In a recent paper, Antoni and St. Onge (2024) argued that the peak of GDP, measured correctly, was in 2021Q4.

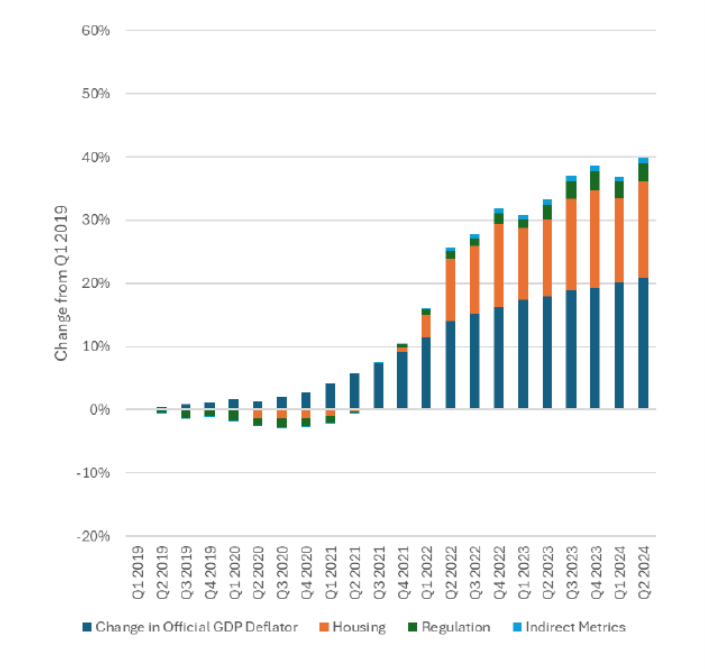

Source: Antony and St. Onge (2024).

Note that real GDP is much lower than that reported in the annual update a few weeks ago. This means that the deflator they use is much higher than the official. Indeed, the cumulative deviation of Antoni-St. The Onge deflator is reported to be 20 percent from 2019Q1.

Source: Antony and St. Onge (2024).

Most of the deviations are accounted for by the different treatment of housing costs. On pages 1-3 of the paper, the authors describe the problems with the CPI – housing, regulation, indirect costs (eg, insurance etc.). About housing costs (pages 1-2):

If the costs of renting and owning change proportionally over time, this method will be relatively accurate. Unfortunately, the cost of owning a home has risen much faster than rents over the past four years and the CPI has under-estimated the increase in house prices.

One of pages 4-5, the authors describe the construction of other indices:

Correction of Inflation Indices

In order to produce an alternative inflation metric that more accurately reflects the rise in the cost of living, several changes must be made to the standard price terms used in the national accounts. These changes can be broadly divided into three groups: housing, regulatory burdens, and indirectly measured prices.

The housing sector has had the greatest impact in terms of adjusting for the real cost of living; in the second half of the year 2024, it increased the additional change in the GDP deflator by about 75 percent. This was due to a combination of not only high housing prices but also high interest rates. That is, the mortgage payment is made up of the loan amount and the interest rate, and if both housing prices and interest rates rise the cost of home ownership increases for both parties.

Conversely, using this precise method lower interest rates in 2019, 2020, and early 2021 actually have a negative effect on reducing GDP. That is, the adjustment reduced inflation in those years.

Likewise, Trump-era deregulation led to a slight decline in the cost of living not captured by official inflation metrics in 2019 and 2020, a trend that was completely reversed to the fourth quarter of 2022 under Biden-Harris.

Substituting indirect metrics for the modified direct ones has a limited effect on the GDP deflator during the years in question. This is partly due to the difficulty in estimating consumer costs such as health insurance without double counting (or double measuring) other purchases, such as medical care or medical care supplies. 5

The cumulative change in real GDP since 2019Q1 is -2.5%, according to their estimates. Now, while the authors describe some deflator measurements, they do so so vaguely that it is impossible to reproduce their calculations. I can’t reproduce indirect costs (which I don’t think should be particularly relevant to the PCE deflator), or regulatory costs (if the BLS still calculates regulatory costs the same way it did when I was a research assistant, the seat belt requirement didn’t help regarding Antoni-St Onge ). So I focus on multiplying the housing effect.

