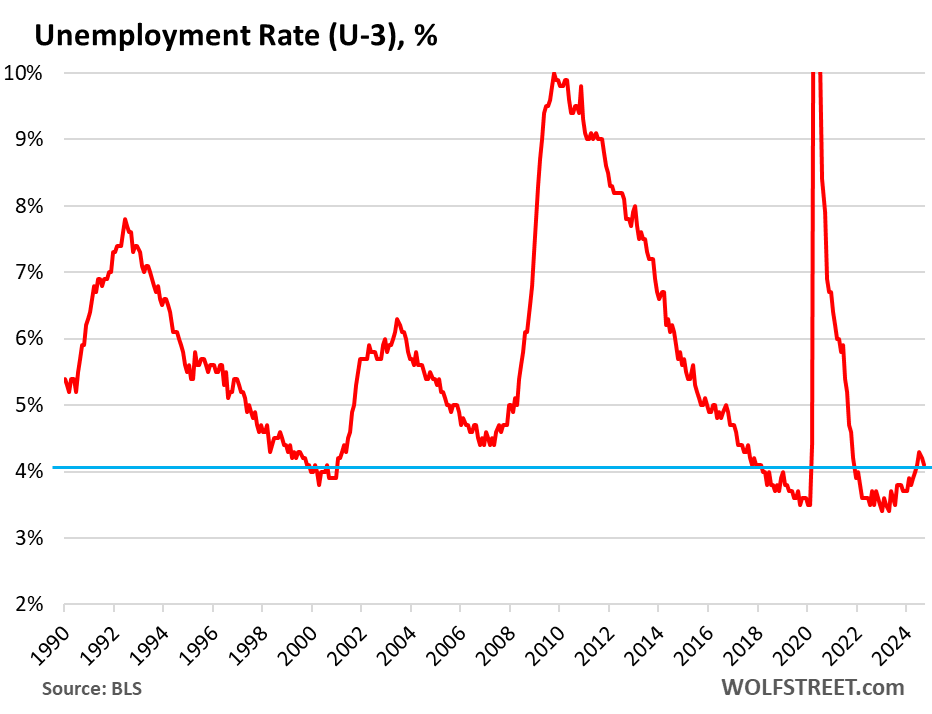

The topic of the unemployment rate (3) fell to 4.1%, the second consecutive month of decline. 4.1% is historically low, but up from the 2022 labor shortage period. This is based on household research.

The unemployment rate is now below the Fed’s average estimate of 4.4% for the end of 2024 and the end of 2025, according to the Fed’s Summary of Economic Projections released at the rate-cutting meeting.

The labor market slowdown that the Fed predicted to justify a 50 basis point rate cut has been withdrawn, revised, or failed to materialize.

The unemployment rate is where the bulk of immigrants over the past two years — estimated at 6 million in 2022 and 2023 by the Congressional Budget Office — is coming from: Those who are looking for a job but haven’t found a job yet. And their entry into the workforce has caused the unemployment rate to rise from last year’s low.

An increase in the unemployment rate caused by an increase in the supply of labor is a different variable than an increase in the unemployment rate caused by a decrease in employment and a decrease in the demand for labor, as we will see during a recession:

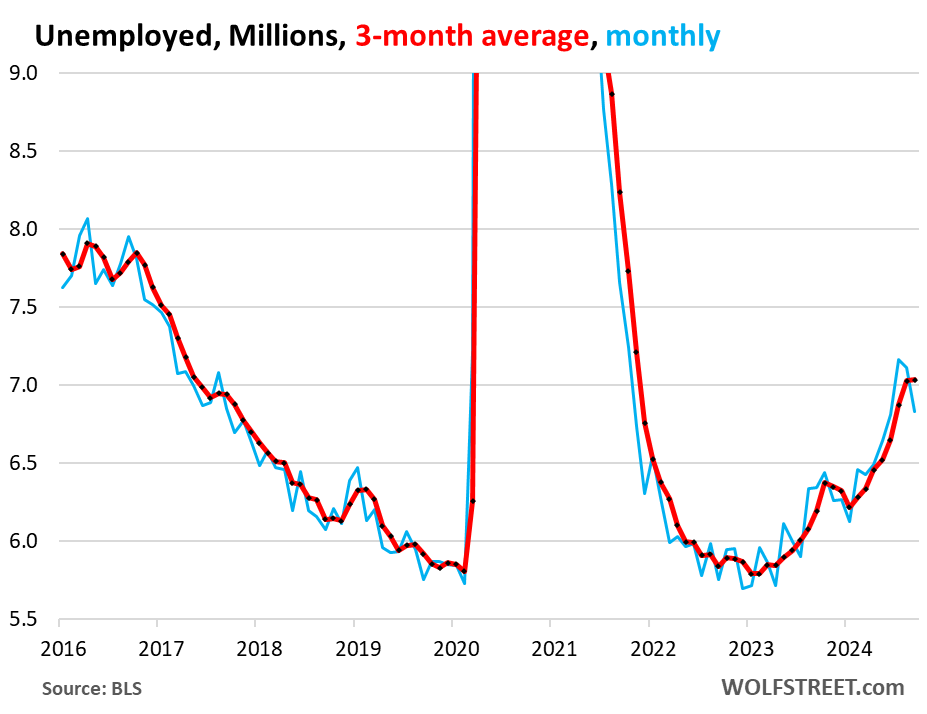

Number of unemployed people job searches fell for the second month in a row, to 6.83 million. The three-month average reached 7.04 million.

The unemployment rate (chart above) accounts for the growth of large numbers of people and workers over the decades. This metric here of the number of unemployed people does not take into account the growth of the population and the number of workers, and over the decades, the increase in the population and the workforce includes a growing number of people looking for work.

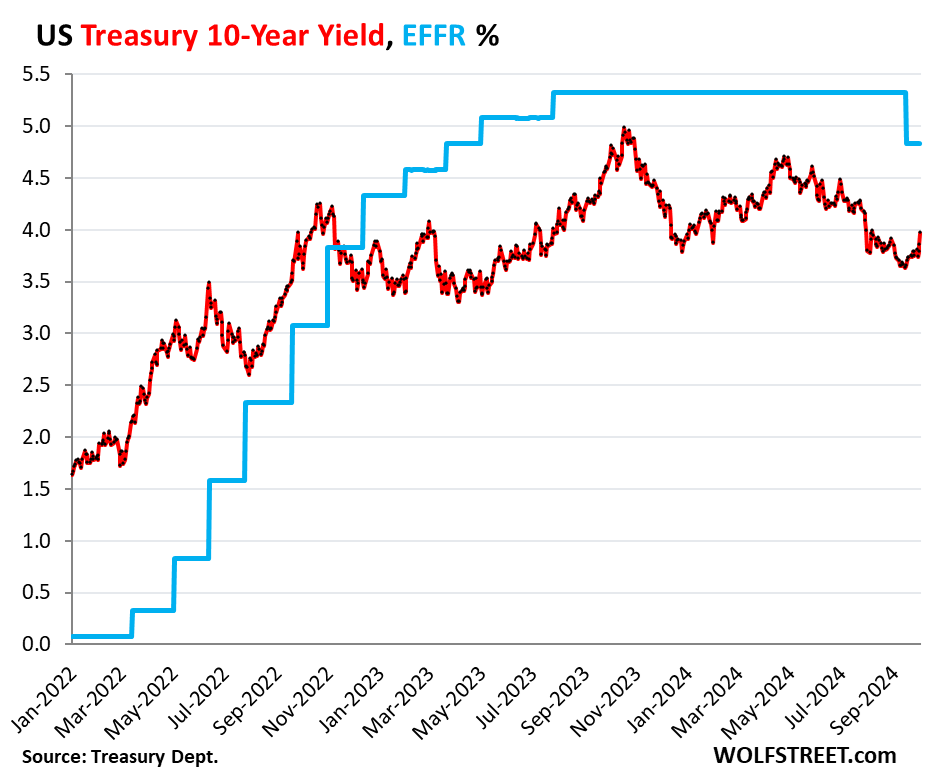

And the bond market rose.

On the news that last month’s labor market panic was a false alarm, that aggressive rate cuts to save the labor market are unnecessary, and that wage growth is contributing to the inflationary concerns we’ve already seen in the Consumer Price Index. in August and July, and in what companies have said about raising their prices, and the pricing power companies are still using…

However, on the news, the bond market rallied, and the 10-year yield jumped 12 basis points to 3.97% currently, the highest since August 8. Since the rate cut, the 10-year Treasury yield has risen 27 basis points.

Source link