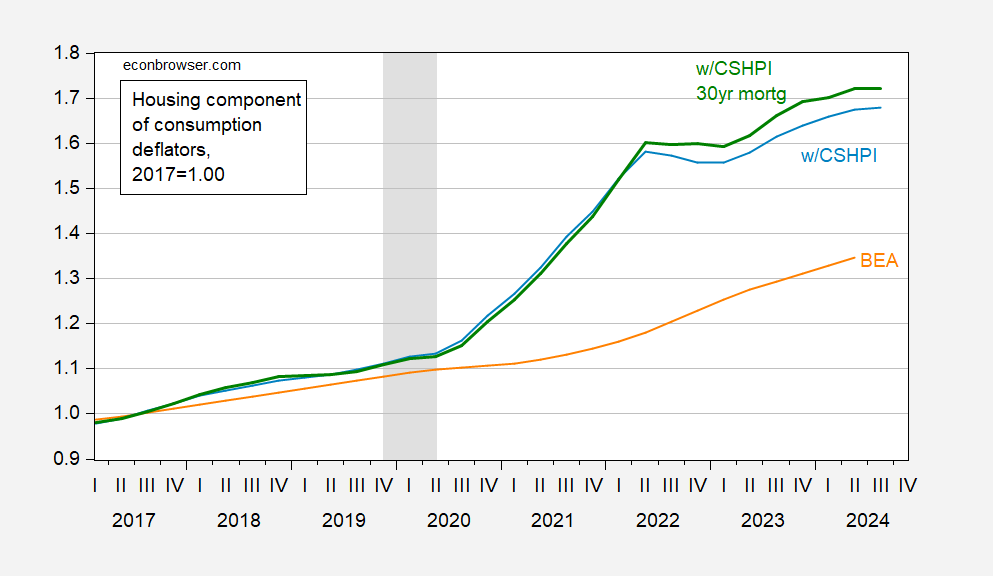

I rescale the Case-Shiller national housing price index (national series; the 20-city version will be slightly higher) to 2017 = 1. I multiply this by the mortgage factor (1+i). In Figure 1, I present the BEA housing consumption index, the Case-Shiller housing price index, and the index adjusted for the 30-year mortgage rate.

Figure 1: BEA component of PCE shelter (orange), Case-Shiller House Price Index – national (blue), house price times mortgage rate factor index (bright green), all 2017=1.00. The NBER has defined recession days as shaded in gray. Source: BEA, S&P Dow Jones, Fannie Mae via FRED, NBER, and author’s calculations.

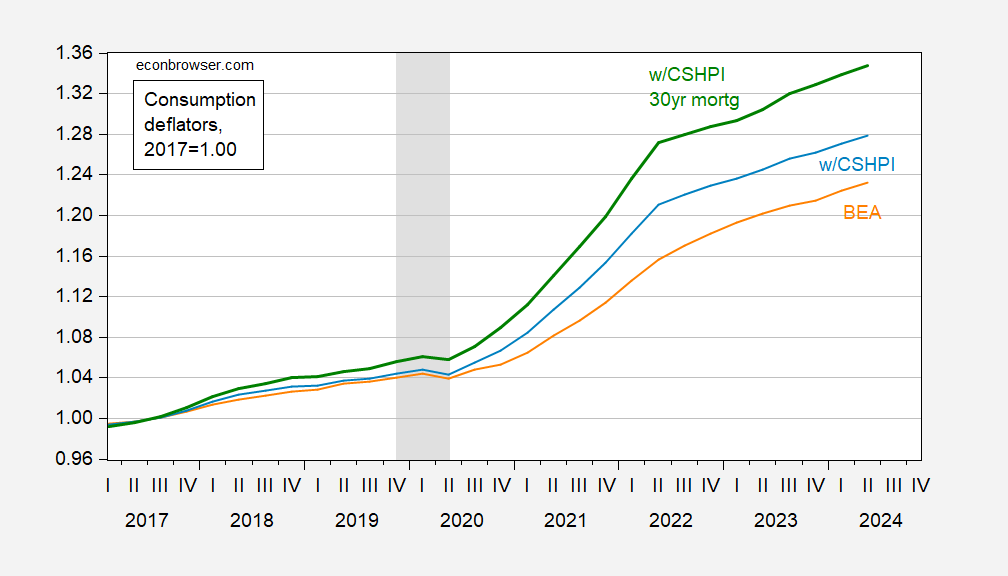

In the PCE deflator, shelter accounts for about 15% of the total weight (less than 26% in the CPI), and calculates the overall consumption deflator as:

Palt_PCE = [(PCSHPI×(1+imort30y)]0.15×(Prelaxation of PCE)0.85

Figure 2: BEA PCE deflator (orange), Case-Shiller House Price Index – national (blue), house price times mortgage rate factor index (bright green), all 2017=1.00. The NBER has defined recession days as shaded in gray. Source: BEA, S&P Dow Jones, Fannie Mae via FRED, NBER, and author’s calculations.

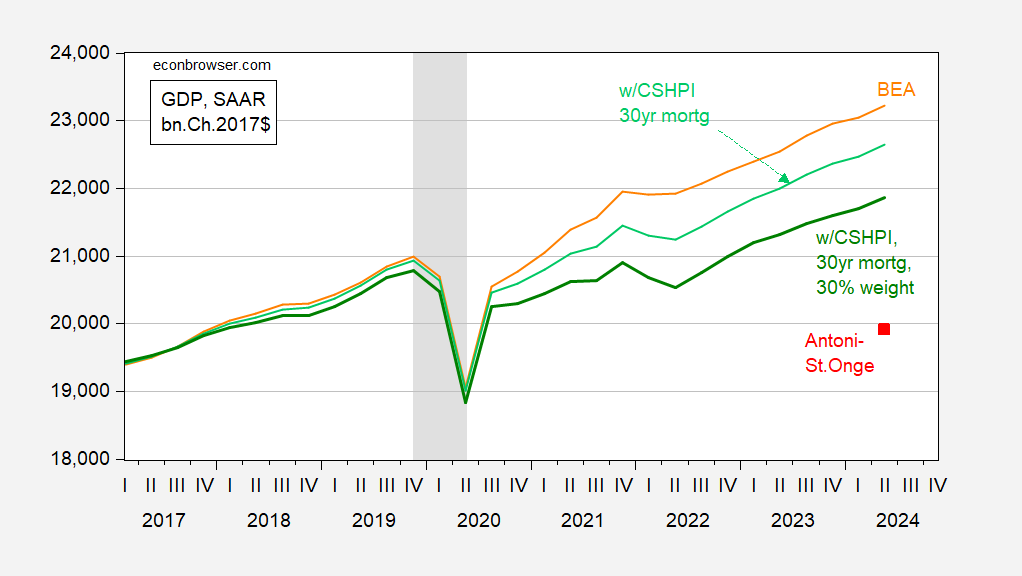

How does this affect GDP? Applying this spending multiplier to consumption alone, then adding the other spending to real GDP consumption, yields the light green line below.

Figure 3: BEA GDP (orange), GDP including PCE using the Case-Shiller House Price Index – national mortgage rate factor index, using a BEA weight of 15% (green), using -30% (dark green), Antoni-St.Onge estimate (red square), all in bn.Ch.2017$ SAAR. The NBER has defined recession days as shaded in gray. Source: BEA, S&P Dow Jones, Fannie Mae via FRED, NBER, and author’s calculations.

Note that the series I get is not close to the Antoni-St.Onge series (the value of 2024Q2 in the red square). Since the authors do not explain the construction of their separate PCE deflator, but they describe the construction of the CPI, I try to use a weight of 30% associated with the CPI (instead of 15% for the PCE). This shows the dark green line – which is much further than the Antoni-St.Onge estimate.

All in all, I cannot repeat the Antoni-St.Onge result of the recession from 2022. Until the authors provide a statistical spreadsheet, we will have to conclude that the authors are using the “mystery meat” of the equation, ask Stockman-ian. a magical star, or placed in a mathematical “special sauce”.

The data used in this post is available here in an Excel spreadsheet.

Source link